Tyson Foods currently trades at $57.74 per share and has shown little upside over the past six months, posting a middling return of 1.5%. The stock also fell short of the S&P 500’s 10% gain during that period.

Is there a buying opportunity in Tyson Foods, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We don't have much confidence in Tyson Foods. Here are three reasons why you should be careful with TSN and a stock we'd rather own.

Why Do We Think Tyson Foods Will Underperform?

Started as a simple trucking business, Tyson Foods (NYSE: TSN) is one of the world’s largest producers of chicken, beef, and pork.

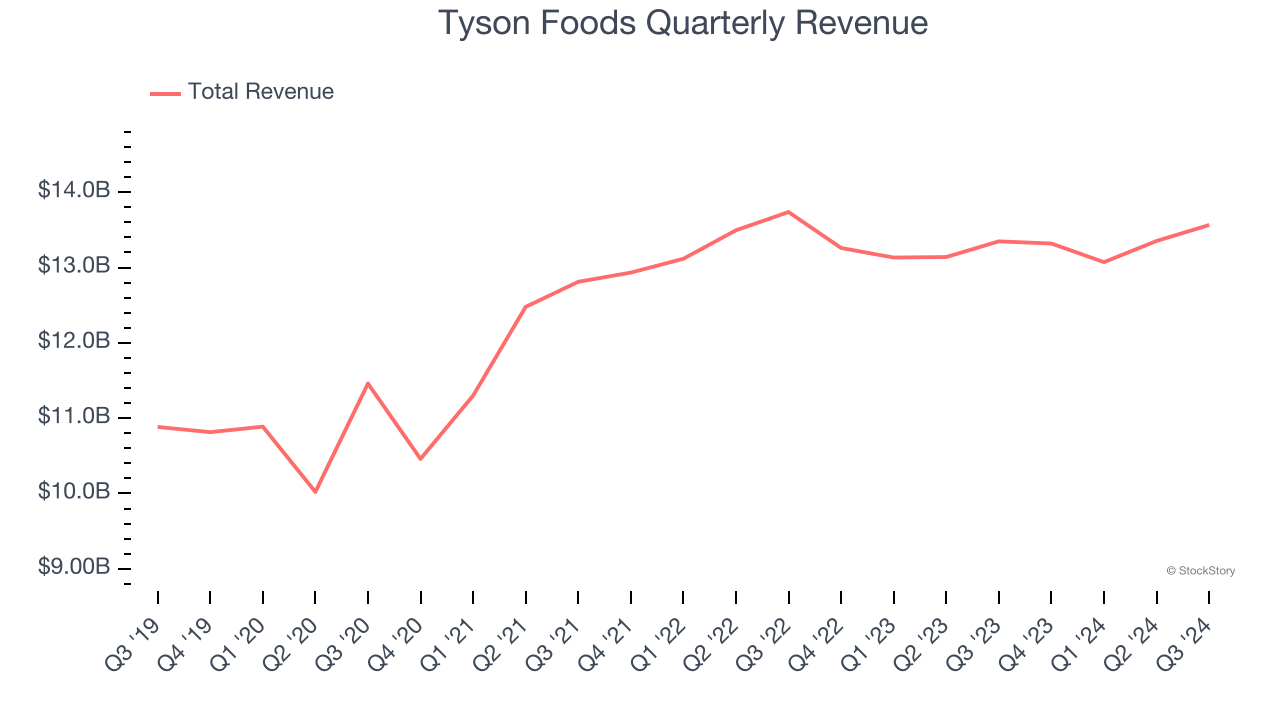

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Tyson Foods’s sales grew at a tepid 4.3% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer staples sector.

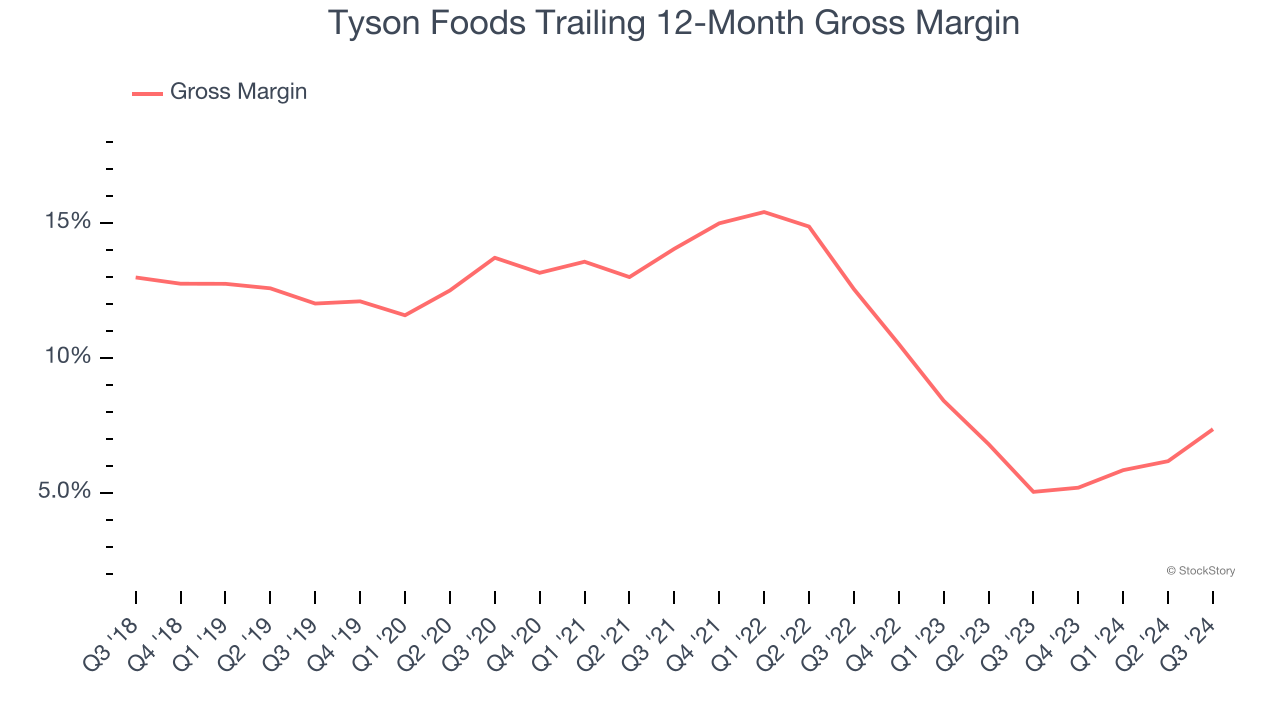

2. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Tyson Foods has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 6.2% gross margin over the last two years. That means Tyson Foods paid its suppliers a lot of money ($93.80 for every $100 in revenue) to run its business.

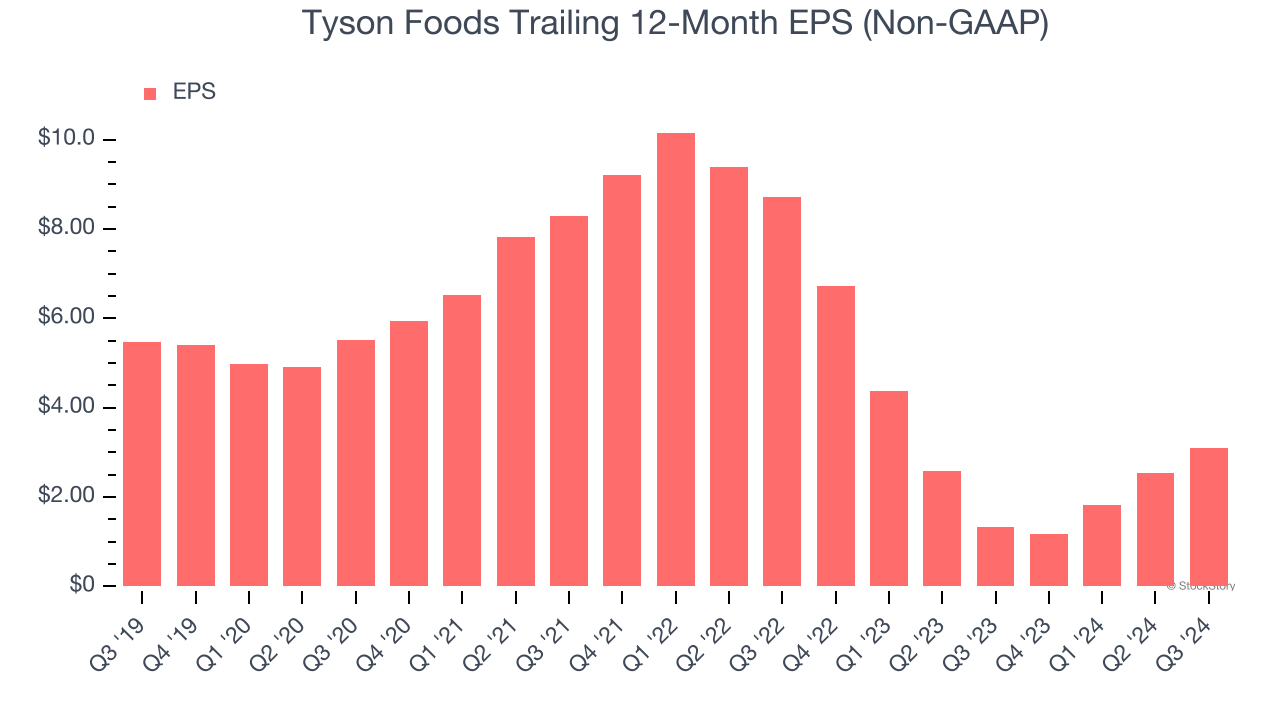

3. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Tyson Foods, its EPS declined by 27.9% annually over the last three years while its revenue grew by 4.3%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Tyson Foods falls short of our quality standards. With its shares lagging the market recently, the stock trades at 16.8× forward price-to-earnings (or $57.74 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere. We’d recommend looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than Tyson Foods

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.