The past six months have been a windfall for Semtech’s shareholders. The company’s stock price has jumped 114%, hitting $62.80 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Semtech, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re happy investors have made money, but we're swiping left on Semtech for now. Here are three reasons why there are better opportunities than SMTC and a stock we'd rather own.

Why Do We Think Semtech Will Underperform?

A public company since the late 1960s, Semtech (NASDAQ: SMTC) is a provider of analog and mixed-signal semiconductors used for Internet of Things systems and cloud connectivity.

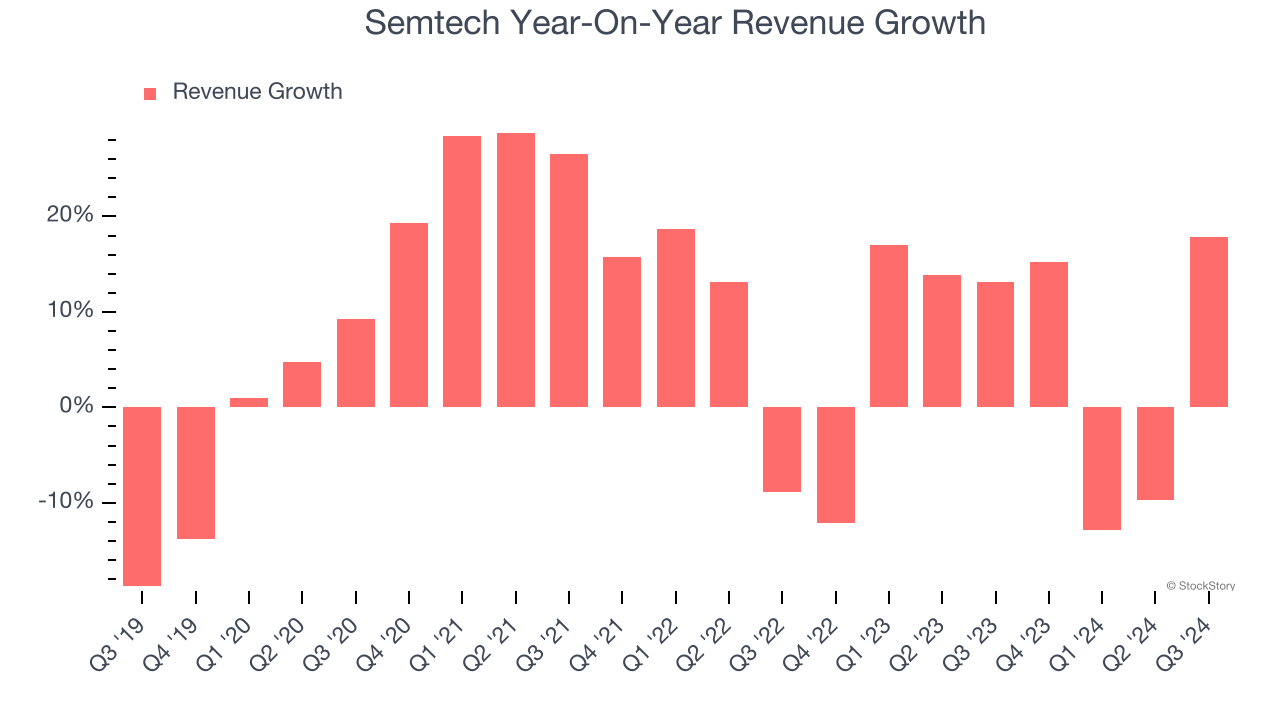

1. Lackluster Revenue Growth

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Semtech’s recent history shows its demand slowed as its annualized revenue growth of 4.5% over the last two years is below its five-year trend.

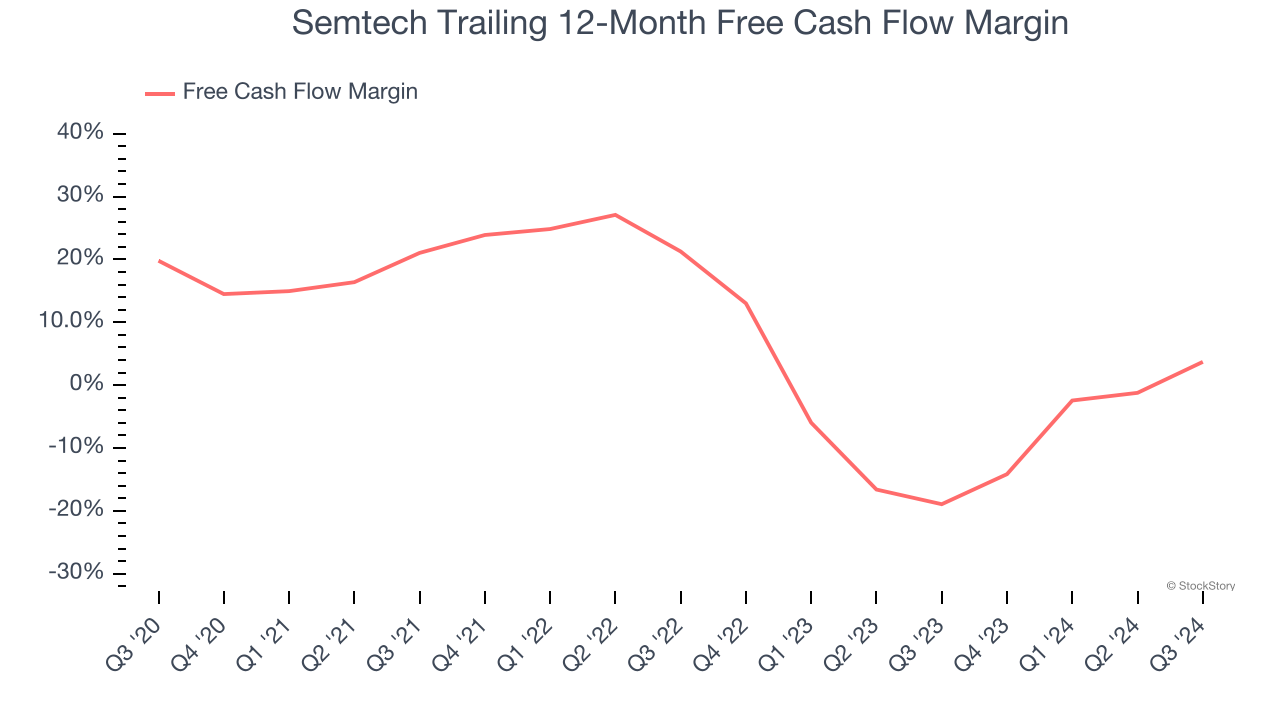

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Semtech’s margin dropped by 16.1 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. Semtech’s free cash flow margin for the trailing 12 months was 3.7%.

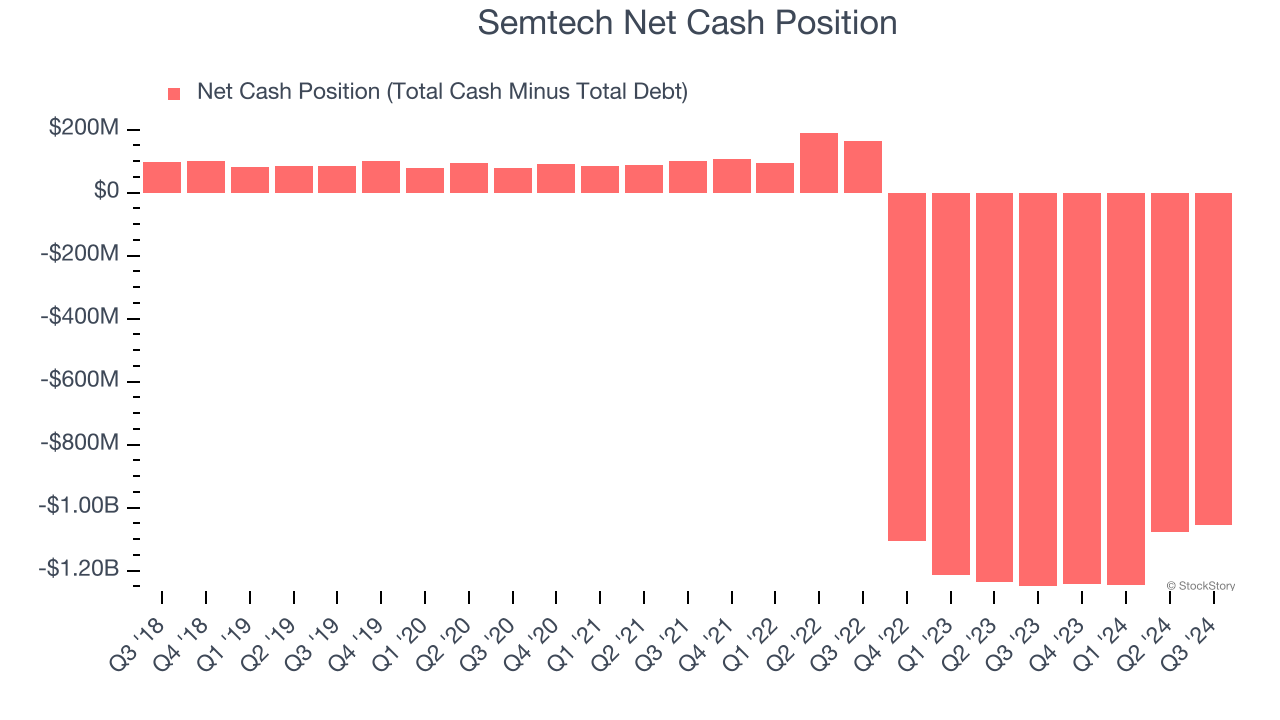

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Semtech’s $1.19 billion of debt exceeds the $136.5 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $165 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Semtech could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Semtech can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Semtech falls short of our quality standards. After the recent rally, the stock trades at 46.5× forward price-to-earnings (or $62.80 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Semtech

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.