Crane and lifting equipment company Manitowoc (NYSE: MTW) reported Q3 CY2024 results topping the market’s revenue expectations, but sales were flat year on year at $524.8 million. Its non-GAAP loss of $2.90 per share was 4,696% below analysts’ consensus estimates.

Is now the time to buy Manitowoc? Find out by accessing our full research report, it’s free.

Manitowoc (MTW) Q3 CY2024 Highlights:

- Revenue: $524.8 million vs analyst estimates of $516.5 million (1.6% beat)

- EBITDA: $26.2 million vs analyst estimates of $30.69 million (14.6% miss)

- Gross Margin (GAAP): 16.7%, down from 18.6% in the same quarter last year

- Operating Margin: 1.4%, down from 3.5% in the same quarter last year

- EBITDA Margin: 5%, down from 6.4% in the same quarter last year

- Free Cash Flow was -$52.9 million, down from $2.7 million in the same quarter last year

- Backlog: $742.1 million at quarter end, down 27.8% year on year

- Market Capitalization: $344.1 million

Company Overview

Contracted by the United States Navy during WWII, Manitowoc (NYSE: MTW) provides cranes and lifting equipment.

Construction Machinery

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new sales opportunities for construction machinery companies. On the other hand, construction machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

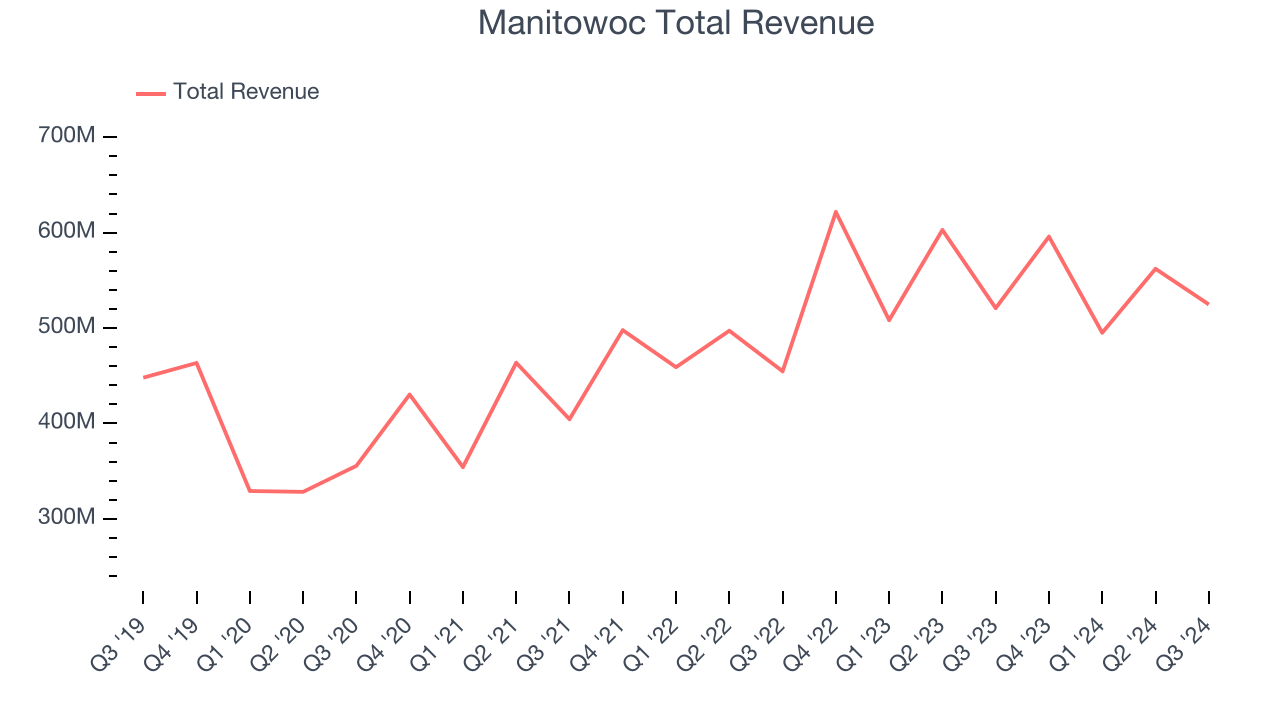

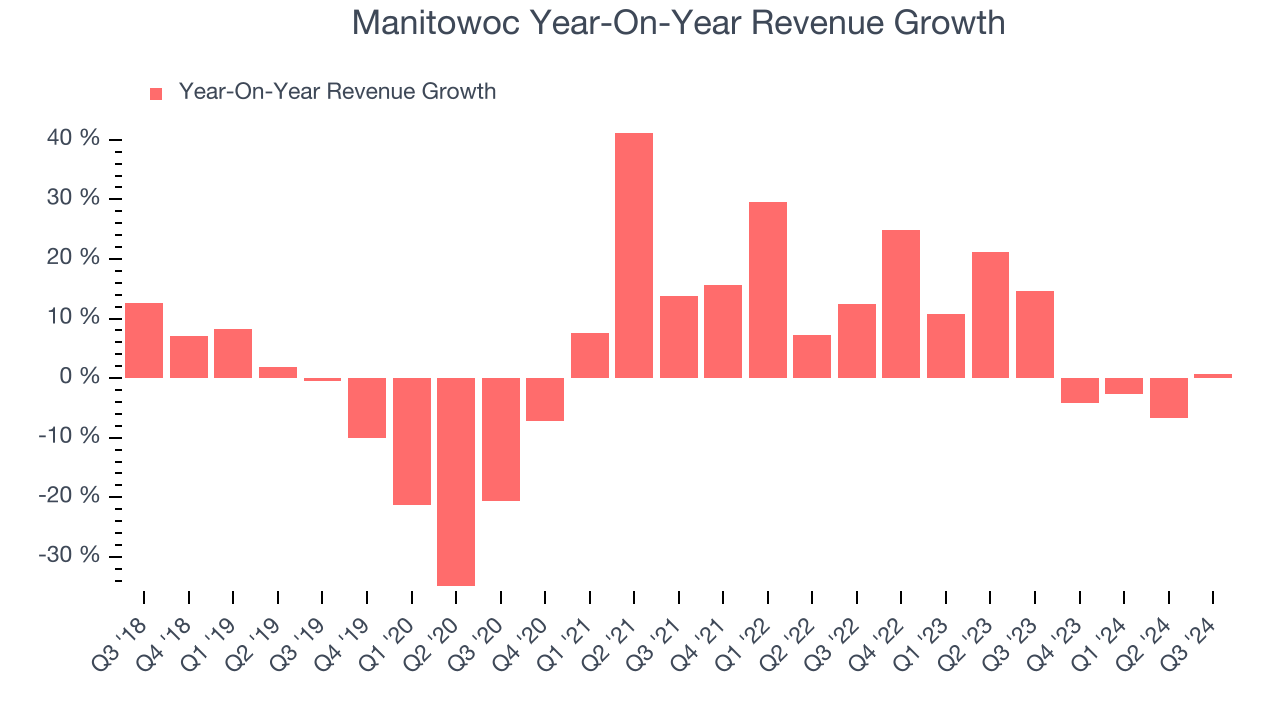

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Manitowoc’s 2.9% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Manitowoc’s annualized revenue growth of 6.8% over the last two years is above its five-year trend, but we were still disappointed by the results.

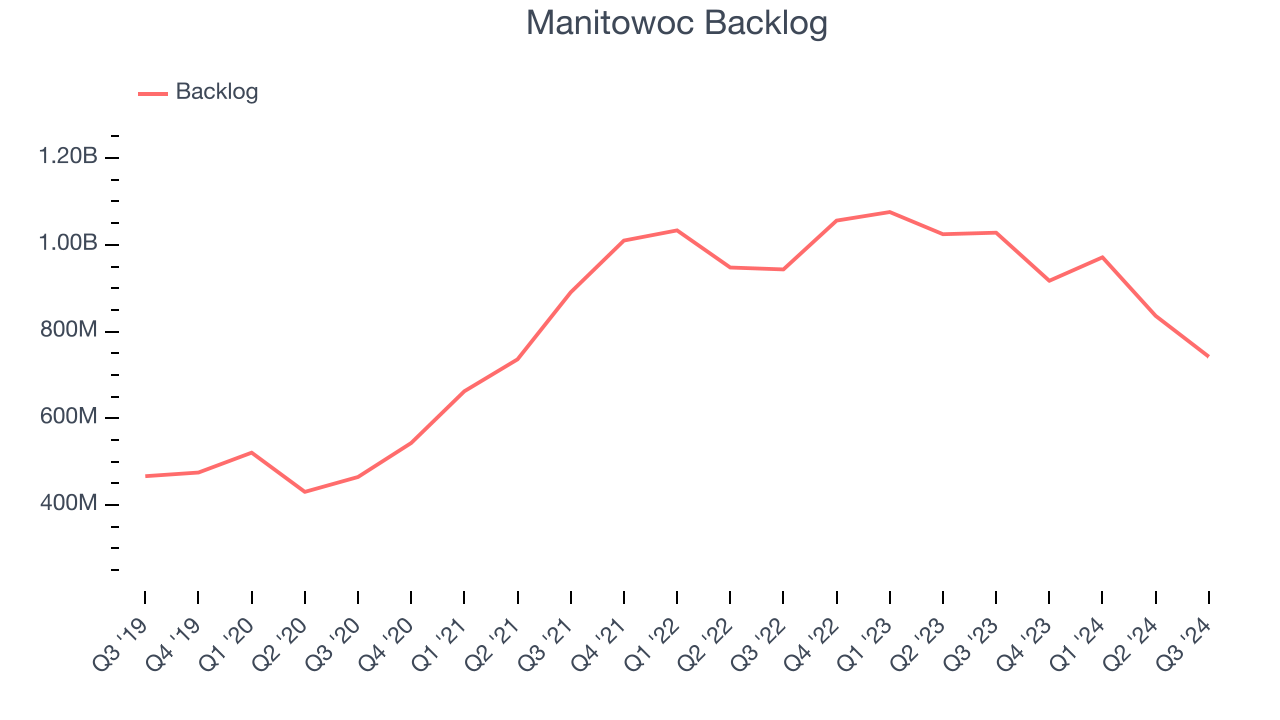

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Manitowoc’s backlog reached $742.1 million in the latest quarter and averaged 5.4% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Manitowoc’s $524.8 million of revenue was flat year on year but beat Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market thinks its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

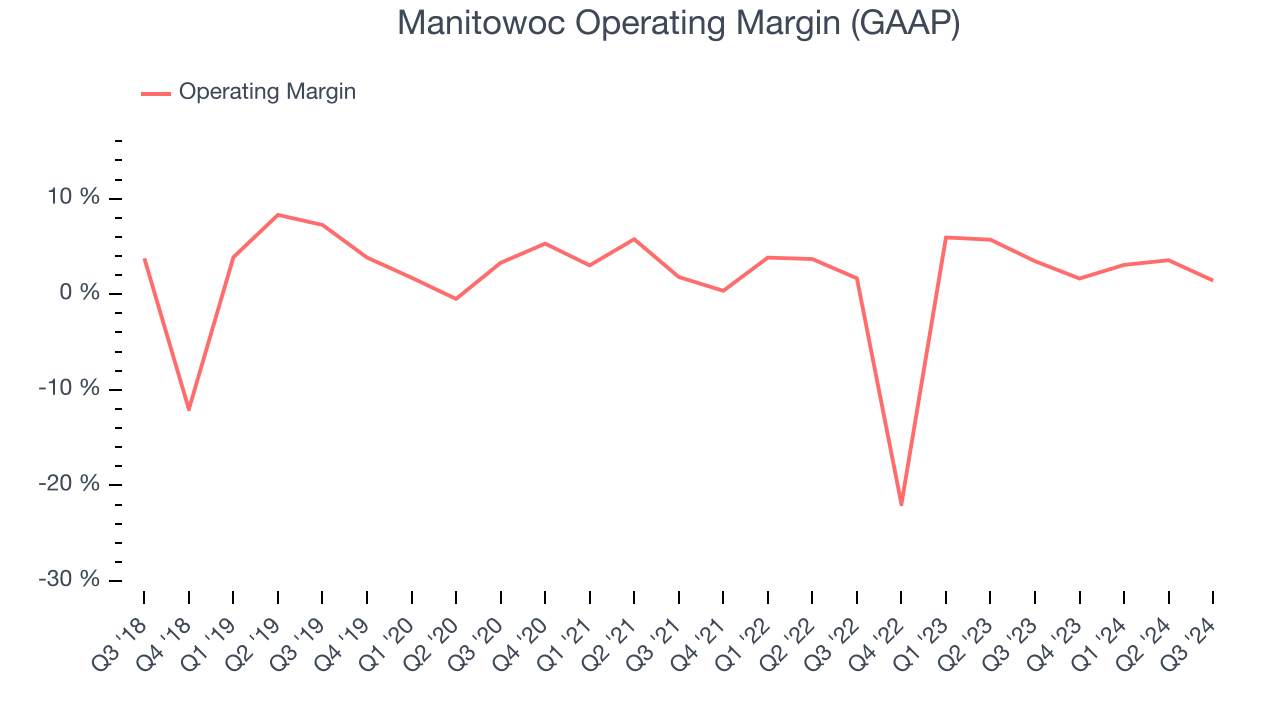

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Manitowoc was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Manitowoc’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business to change.

In Q3, Manitowoc generated an operating profit margin of 1.4%, down 2 percentage points year on year. Since Manitowoc’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Key Takeaways from Manitowoc’s Q3 Results

It was good to see Manitowoc beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 6.1% to $9.75 immediately after reporting.

Manitowoc didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.