Natural food company Hain Celestial (NASDAQ:HAIN) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 7.2% year on year to $394.6 million. Its non-GAAP loss of $0.04 per share was 145% below analysts’ consensus estimates.

Is now the time to buy Hain Celestial? Find out by accessing our full research report, it’s free.

Hain Celestial (HAIN) Q3 CY2024 Highlights:

- Revenue: $394.6 million vs analyst estimates of $394.2 million (in line)

- Adjusted EPS: -$0.04 vs analyst estimates of -$0.02 (-$0.02 miss)

- Gross Margin (GAAP): 20.7%, in line with the same quarter last year

- Operating Margin: 0.8%, down from 1.9% in the same quarter last year

- Free Cash Flow was -$16.54 million, down from $7.12 million in the same quarter last year

- Organic Revenue fell 5% year on year (-2.9% in the same quarter last year)

- Market Capitalization: $799.6 million

“Our performance in the first quarter built upon the momentum from our foundational year by further streamlining our portfolio and operational footprint, enabling us to deliver gross margin expansion,” said Wendy Davidson, Hain Celestial President and CEO.

Company Overview

Sold in over 75 countries around the world, Hain Celestial (NASDAQ:HAIN) is a natural and organic food company whose products range from snacks to teas to baby food.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Hain Celestial is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale.

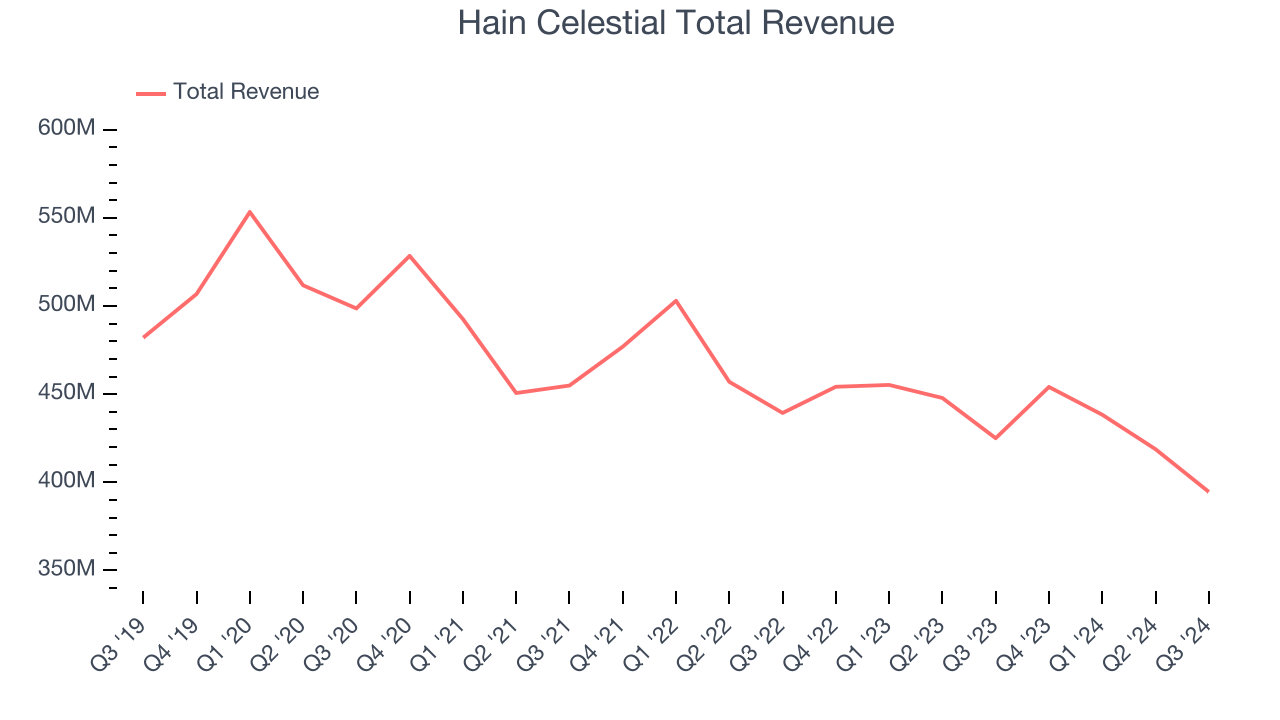

As you can see below, Hain Celestial’s revenue declined by 4% per year over the last three years, showing demand was weak. This is a tough starting point for our analysis.

This quarter, Hain Celestial reported a rather uninspiring 7.2% year-on-year revenue decline to $394.6 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last three years. Although this projection shows the market thinks its newer products will fuel better performance, it is still below the sector average.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Organic Revenue Growth

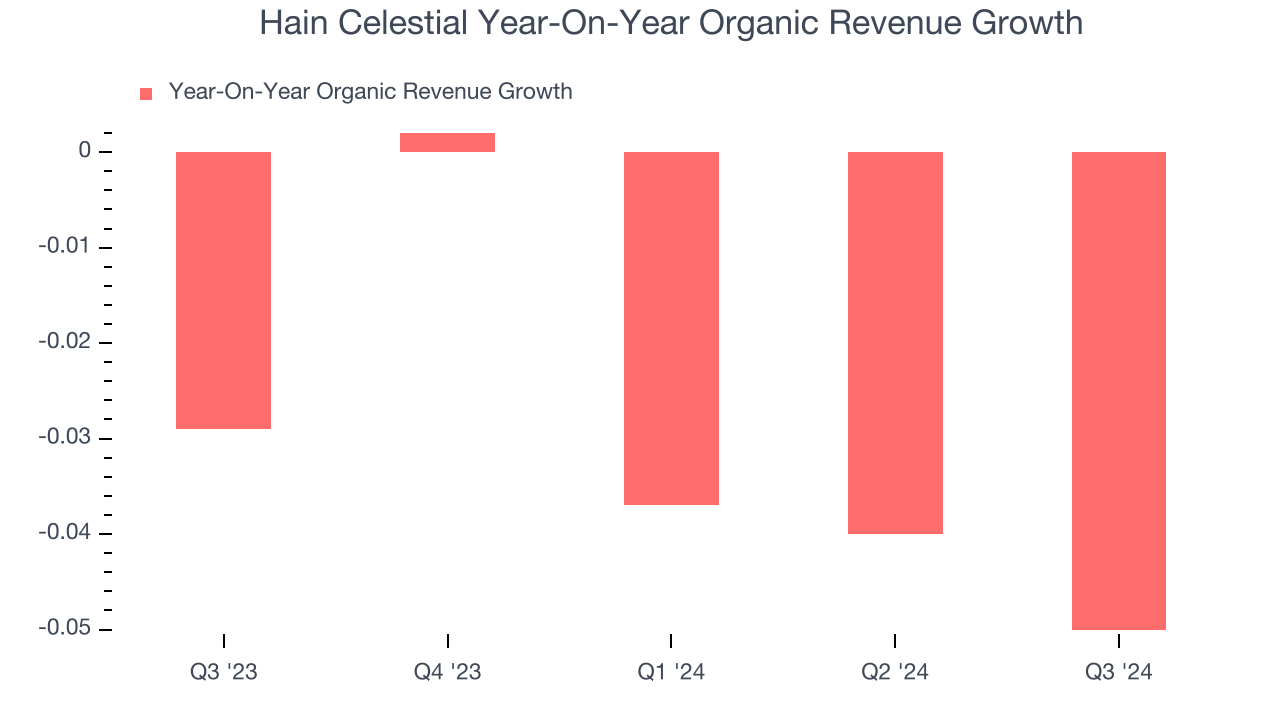

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

Hain Celestial’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 3.1% year on year.

In the latest quarter, Hain Celestial’s organic sales fell 5% year on year. This decrease was a further deceleration from the 2.9% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Hain Celestial’s Q3 Results

It was good to see Hain Celestial beat analysts’ organic revenue growth expectations this quarter. On the other hand, its EBITDA missed and its EPS missed Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.9% to $8.74 immediately after reporting.

Hain Celestial’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.