If you are bullish on any optionable stock in any stock sector, you can play any number of options trades. The easiest directional strategy is to buy a call option. However, you will fight time whenever you own a long call option since the Theta (time decay) works against you. Even if the underlying stock remains flat, the option loses money incrementally every day by the Theta value. You also have the chance of losing 100% of your investment if the stock closes below its strike price on expiration.

Naked put strategy

You could consider a naked put strategy, also known as selling or shorting a put. While this bullish directional trade can reap upside profits and is Theta friendly as you profit on the time decay, the risk of being assigned if the stock closes under the strike price can be costly. Unless you want to own the stock at the selected strike price. Additionally, most brokers require higher options authorization approval to qualify to trade naked puts.

Call debit spread strategy

Consider a call debit spread strategy where you simultaneously buy a call option and sell/short a higher strike price call option. It's called a debit spread because you pay the premium difference between long and short-call option prices. This enables you to pay less for the long directional position than just buying the calls. However, your upside is capped up to the higher strike price of the short-call option. In exchange, your downside is also limited to the cost of the spread, which is still less than losing 100% of the long call option. Theta is not your friend on debit spreads. Debit spreads are preferred when the implied volatility (IV) is low.

Put credit spread strategy

Another option strategy is called a put credit spread, also known as a bull put credit spread or a short put spread. This is similar to the debit spread strategy but with some variations. In this trade, you would simultaneously sell a put at a strike price that you feel is a support level and buy a put at a lower strike price. It's called a credit spread because it pays you the premium first, meaning you receive a credit up front.

The maximum profit is the credit premium you receive. You keep the net credit premium if the stock stays above the higher strike price on expiration.

Theta is your friend on put credit spreads because when you sell puts, you are the one collecting on the time decay. Credit spreads are favorable when implied volatility (IV) is high. The max loss is hit if the underlying stocks fall under the lower long put strike price level. Your loss would be the difference between the put strike prices minus the premium received. The benefit of a credit spread is that you get paid your max gain up front versus a debit spread where you pay to max loss up front to acquire the spread.

Putting on the trade

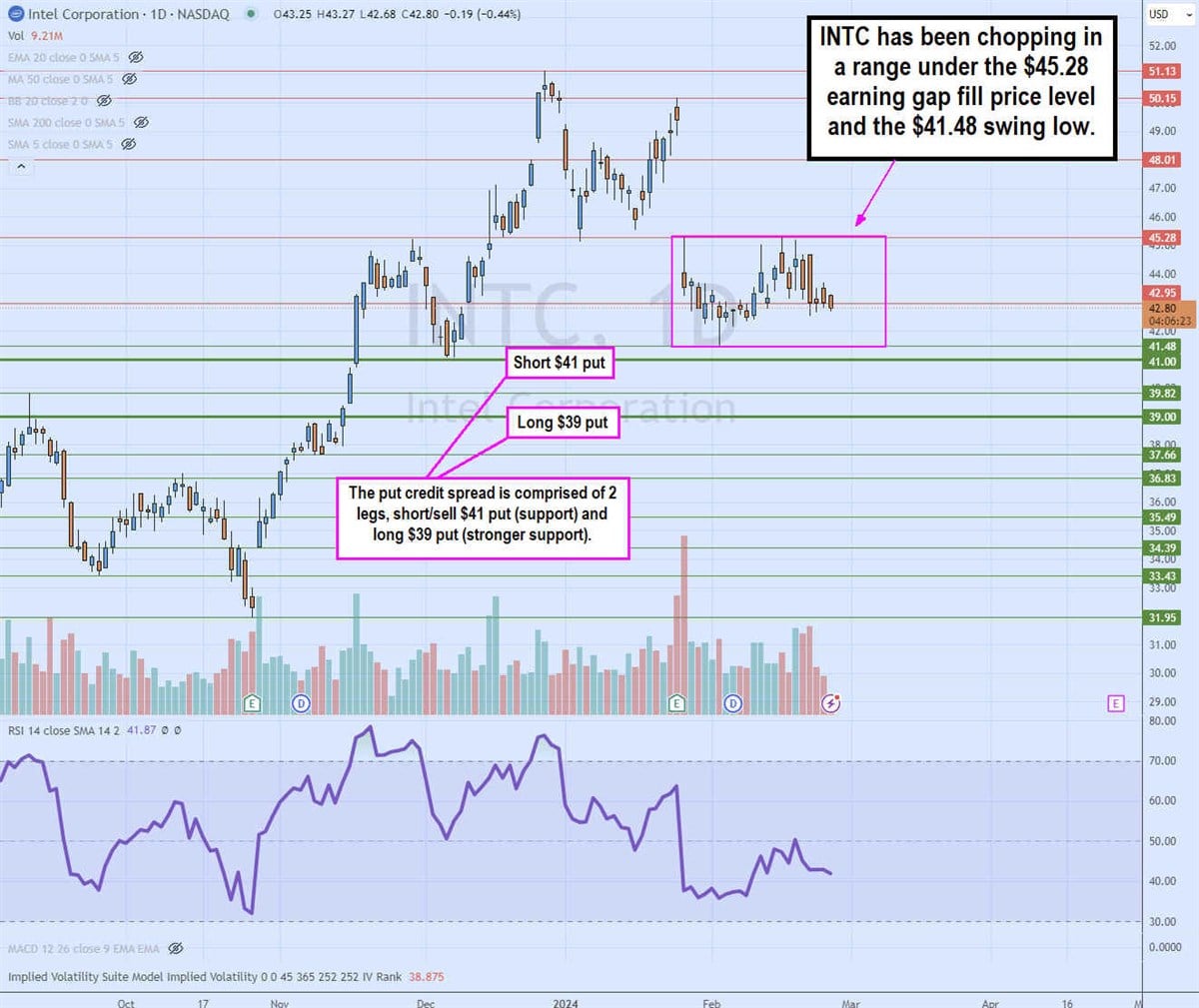

Let’s use Intel Co. (NASDAQ: INTC) on the daily candlestick chart.

INTC is trading at $42.85 on February 27, 2024. The $45.28 has been a gap-fill resistance level as it gapped down on its Q4 2023 earnings miss and lowered guidance. There are two relatively strong support levels at $41.38 and $39.00. The daily relative strength index (RSI) is starting to lose steam again sliding down towards the 40-band. If we feel bullish on INTC, then we can consider a put credit spread around the support levels to collect premiums.

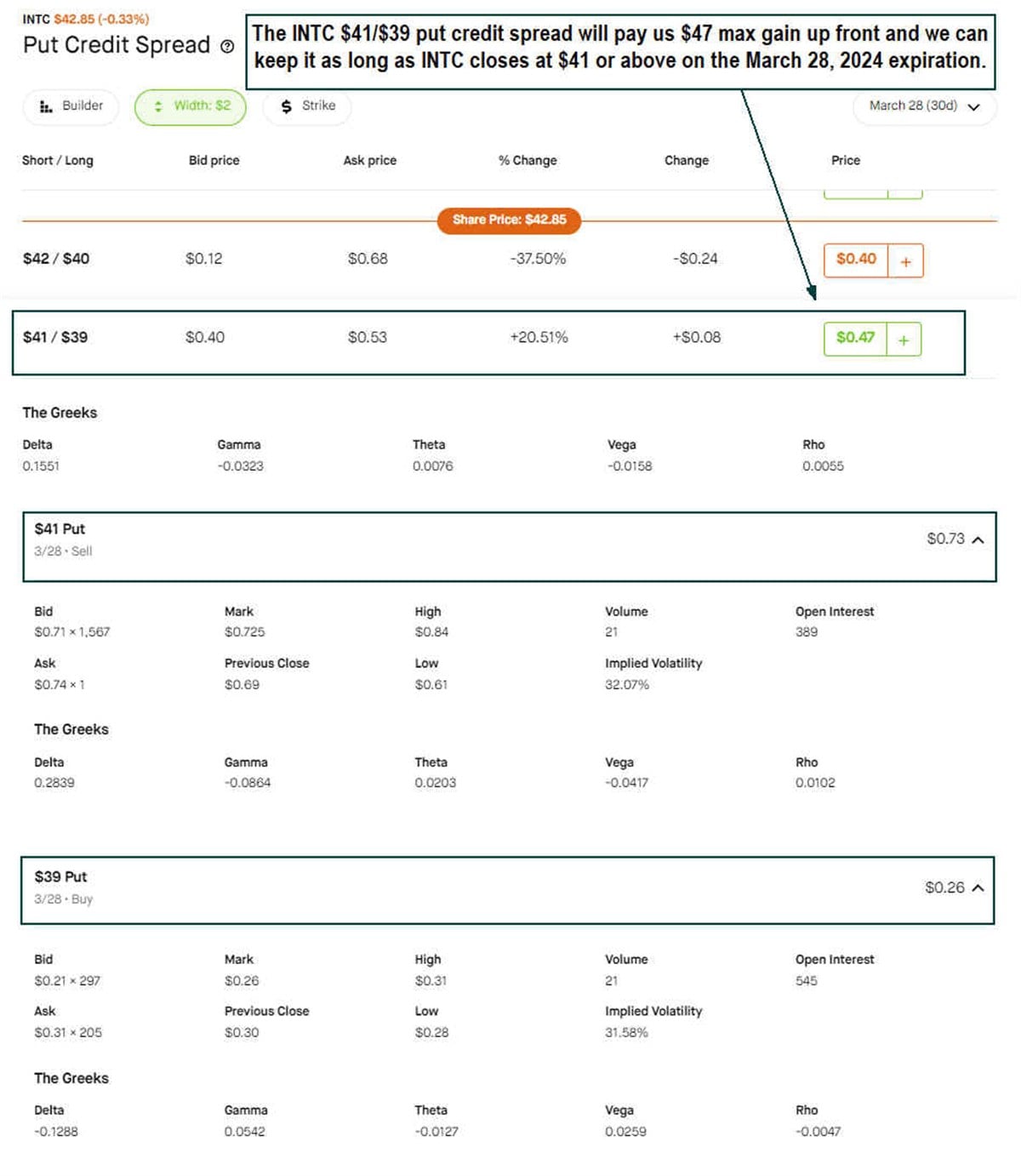

The put credit spread is a vertical options trade comprised of selling/shorting a $41 put and buying a $39 put option, both expiring on March 28, 2024, in 30 days. Many brokerage platforms already have credit spreads available, so you can execute a single trade rather than manually putting in 2 trades. The cost of the INTC $41/$39 put credit spread is 47 cents or a credit of $47 given to us. There is a 73% probability of a profit.

Both strike prices represent price support levels for INTC. The spread is $2 between the strike prices. Since we’re bullish on INTC, we are expecting INTC to trade above the $41 price level support on expiration in 30 days on March 28, 2024.

Possible outcomes

Upon expiration, if INTC closes at $41.00 or higher, then we keep the 47-cent premium x 100 shares for a $47 profit. The $41 represents the highest strike price. There is a 70% probability of a profit. This is a 30.7% max return on the risk.

If INTC closes at $40.53, the trade is breakeven.

IF INTC closes below $39.00, then we would lose the difference between the strikes of $2.00 minus the 47-cent premium received for a max loss of $1.53 or $153.00. The $39 represents the lowest put strike price.

Managing the trade

As with all options trades, you aren't required to hold through expiration. At any point, you can make adjustments or close out the position. Since it's a credit spread, the position gains daily from the time decay. The trade is profitable if INTC trades between $40.54 or higher with a max profit above $41.00. The trade loses money when INTC trades below $40.53, with max loss triggering under $39.00. We will cover ways to mitigate losses in future options articles.