Over the last six months, Domino’s shares have sunk to $431, producing a disappointing 18.4% loss - a stark contrast to the S&P 500’s 10.4% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Domino's, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the more favorable entry price, we're cautious about Domino's. Here are two reasons why we avoid DPZ and a stock we'd rather own.

Why Is Domino's Not Exciting?

Founded by two brothers in Michigan, Domino’s (NYSE: DPZ) is a globally recognized pizza chain known for its creative marketing and fast delivery.

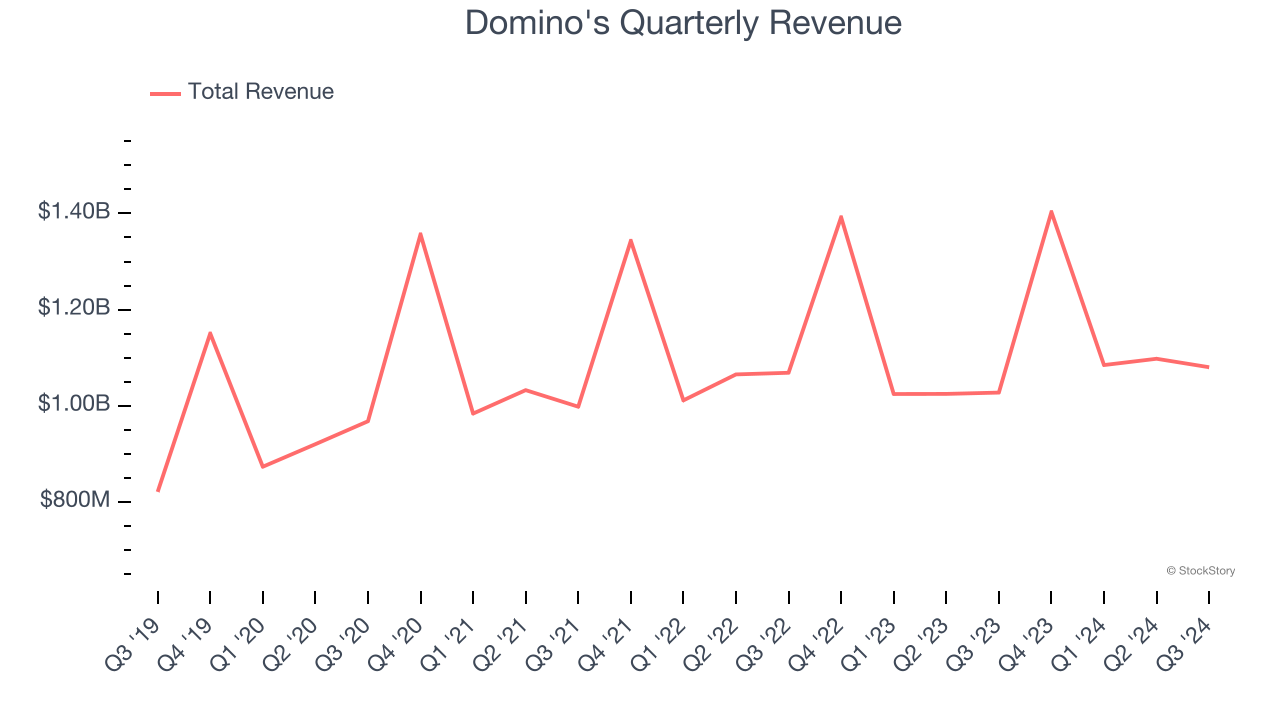

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Domino’s 5.6% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the restaurant sector.

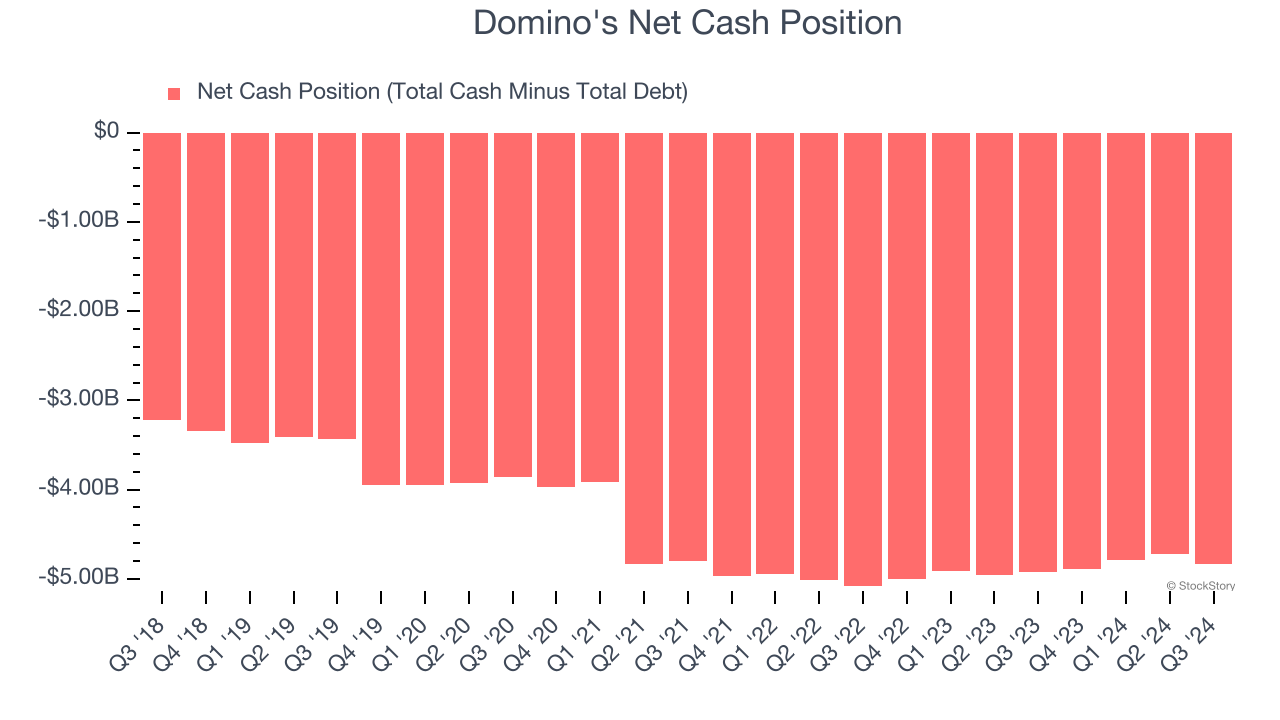

2. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Domino’s $5.20 billion of debt exceeds the $374.5 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $949.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Domino's could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Domino's can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Domino's isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 25.3× forward price-to-earnings (or $431 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at Chipotle, which surprisingly still has a long runway for growth.

Stocks We Like More Than Domino's

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.