As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the toys and electronics industry, including Hasbro (NASDAQ: HAS) and its peers.

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

The 4 toys and electronics stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 6.6% below.

In light of this news, share prices of the companies have held steady as they are up 2.9% on average since the latest earnings results.

Best Q3: Hasbro (NASDAQ: HAS)

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ: HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

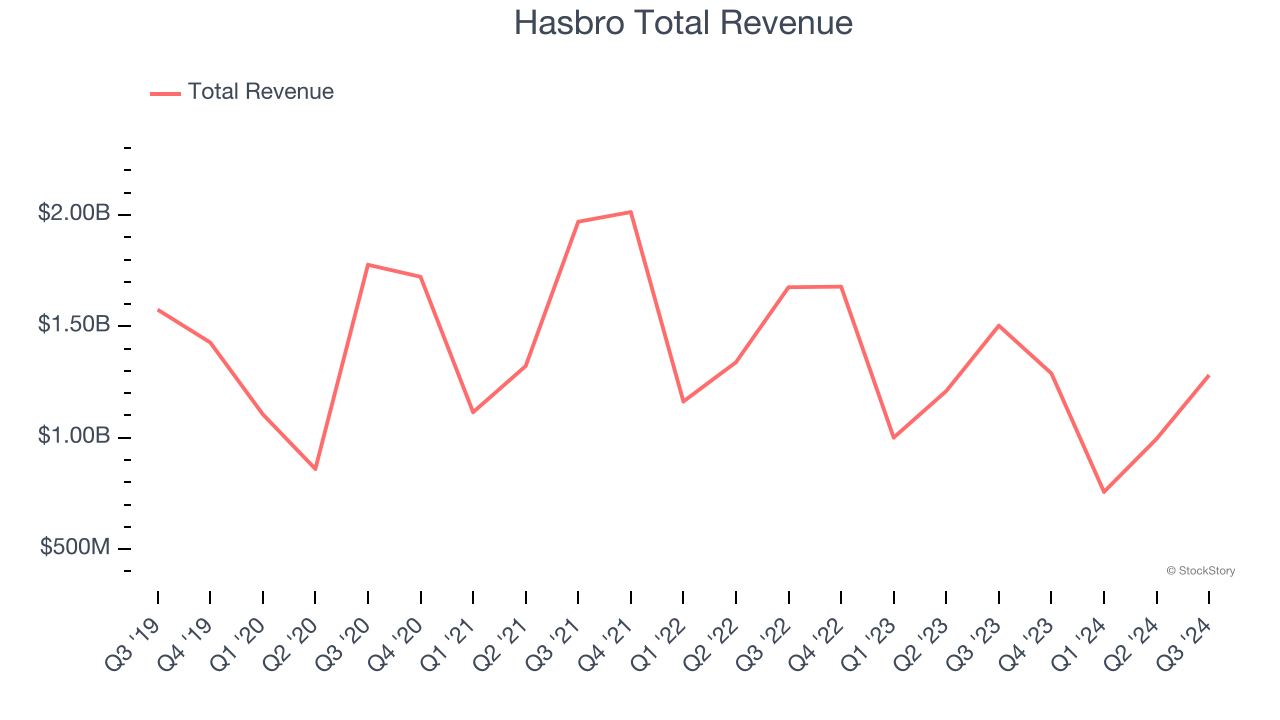

Hasbro reported revenues of $1.28 billion, down 14.8% year on year. This print fell short of analysts’ expectations by 1.3%, but it was still a strong quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

“Outperformance within our gaming and licensing businesses in the third quarter highlights the strength in two of our highest profit areas,” said Chris Cocks, Hasbro Chief Executive Officer.

Hasbro delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 18.7% since reporting and currently trades at $57.15.

Is now the time to buy Hasbro? Access our full analysis of the earnings results here, it’s free.

Mattel (NASDAQ: MAT)

Known for the creation of iconic toys such as Barbie and Hotwheels, Mattel (NASDAQ: MAT) is a global children's entertainment company specializing in the design and production of consumer products.

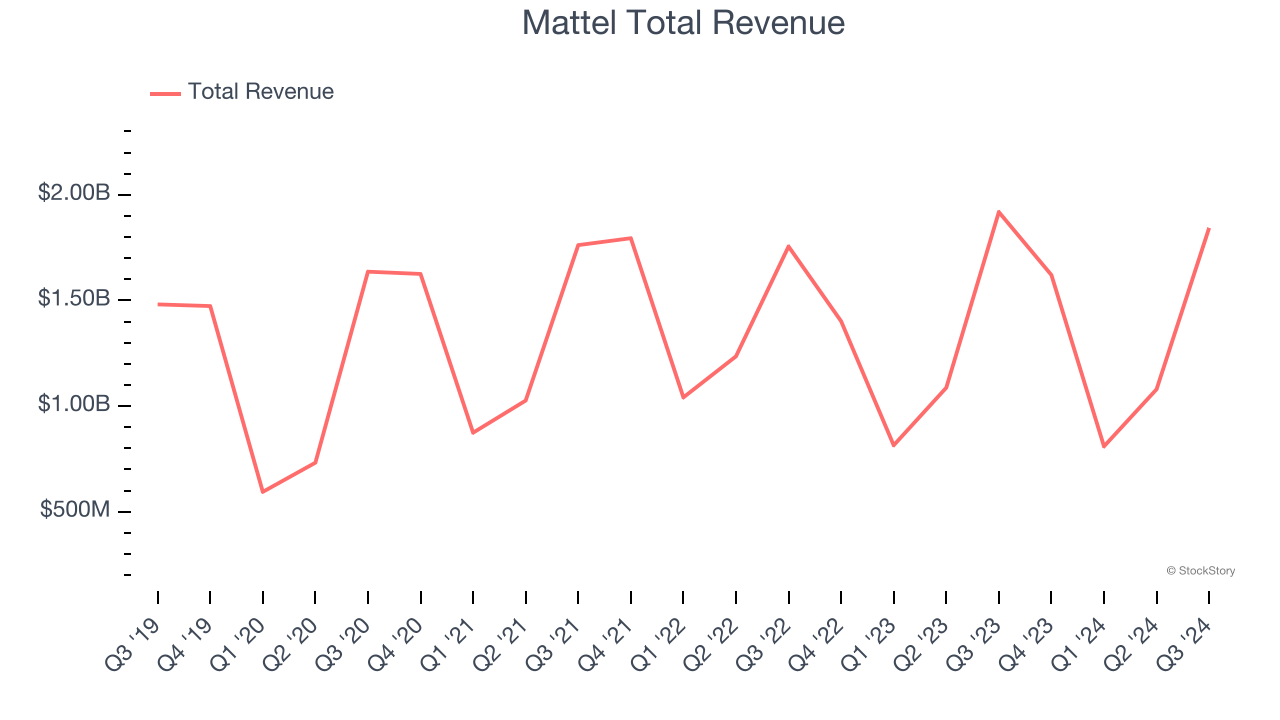

Mattel reported revenues of $1.84 billion, down 3.9% year on year, falling short of analysts’ expectations by 0.9%. However, the business still had a satisfactory quarter with an impressive beat of analysts’ EPS estimates but full-year EBITDA guidance slightly missing analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $17.93.

Is now the time to buy Mattel? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Bark (NYSE: BARK)

Making a name for itself with the BarkBox, Bark (NYSE: BARK) specializes in subscription-based, personalized pet products.

Bark reported revenues of $126.1 million, up 2.5% year on year, exceeding analysts’ expectations by 0.7%. Still, it was a mixed quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 28.4% since the results and currently trades at $1.90.

Read our full analysis of Bark’s results here.

Funko (NASDAQ: FNKO)

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ: FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Funko reported revenues of $292.8 million, down 6.4% year on year. This number topped analysts’ expectations by 1.1%. More broadly, it was a mixed quarter as it also logged a solid beat of analysts’ EPS estimates but full-year revenue guidance missing analysts’ expectations.

Funko delivered the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is up 1.2% since reporting and currently trades at $12.35.

Read our full, actionable report on Funko here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.