Precision measurement and sensing technologies provider Vishay Precision (NYSE:VPG) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, but sales fell 11.8% year on year to $75.73 million. The company expects next quarter’s revenue to be around $74 million, close to analysts’ estimates. Its GAAP loss of $0.10 per share was 154% below analysts’ consensus estimates.

Is now the time to buy Vishay Precision? Find out by accessing our full research report, it’s free.

Vishay Precision (VPG) Q3 CY2024 Highlights:

- Revenue: $75.73 million vs analyst estimates of $73.97 million (2.4% beat)

- EPS: -$0.10 vs analyst estimates of $0.19 (-$0.29 miss)

- EBITDA: $8.08 million vs analyst estimates of $8.02 million (small beat)

- Revenue Guidance for Q4 CY2024 is $74 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 40%, down from 42.1% in the same quarter last year

- Operating Margin: 5.1%, down from 11.1% in the same quarter last year

- EBITDA Margin: 10.7%, down from 15.3% in the same quarter last year

- Free Cash Flow was -$2.62 million, down from $5.92 million in the same quarter last year

- Market Capitalization: $312.9 million

Ziv Shoshani, Chief Executive Officer of VPG, commented, "Total revenue in the third quarter was fairly stable sequentially, as trends across our markets remained mixed. Some of our cyclical markets such as steel and consumer were soft, while orders in test and measurement and avionics, military & space were higher. Total orders of $68.6 million declined 6.7% sequentially and resulted in a book-to-bill of 0.91."

Company Overview

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE:VPG) operates as a global provider of precision measurement and sensing technologies.

Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

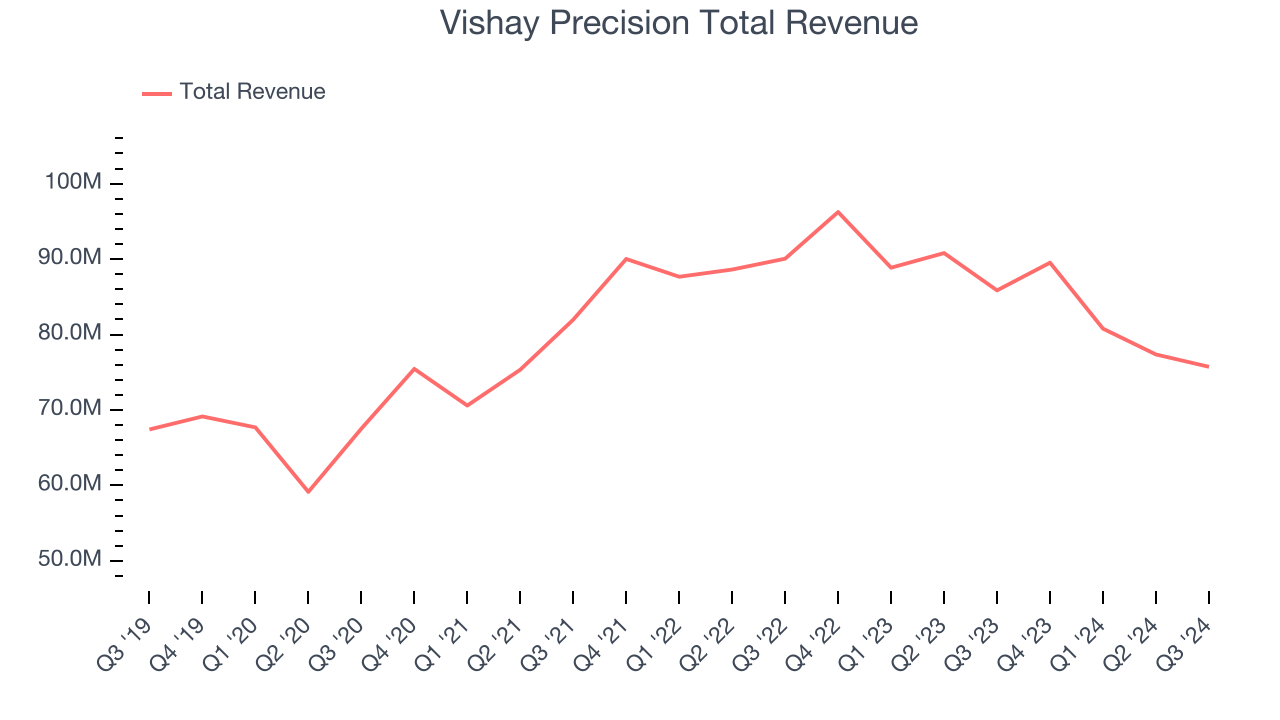

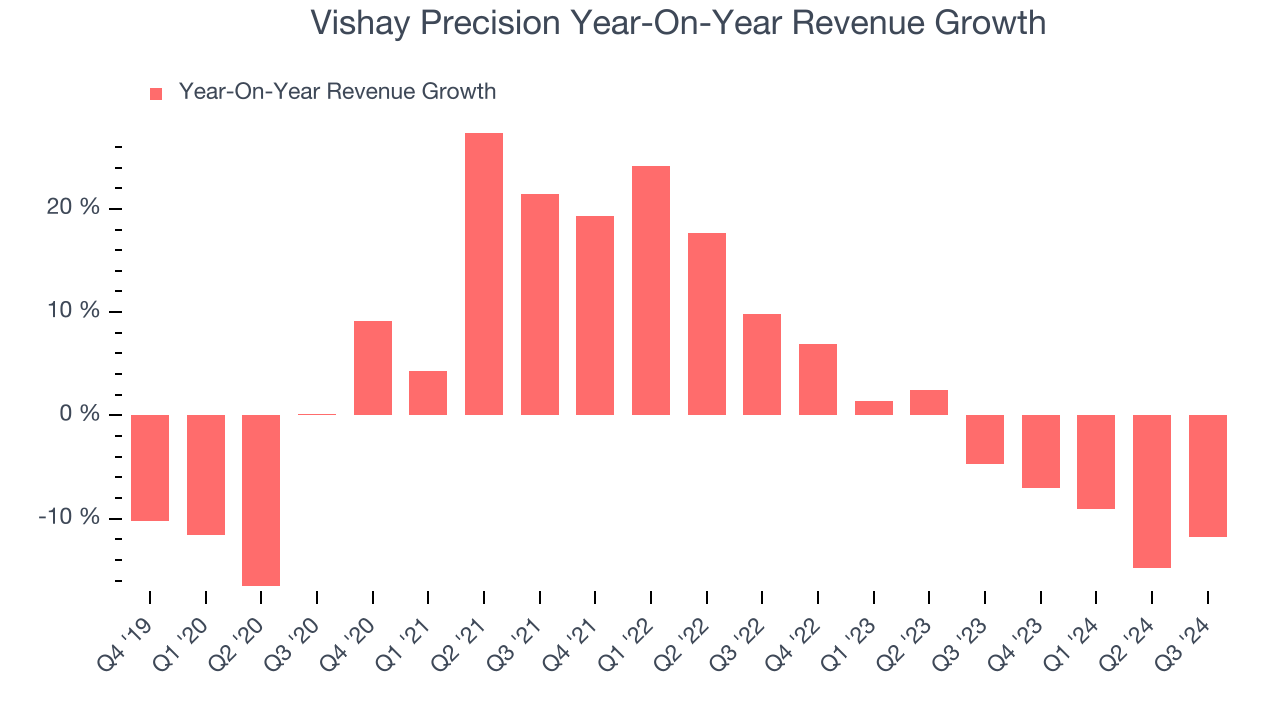

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Unfortunately, Vishay Precision’s 2.1% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Vishay Precision’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.7% annually. Vishay Precision isn’t alone in its struggles as the Electronic Components industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Vishay Precision’s revenue fell 11.8% year on year to $75.73 million but beat Wall Street’s estimates by 2.4%. Management is currently guiding for a 17.3% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to decline 2.9% over the next 12 months. Although this projection is better than its two-year trend it's tough to feel optimistic about a company facing demand difficulties.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

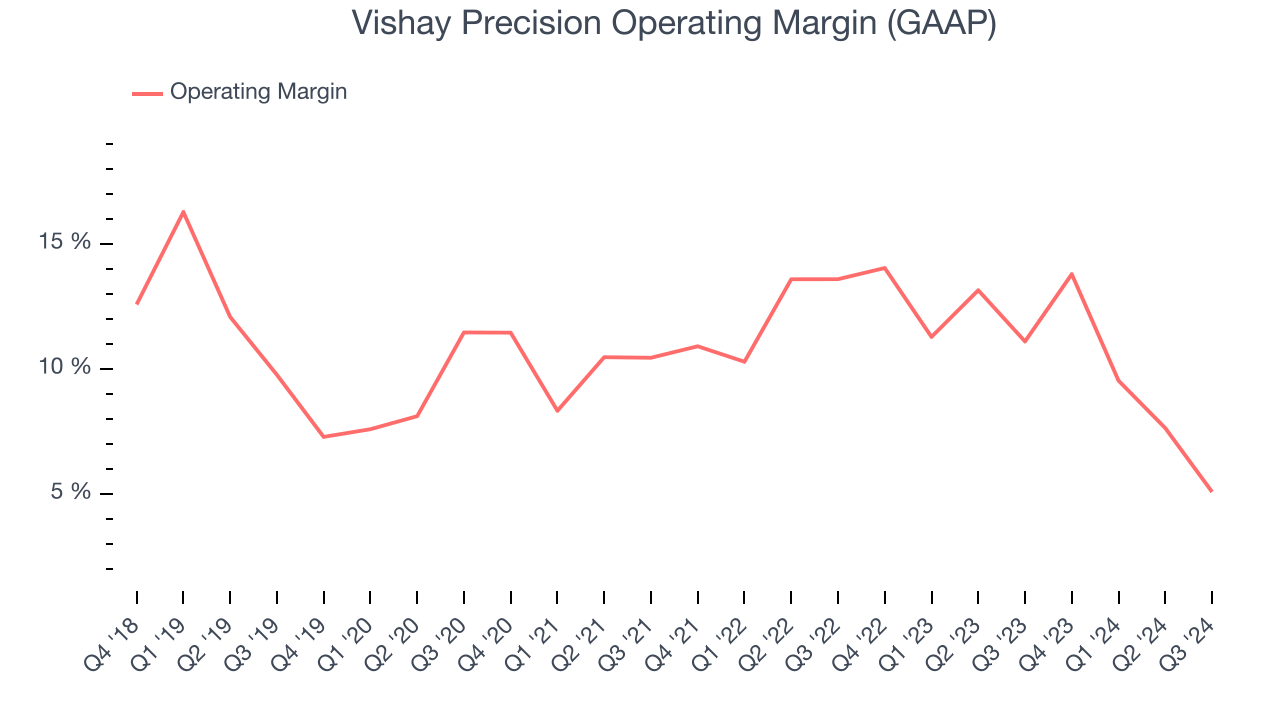

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Vishay Precision has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Vishay Precision’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, Vishay Precision generated an operating profit margin of 5.1%, down 6 percentage points year on year. Since Vishay Precision’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

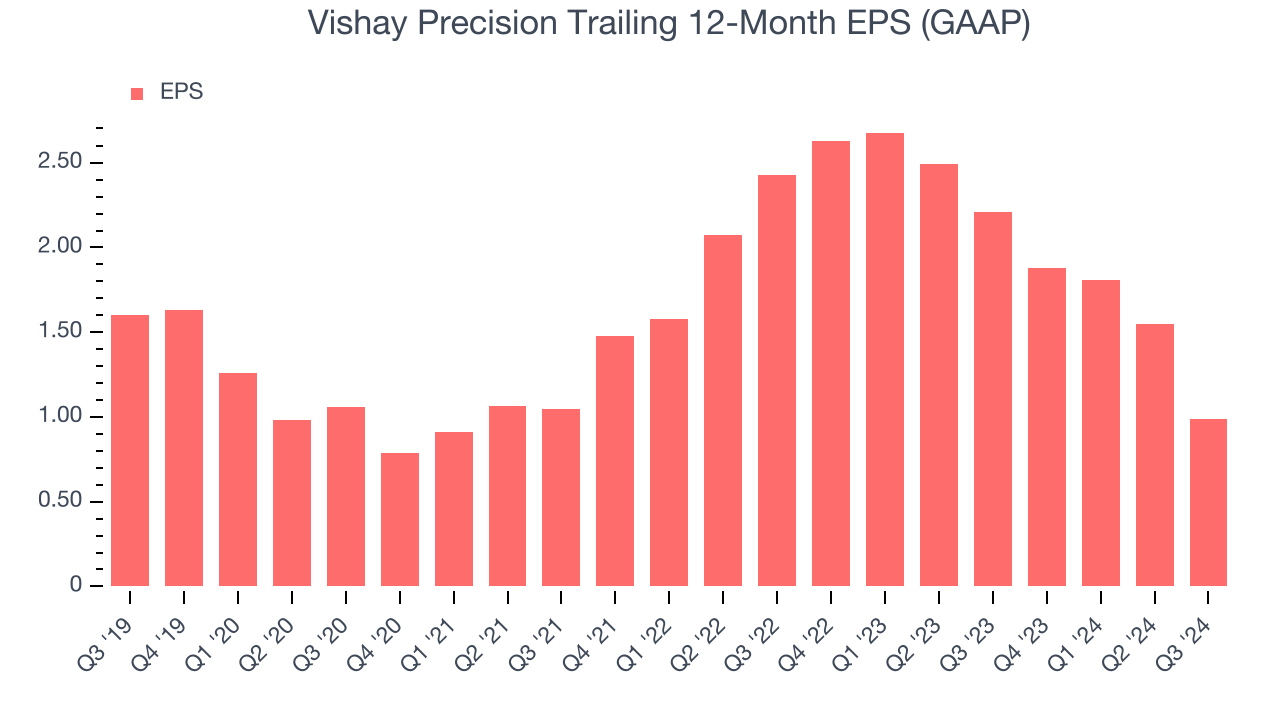

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Vishay Precision, its EPS declined by 9.2% annually over the last five years while its revenue grew by 2.1%. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Vishay Precision, its two-year annual EPS declines of 36.2% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Vishay Precision reported EPS at negative $0.10, down from $0.46 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Vishay Precision’s full-year EPS of $0.99 to grow by 23.9%.

Key Takeaways from Vishay Precision’s Q3 Results

We enjoyed seeing Vishay Precision exceed analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock traded down 2.5% to $23 immediately following the results.

So do we think Vishay Precision is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.