What a fantastic six months it’s been for Redfin. Shares of the company have skyrocketed 40.8%, hitting $8.35. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Redfin, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why you should be careful with RDFN and a stock we'd rather own.

Why Do We Think Redfin Will Underperform?

Founded by a former medical school student, electrical engineer, and Amazon data engineer, Redfin (NASDAQ: RDFN) is a real estate company offering brokerage services through an online platform.

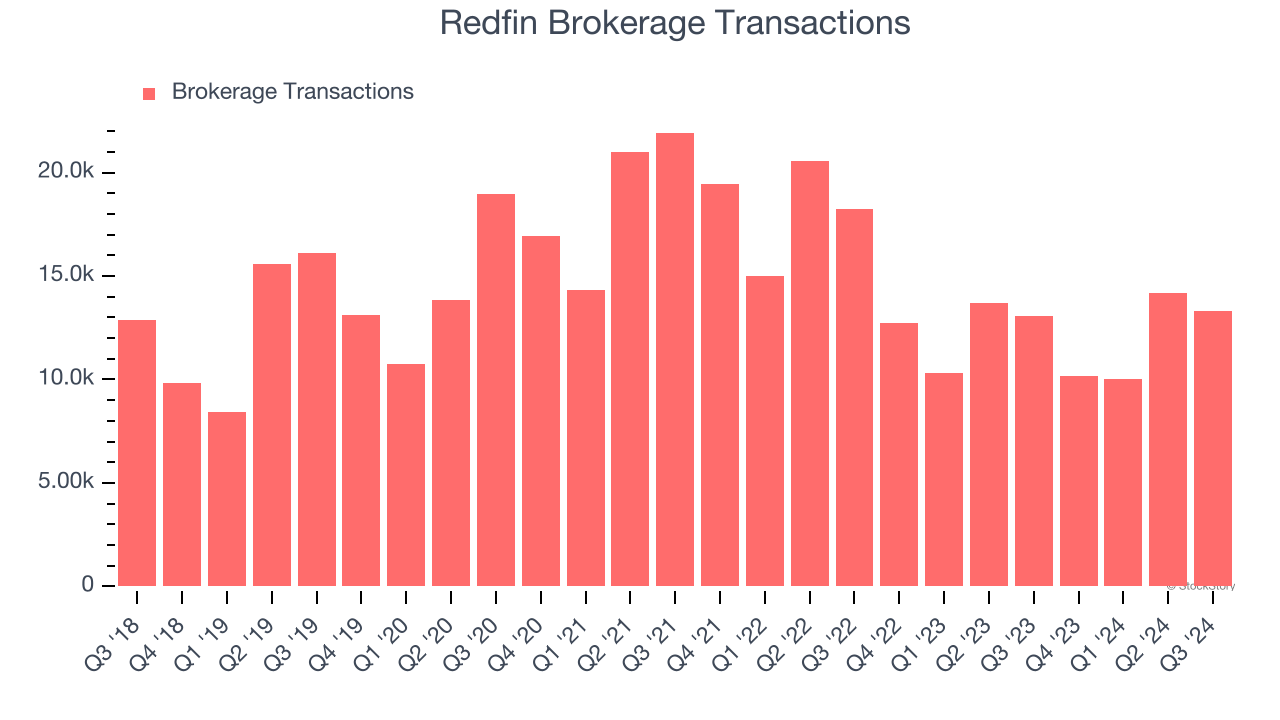

1. Decline in Brokerage Transactions Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Redfin, our preferred volume metric is brokerage transactions). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Redfin’s brokerage transactions came in at 13,324 in the latest quarter, and over the last two years, averaged 18.1% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Redfin might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

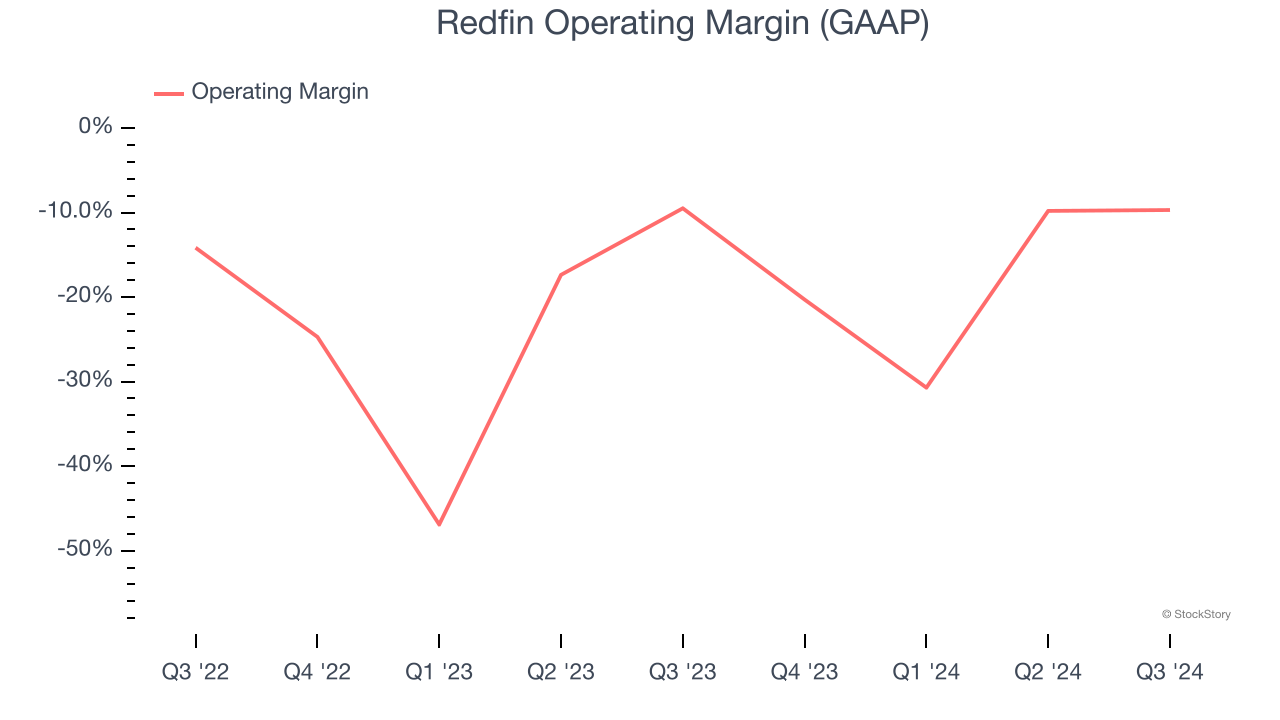

2. Operating Losses Sound the Alarms

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Redfin’s operating margin has been trending up over the last 12 months, but it still averaged negative 20.5% over the last two years. This is due to its large expense base and inefficient cost structure.

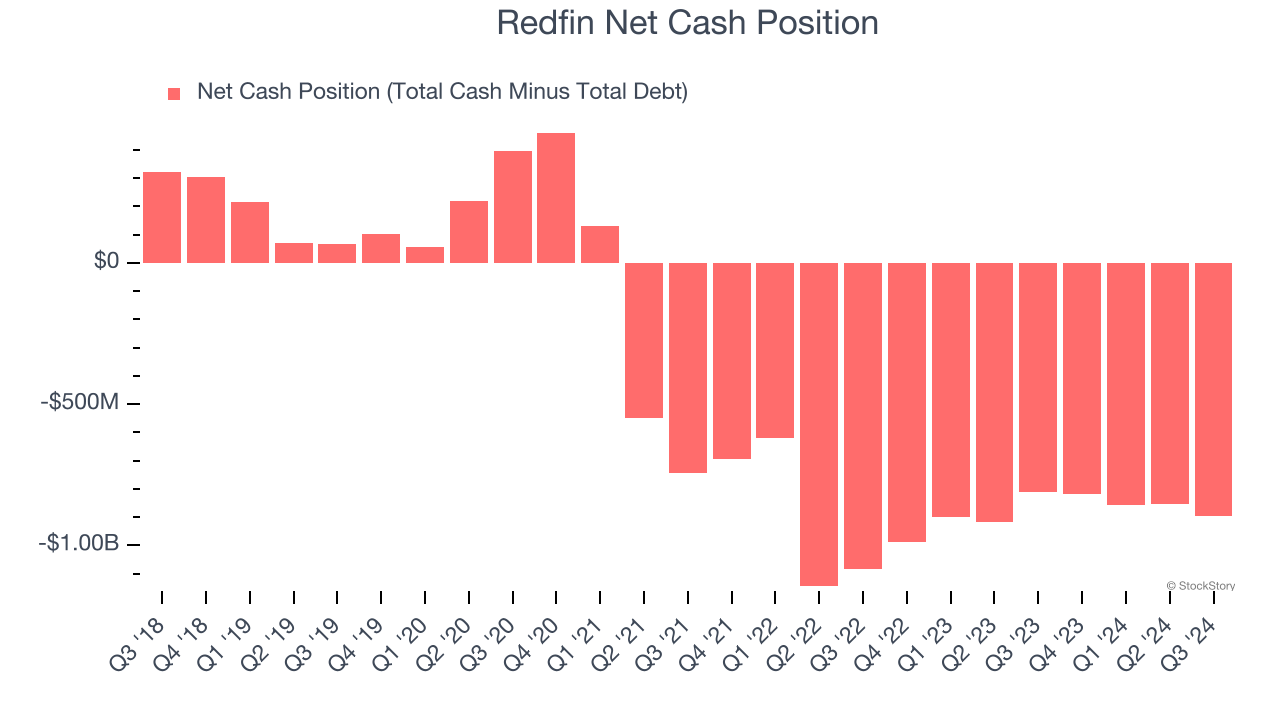

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Redfin burned through $142.5 million of cash over the last year, and its $1.06 billion of debt exceeds the $165.7 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Redfin’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Redfin until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

We see the value of companies helping consumers, but in the case of Redfin, we’re out. Following the recent rally, the stock trades at 34.2× forward EV-to-EBITDA (or $8.35 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. Let us point you toward Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Redfin

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.