Electrical construction and infrastructure services provider MYR Group (NASDAQ:MYRG) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 5.5% year on year to $888 million. Its GAAP profit of $0.65 per share was 54.8% above analysts’ consensus estimates.

Is now the time to buy MYR Group? Find out by accessing our full research report, it’s free.

MYR Group (MYRG) Q3 CY2024 Highlights:

- Revenue: $888 million vs analyst estimates of $917.2 million (3.2% miss)

- EPS: $0.65 vs analyst estimates of $0.42 (54.8% beat)

- EBITDA: $37.17 million vs analyst estimates of $27.29 million (36.2% beat)

- Gross Margin (GAAP): 8.7%, down from 9.8% in the same quarter last year

- Operating Margin: 2.3%, down from 3.4% in the same quarter last year

- EBITDA Margin: 4.2%, in line with the same quarter last year

- Free Cash Flow was $17.95 million, up from -$9.51 million in the same quarter last year

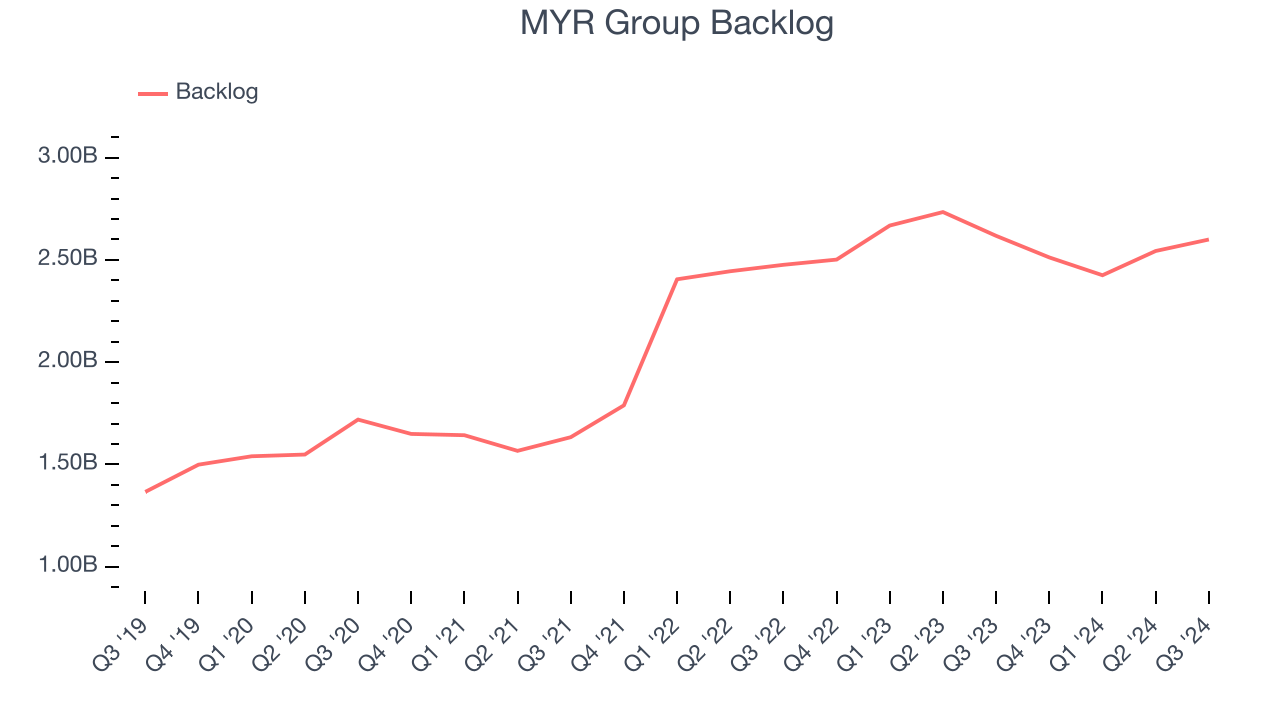

- Backlog: $2.6 billion at quarter end, in line with the same quarter last year

- Market Capitalization: $1.92 billion

Management CommentsRick Swartz, MYR’s President and CEO, said, “Our core markets remain active, and bidding activity continued at a robust pace during the quarter. Opportunities for long-term growth remain healthy as we continue to strategically expand our strong customer relationships across our business segments.”

Company Overview

Constructing electrical and phone lines in the American Midwest dating back to the 1890s, MYR Group (NASDAQ:MYRG) is a specialty contractor in the electrical construction industry.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Sales Growth

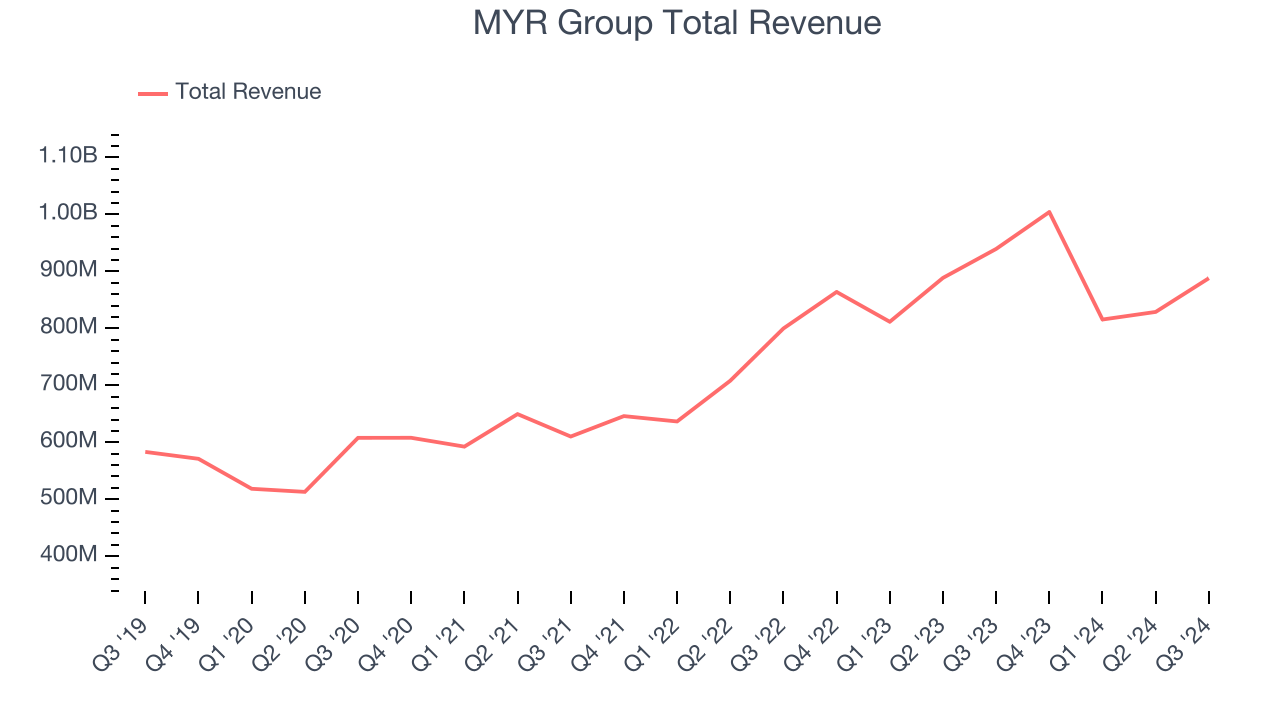

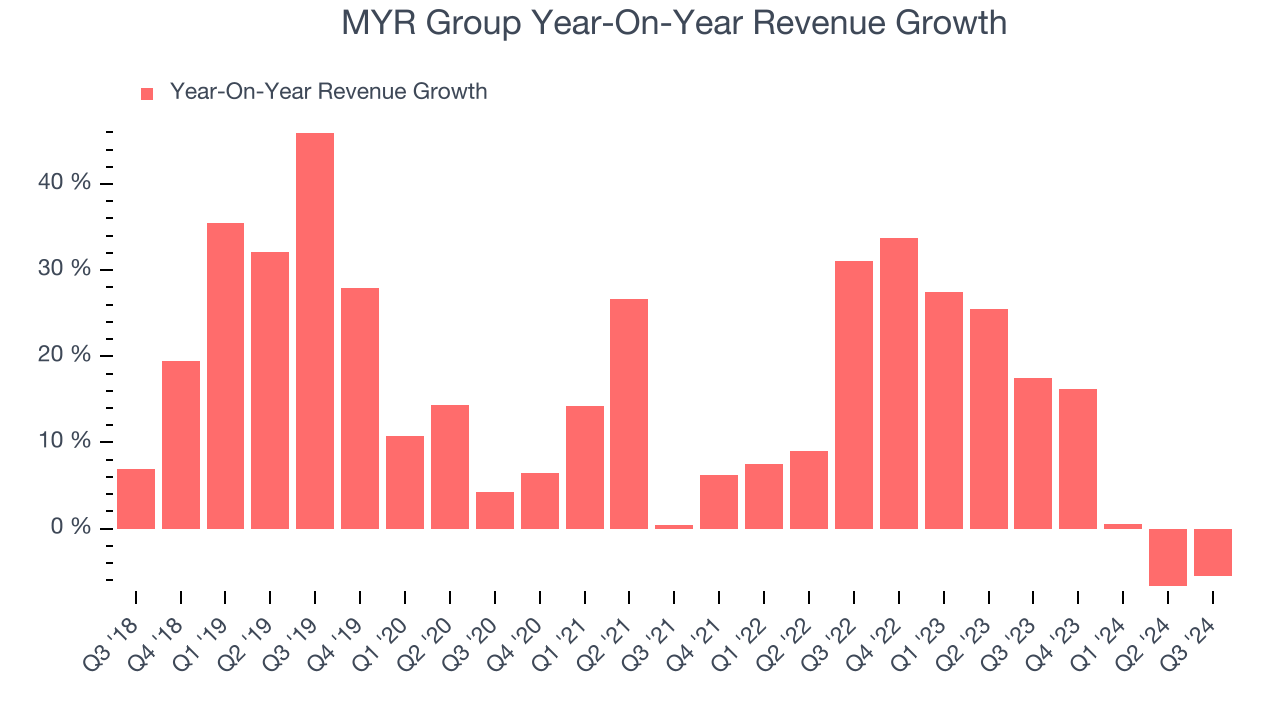

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, MYR Group’s 12.7% annualized revenue growth over the last five years was excellent. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. MYR Group’s annualized revenue growth of 12.6% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. MYR Group’s backlog reached $2.6 billion in the latest quarter and averaged 6.5% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies MYR Group was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, MYR Group missed Wall Street’s estimates and reported a rather uninspiring 5.5% year-on-year revenue decline, generating $888 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market believes its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

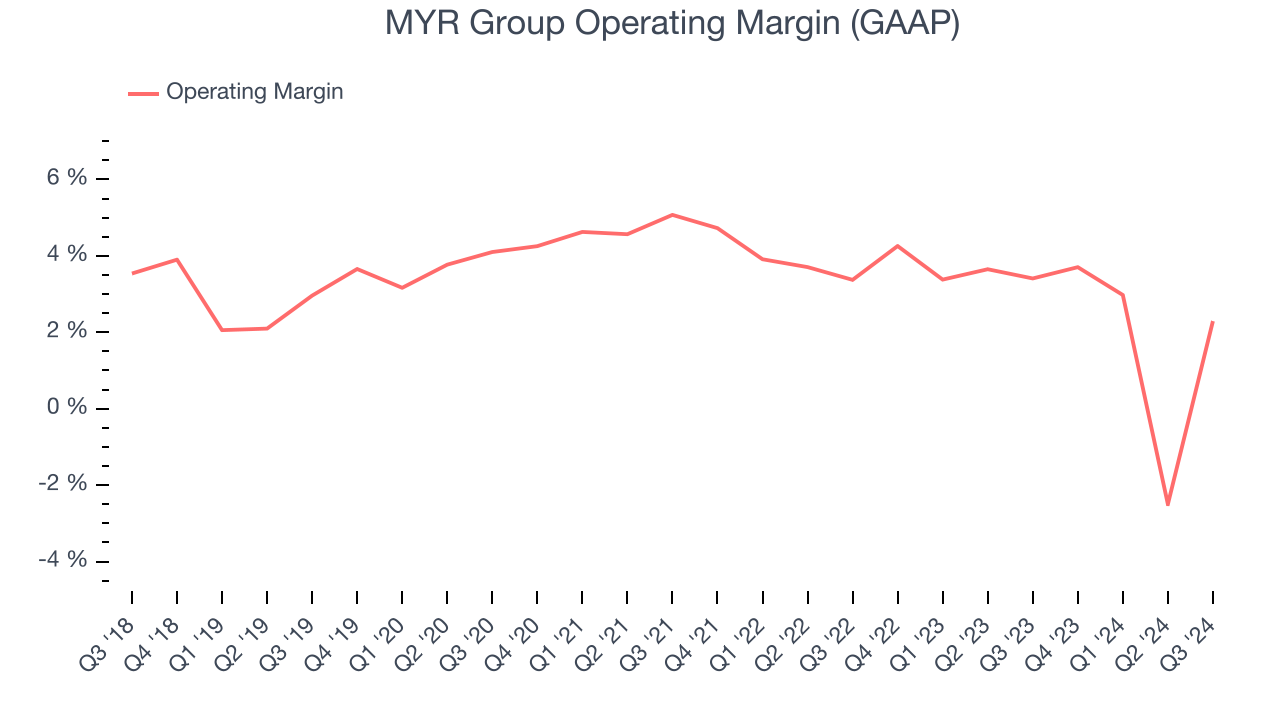

MYR Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, MYR Group’s annual operating margin decreased by 2 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, MYR Group generated an operating profit margin of 2.3%, down 1.1 percentage points year on year. Since MYR Group’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

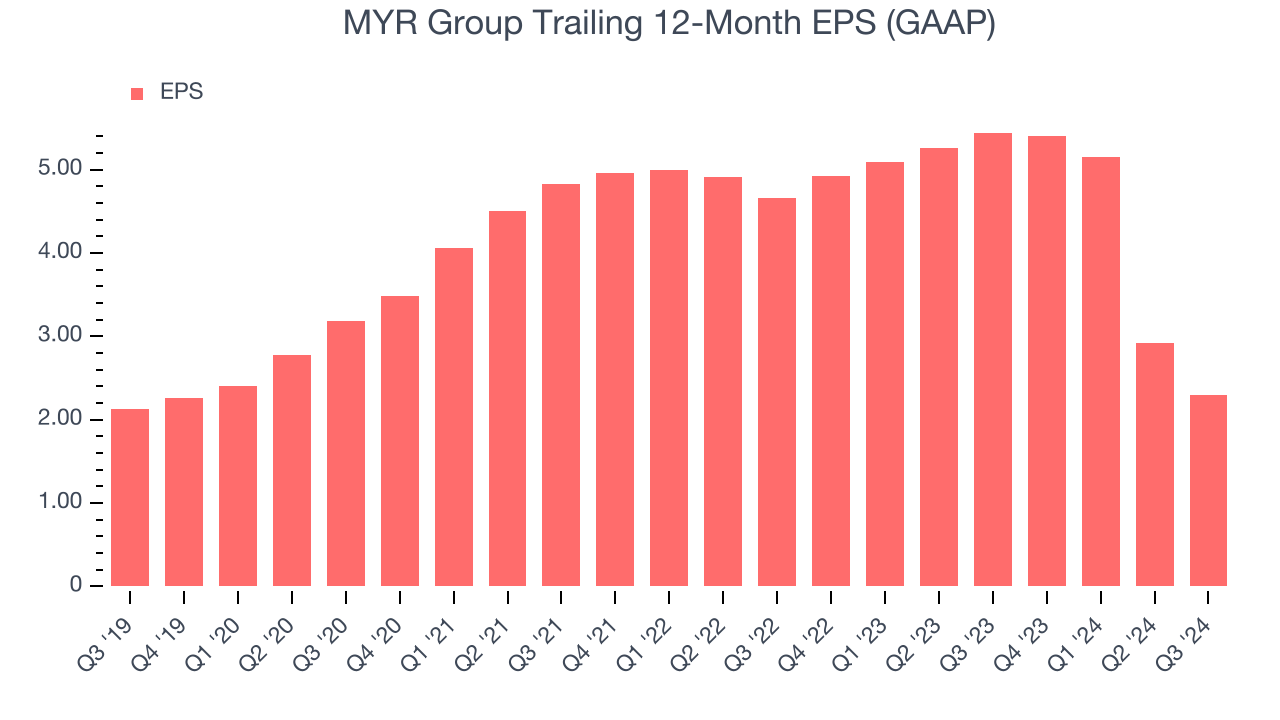

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

MYR Group’s EPS grew at a weak 1.5% compounded annual growth rate over the last five years, lower than its 12.7% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into MYR Group’s earnings to better understand the drivers of its performance. As we mentioned earlier, MYR Group’s operating margin declined by 2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

MYR Group’s two-year annual EPS declines of 29.8% were bad and lower than its 12.6% two-year revenue growth.In Q3, MYR Group reported EPS at $0.65, down from $1.28 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects MYR Group’s full-year EPS of $2.29 to grow by 106%.

Key Takeaways from MYR Group’s Q3 Results

We were impressed by how significantly MYR Group blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $115 immediately following the results.

Is MYR Group an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.