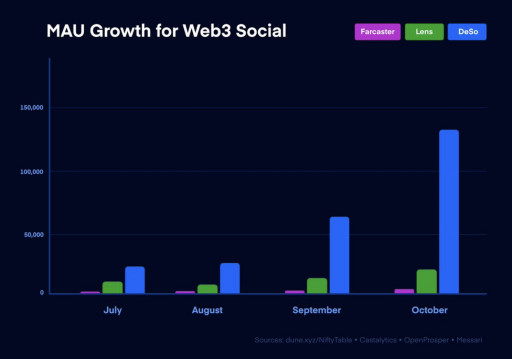

Decentralized Social Blockchain Reaches 130,000 MAUs

A graph showing user growth on the DeSo blockchain

Takeaways:

- DeSo, a new blockchain that has raised $200 million from Coinbase, Sequoia, and Andreessen Horowitz, just launched Openfund, a breakthrough cross-chain fundraising platform.

- Openfund allows entrepreneurs to launch fundraising rounds with tradeable coins via an on-chain order-book exchange backed by the DeSo blockchain.

- Founders can raise capital with any currency, including fiat cash, Bitcoin, Ethereum, Solana, DeSo, and USDC, and cash out directly to USDC and SOL.

At the forefront of this disruptive trend, a new app called Openfund is launching today. Built on the DeSo blockchain, backed by Coinbase, Sequoia, Andreessen Horowitz, and others, Openfund allows any Bitcoin, Ethereum, or Solana user to invest in promising founders before they go to pitch venture capitalists.

Today, the fundraising process for founders is highly centralized, with a handful of elite venture capitalists controlling who gets funded and who doesn't. In addition, founders must typically wait 10 years or more for their company to "go public" and become traded on a liquid exchange. But that could soon change as blockchains like DeSo enable founders to raise money from millions of Bitcoin, Ethereum, and Solana users with just the click of a button.

For founders, setting up a fundraise on Openfund is as easy as creating a social media account. Funds are automatically converted to USD, and founders can cash out seamlessly to USDC anytime.

Perhaps the most interesting component of Openfund, however, is that founders have the option of giving contributors a liquid token with their purchase, which can immediately trade on DeSo's decentralized on-chain gas-less order-book exchange.

Such a breakthrough raises the question of whether the traditional fundraising model of waiting 10 years for a company to trade on the open market could now be obsolete.

"DeSo is the only blockchain that could support something like Openfund today," says Arash Ghaemi, Growth Marketing Lead at DeSo. "DeSo's recent USDC integration, as well as the use of the MegaSwap swapping facility to convert crypto into USD, were both critical, and unique components of the DeSo ecosystem. On top of that, DeSo's order-book exchange can process 40,000 matches per second, which makes it the fastest in the world as far as we know," he continues.

DeSo is also capable of supporting unique social features leveraged by Openfund, including on-chain profiles and an on-chain social graph. "It costs about $75 to store a 200-character Tweet on Ethereum, and about fifteen cents to store it on Solana, Avalanche, or Polygon. In contrast, DeSo is one ten-thousandth of a cent, making it the first blockchain capable of disrupting storage-heavy applications like social fundraising. It really is the Social Layer for all of web3," Ghaemi adds.

This is the latest in a recent string of successes for DeSo. The platform was listed on Coinbase this last year and announced a groundbreaking MetaMask integration. The platform also announced a USDC integration recently that has attracted many new builders to the ecosystem, including Openfund.

With the launch of Openfund, DeSo's true disruptive power becomes apparent. It is a platform that can disrupt not only social media, but the trillion-dollar early-stage financing market as well.

Contact Information:

Arash Ghaemi

Growth Marketing Lead

ash@deso.org

Press Release Service by Newswire.com

Original Source: Coinbase-Backed Openfund Pioneers New Fundraising Model, Powered by Decentralized Social