Computer processor maker Intel (NASDAQ:INTC) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, but sales fell 6.2% year on year to $13.28 billion. The company expects next quarter’s revenue to be around $13.8 billion, close to analysts’ estimates. Its non-GAAP loss of $0.46 per share was 1,534% below analysts’ consensus estimates.

Is now the time to buy Intel? Find out by accessing our full research report, it’s free.

Intel (INTC) Q3 CY2024 Highlights:

- Revenue: $13.28 billion vs analyst estimates of $13.04 billion (1.8% beat)

- Adjusted EPS: -$0.46 vs analyst estimates of -$0.03 (-$0.43 miss due to $3.1 billion of impairment charges)

- Revenue Guidance for Q4 CY2024 is $13.8 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q4 CY2024 is $0.12 at the midpoint, above analyst estimates of $0.07

- Gross Margin (GAAP): 15%, down from 42.5% in the same quarter last year

- Inventory Days Outstanding: 97, down from 123 in the previous quarter

- Operating Margin: -68.2%, down from -0.1% in the same quarter last year

- Free Cash Flow was -$2.70 billion, down from $943 million in the same quarter last year

- Market Capitalization: $95.35 billion

Company Overview

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is the leading manufacturer of computer processors and graphics chips.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

Sales Growth

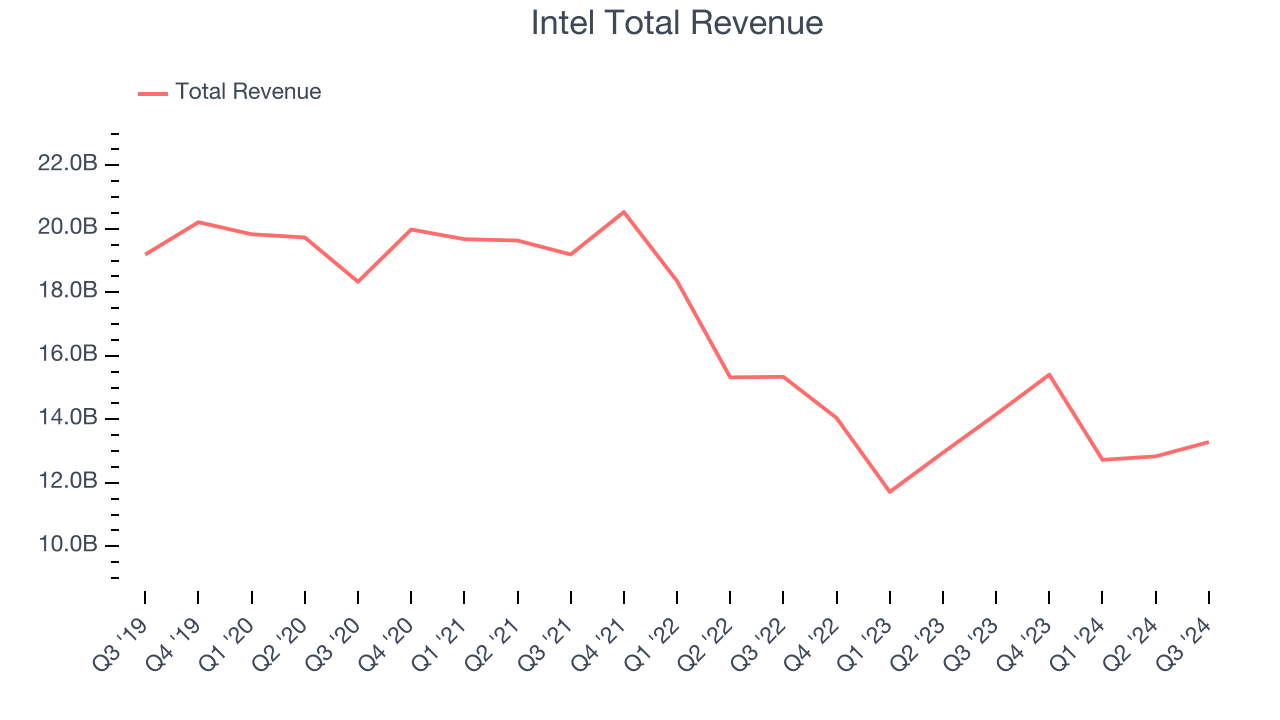

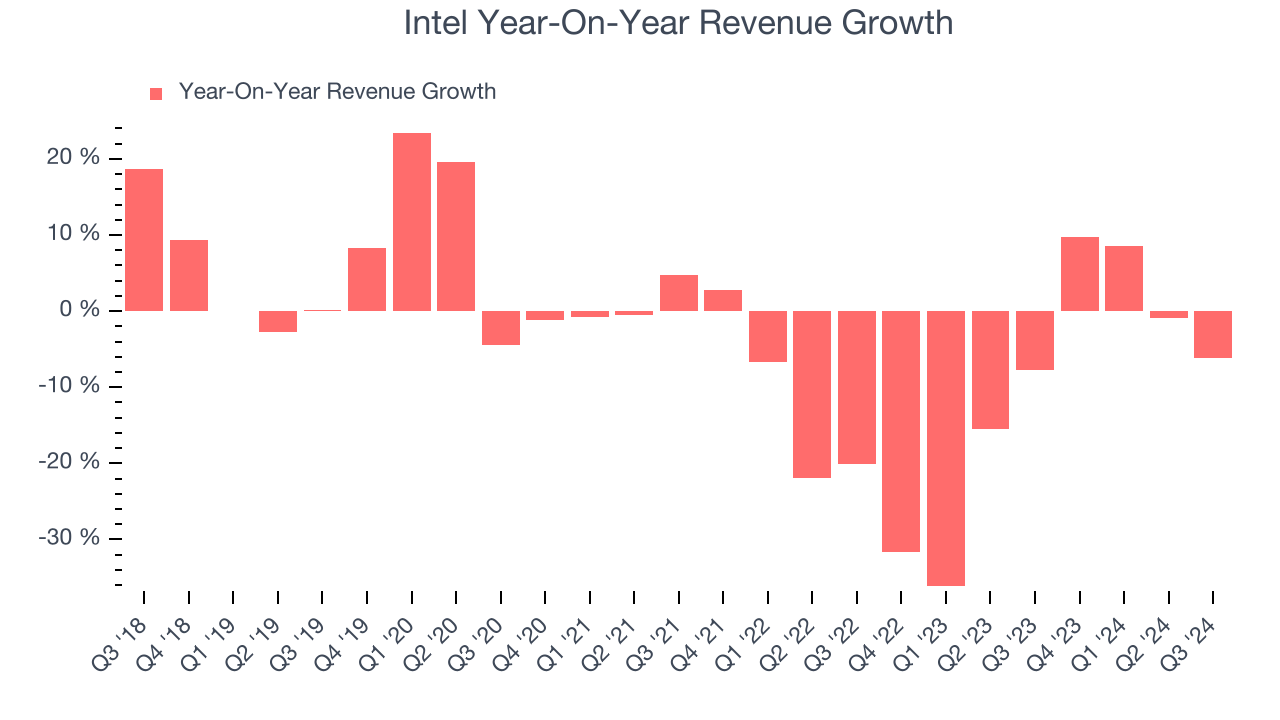

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Intel struggled to generate demand over the last five years as its sales dropped by 5.1% annually, a rough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Intel’s recent history shows its demand has stayed suppressed as its revenue has declined by 11.7% annually over the last two years.

This quarter, Intel’s revenue fell 6.2% year on year to $13.28 billion but beat Wall Street’s estimates by 1.8%. Management is currently guiding for a 10.4% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last two years. Although this projection indicates the market believes its newer products and services will fuel better performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

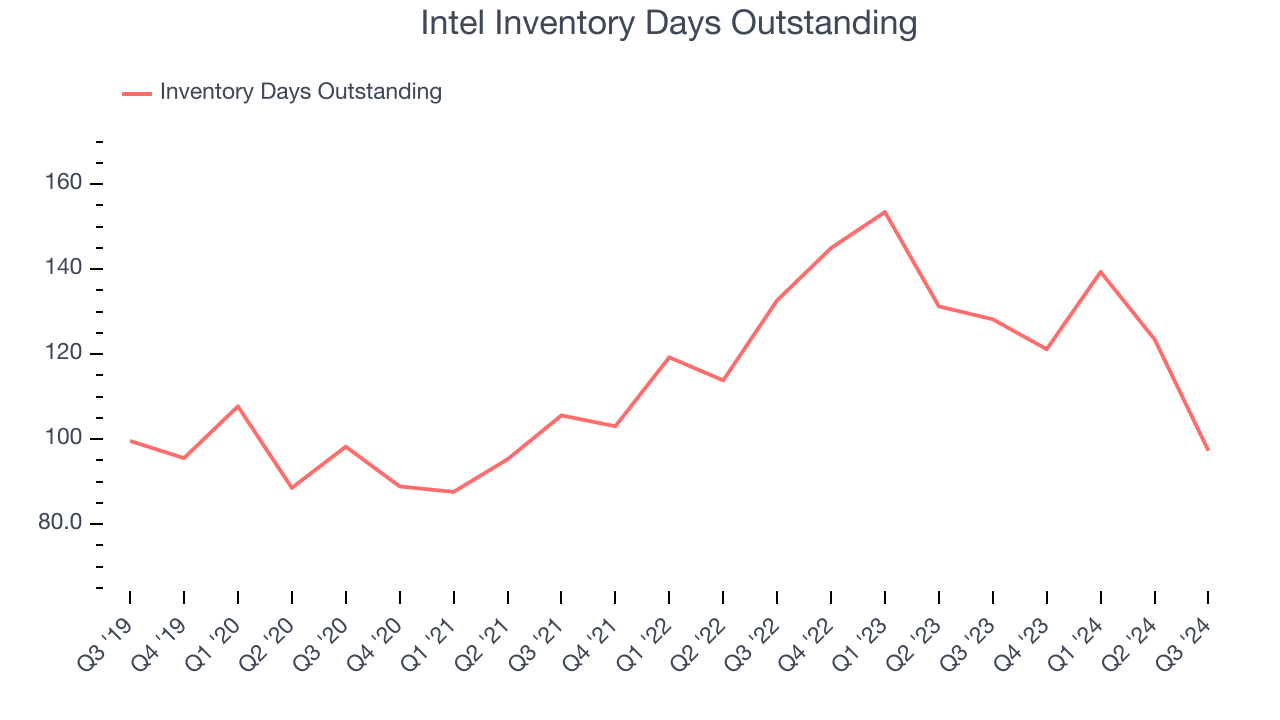

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Intel’s DIO came in at 97, which is 16 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Intel’s Q3 Results

We were impressed by Intel’s strong improvement in inventory levels. We were also glad next quarter’s EPS guidance exceeded Wall Street’s estimates, and the market seems to be cheering this. As for the quarter, revenue beat, and we would disregard the operating profit and EPS misses vs. Consensus expectations due to the large impairment charge. Lastly, management noted that it is making significant progress on plan to deliver $10 billion in cost reductions in 2025. Overall, this was a strong quarter amid low expectations. The stock traded up 14.3% to $24.60 immediately following the results.

Is Intel an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.