Acuity Brands’s 26.2% return over the past six months has outpaced the S&P 500 by 16.5%, and its stock price has climbed to $304.89 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Acuity Brands, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we don't have much confidence in Acuity Brands. Here are two reasons why we avoid AYI and a stock we'd rather own.

Why Is Acuity Brands Not Exciting?

One of the pioneers of smart lights, Acuity (NYSE: AYI) designs and manufactures light fixtures and building management systems used in various industries.

1. Long-Term Revenue Growth Flatter Than a Pancake

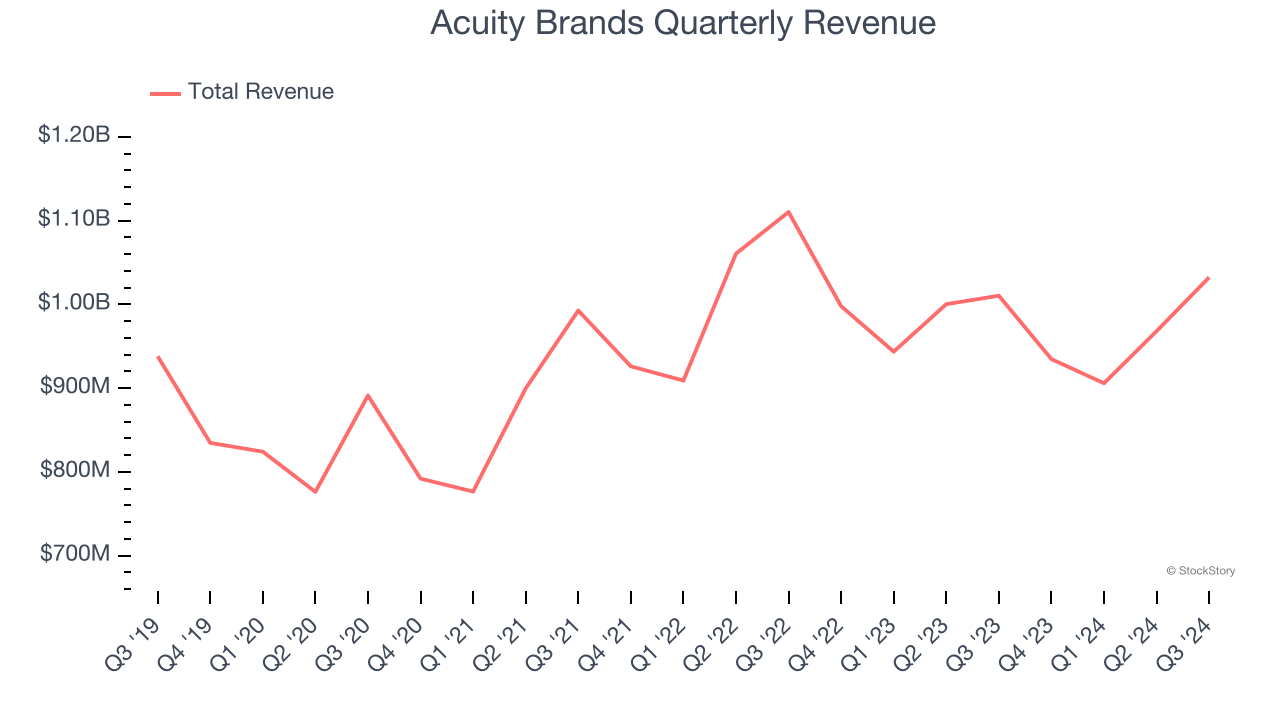

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Acuity Brands struggled to consistently increase demand as its $3.84 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and is a sign of lacking business quality.

2. Core Business Falling Behind as Demand Declines

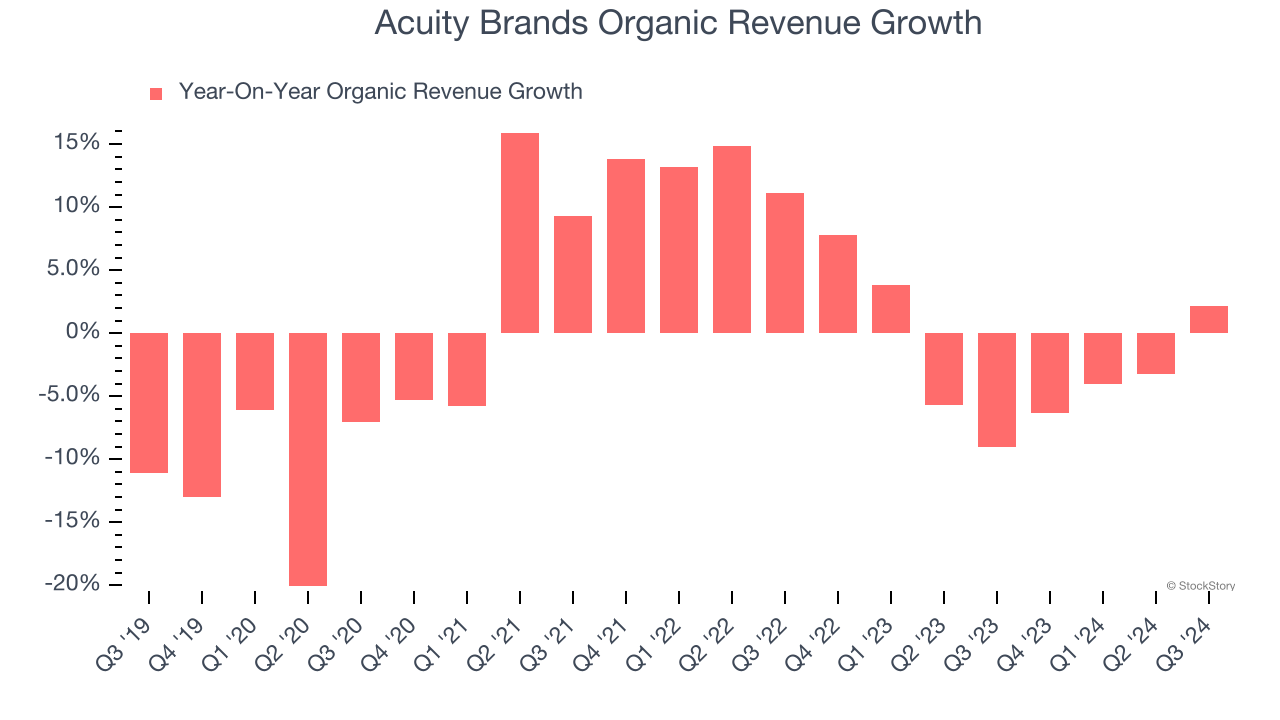

We can better understand Electrical Systems companies by analyzing their organic revenue. This metric gives visibility into Acuity Brands’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Acuity Brands’s organic revenue averaged 1.8% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Acuity Brands might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

Final Judgment

Acuity Brands isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 18.3× forward price-to-earnings (or $304.89 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Acuity Brands

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.