Although the Q1 results sparked a round of profit-taking, Boston Scientific (NYSE: BSX) can set another new all-time high in 2023. The market has been trending higher on a combination of factors that result in up trending sentiment and analyst price targets that have yet to end. The factors driving the stock are the rebound in medical procedures, organic growth of healthcare services, innovation, acquisitions and results. The Q1 results may have made the market doubtful, but the news is unlikely to alter the trend in analysts' sentiment.

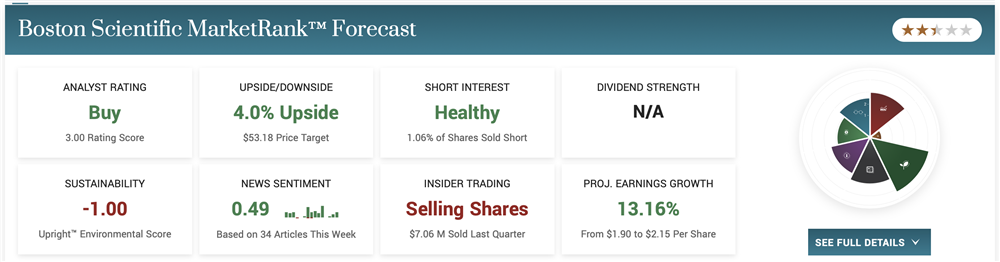

Marketbeat’s analyst tracking tools haven’t picked up any new coverage, but there were several updates just before the Q1 results were released. They include 4 increased price targets above the consensus price target. The consensus price target is trending higher and supporting the price action, although it assumes the market is fairly valued at its current levels. The takeaway is that recent sentiment sees this stock trading 10% to 15% above its current levels, and the price target may trend higher now that the Q1 results are in.

Boston Scientific: Strength Was Expected

Boston Scientific had an outstanding quarter, with top and bottom-line growth outpacing the analyst consensus. The problem is that even with the estimates rising, the market was expecting solid results, which is what it got. The $3.39 billion in revenue is up 11.9% compared to last year and beat the Marketbeat.com consensus by 720 basis points on an 11% increase in MedSurg sales and a 12.7% increase in Cardio sales. Revenue is up 14.9% on an operational basis which shows the strength of the core business. Organic growth is also up firmly at 14%.

The bottom line results are equally good with YOY growth and outperformance relative to the consensus. The $0.47 adjusted EPS is up about 20% YOY to outpace the topline growth and beat by 850 basis points. This led to an increase in guidance favorable to higher share prices over the longer term. The company expects revenue to grow by 8.5% to 10.5%, up from the prior view of 5% to 7%, and the EPS outlook is robust. The company expects FY and 2nd quarter EPS to match the consensus at the low end of the range; this should be enough to get a few analysts to raise their targets.

Boston Scientific Versus Peers

Boston Scientific is a growth-oriented company without dividends, which may turn off some investors. Others in the group offer yield and growth for the same value. Among those are Abbott Laboratories (NYSE: ABT), which also provides diversification and Medtronic (NYSE: MDT). Abbott Laboratories trades at the same 25X/26X multiple as BSX but pays a healthy 1.85% dividend yield. The distribution is also growing and backed up by a solid balance sheet. Medtronic has been lagging behind the medical device group and so offers value. It trades at only 17X earnings and pays an excellent 3.% yield. It just received early approval for the MiniMed 780G insulin pump, news that should show up in results as soon as the summer quarter.

The chart of Boston Scientific is bullish regardless of the dividend and the post-release action. The post-release action resulted in profit-taking, but support is strong at the short-term moving average and indicates a trend-following buy signal. Assuming the market follows through on this move, this stock should retest the all-time highs soon and possibly break to new ones.