Hub Group currently trades at $43.96 per share and has shown little upside over the past six months, posting a middling return of 1.7%. The stock also fell short of the S&P 500’s 10% gain during that period.

Is now the time to buy Hub Group, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We don't have much confidence in Hub Group. Here are three reasons why there are better opportunities than HUBG and a stock we'd rather own.

Why Do We Think Hub Group Will Underperform?

Started with $10,000, Hub Group (NASDAQ: HUBG) is a provider of intermodal, truck brokerage, and logistics services, facilitating transportation solutions for businesses worldwide.

1. Demand Slipping as Sales Volumes Decline

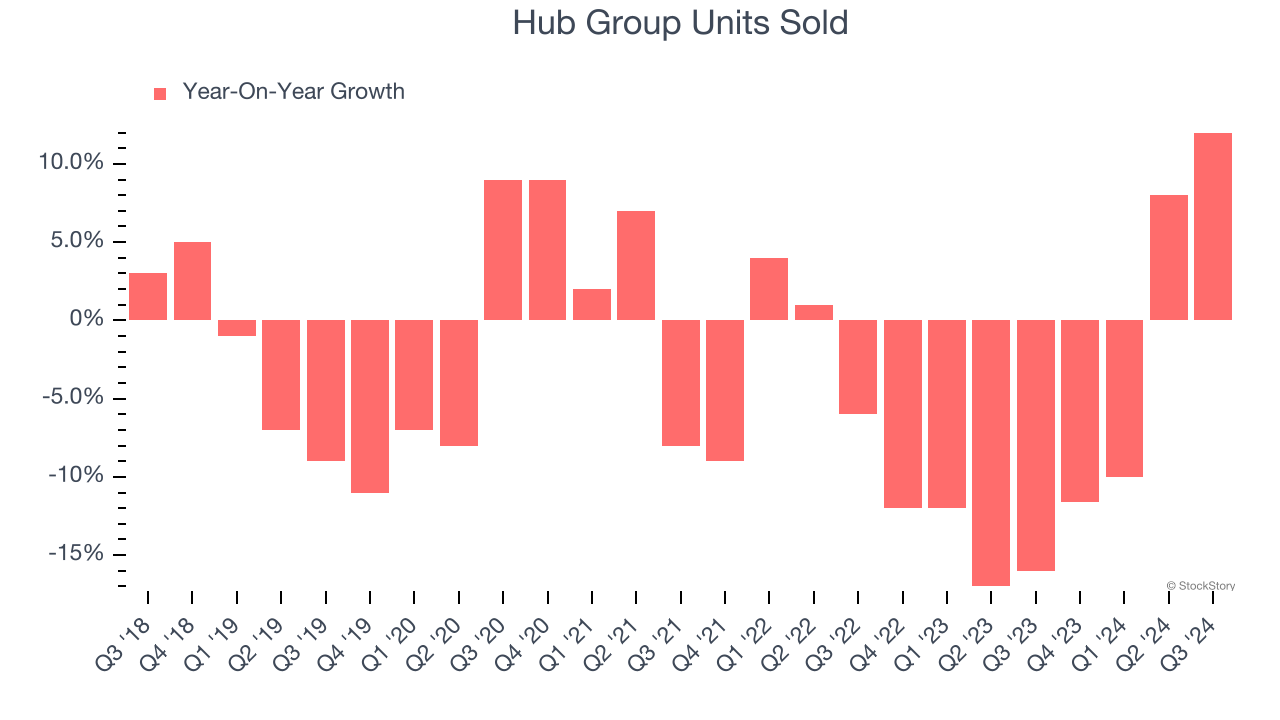

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Air Freight and Logistics company because there’s a ceiling to what customers will pay.

Over the last two years, Hub Group’s units sold averaged 7.3% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Hub Group might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Low Gross Margin Reveals Weak Structural Profitability

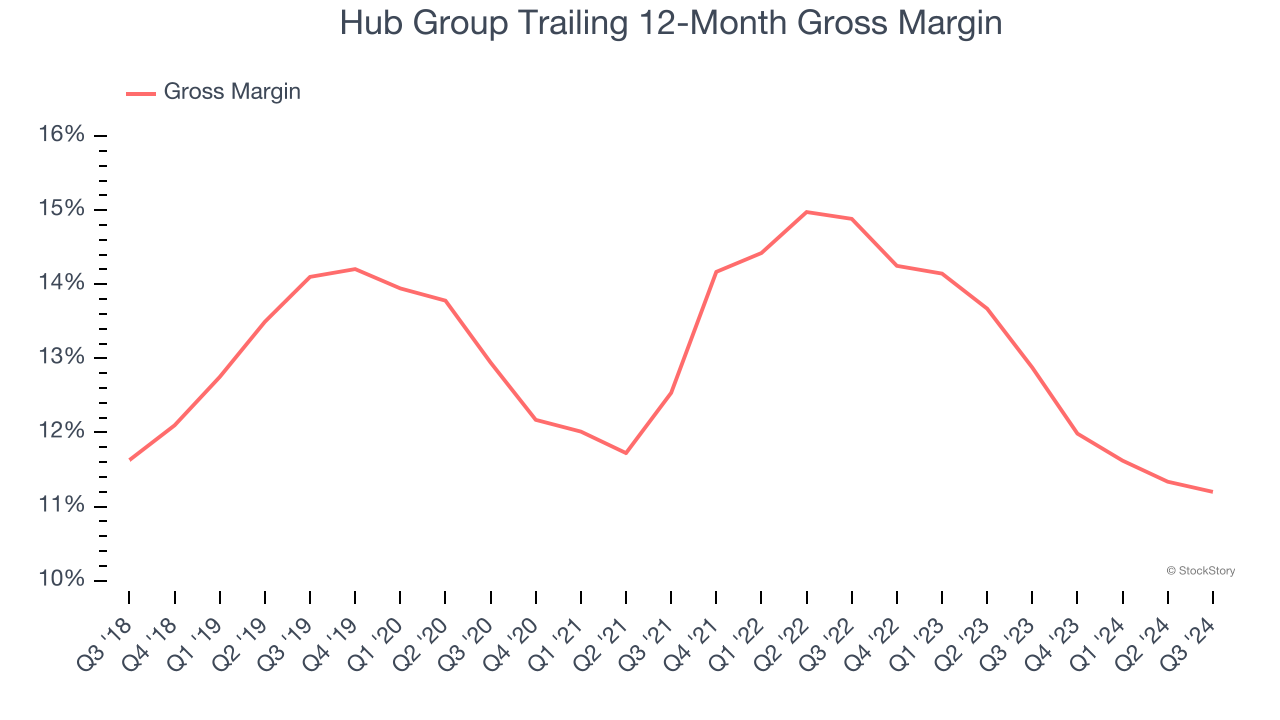

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Hub Group has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13% gross margin over the last five years. That means Hub Group paid its suppliers a lot of money ($86.99 for every $100 in revenue) to run its business.

3. EPS Trending Down

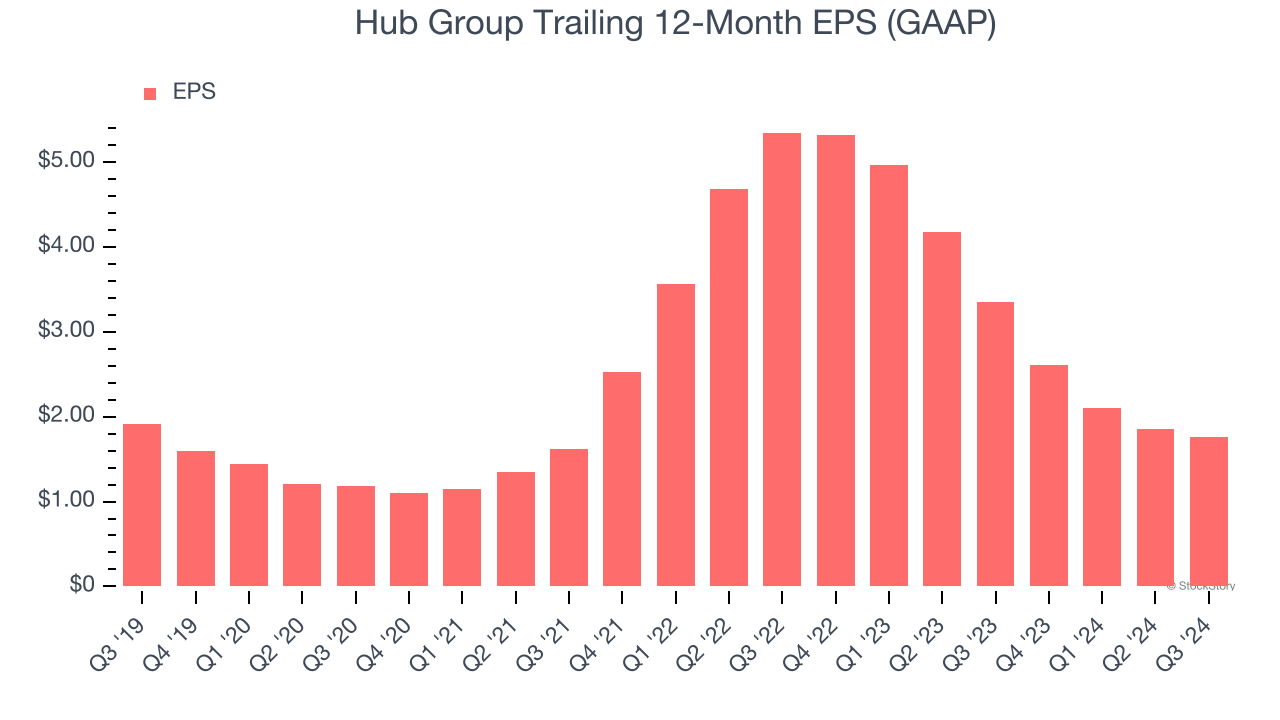

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Hub Group, its EPS declined by 1.6% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Hub Group, we’ll be cheering from the sidelines. With its shares trailing the market in recent months, the stock trades at 19.3× forward price-to-earnings (or $43.96 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. Let us point you toward KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Like More Than Hub Group

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.