Yalla Group (NYSE: YALA), the largest Middle East and North Africa (MENA)-based online social networking and gaming company, refreshed investors with outstanding performance on November 21. The company delivered a robust third quarter performance, highlighted by its record-high revenues and impressive net margin enhancement.

Introduction

Yalla Group operate two flagship mobile applications, Yalla, a voice-centric group chat platform, and Yalla Ludo, a casual gaming application featuring online versions of board games, popular in MENA, with in-game voice chat and localized Majlis functionality.

Leveraging the successful expertise on Yalla and Yalla Ludo, the company is determined to gradually increase their investment in the mid-core and hard-core game business, bring innovative gaming content to its users. In addition, the growing Yalla ecosystem includes YallaChat, an IM product tailored for Arabic users and casual games such as Yalla Baloot and 101 Okey Yalla, developed to sustain vibrant local gaming communities in MENA.

Outstanding performance

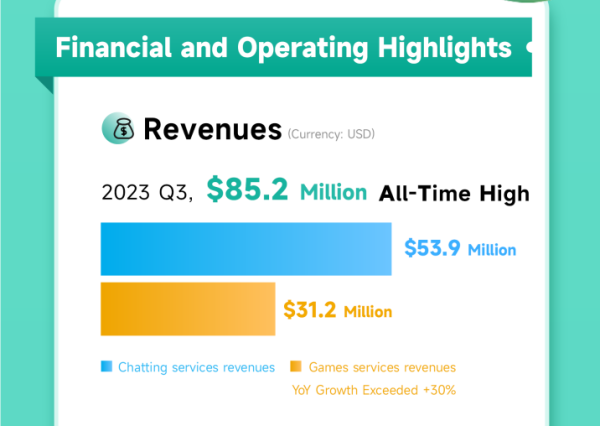

In the third quarter of 2023, Yalla Group recorded all-time high revenues of US$ 85.2 million, beating the upper end of their guidance. Revenues generated from chatting services were US$53.9 million, while games services were US$31.2 million. The year-over-year revenue growth from games services exceeded 30% once again.

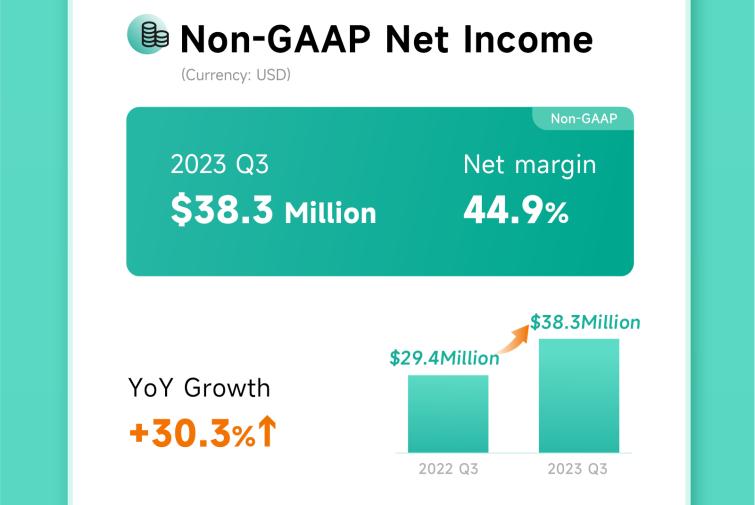

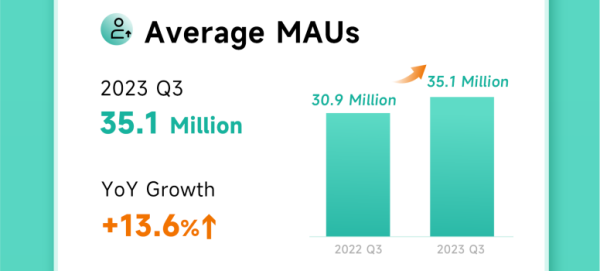

Yalla's relentless efforts to streamline costs as well as it enhanced, ROI-focused marketing strategy continued to yield positive outcomes, enabling it to elevate the overall efficiency. As a result, in the third quarter of 2023, the net income stood at US$35.2 million, a 44.3% increase from US$24.4 million in the third quarter of 2022. Regarding users' evolution, the average MAUs reached 35.1 million, reflected by a 13.6% year-over-year increase from 30.9 million in the third quarter of 2022. Although the number of paying users decreased by 2.6% to 11.2 million due to a near-term game mechanism adjustment, the average revenue per paying user (ARPPU) reached US$7.35. Compared to US$6.89 in the third quarter of 2022, which shows high-value users exhibited an even stronger willingness to pay.

For the fourth quarter of 2023, Yalla currently expects revenues to be between US$73.0 million and US$80.0 million. "we will continue to execute our high-quality growth strategy with focus on efficiency and profitability enhancement" said Ms. Karen Hu, CFO of Yalla Group.

Visionary business model

Yalla Group is deeply engaged in the social networking and gaming section, with a long-term focus on the local market in MENA region. Instead of chasing hot topics, Yalla devotes itself to steadily improving product quality and operational efficiency, which laid a solid foundation for its development.

With the expertise on Yalla and Yalla Ludo, Yalla Group has shifted its focus to innovative content. Through its holding subsidiary Yalla Game Limited, the company has expanded its capabilities in mid-core and hard-core games in the MENA region, leveraging its local expertise to bring innovative game content to its users.

Admittedly, MENA is one of the fastest-growing markets in the world with ample demographic dividends, younger population structure, ultra-high Internet penetration, as well as high-net-worth players with good willingness to pay.

Although there is still some way to go on penetration rate to overtake some mature markets as Europe, the U.S., China, Japan, and South Korea, but still a huge development potential in the blue ocean market. At the same time, SLG, as a popular category among global hardcore games with better longevity and good payment results, of which the joys lie in the social interaction of players, complying with the fact that MENA region is male dominated with strong social networking needs. From this point of view, Yalla Group will see immense room for further and deeper development in the mid-core and hard-core game business.

In the future, Yalla will gradually increase investment in the mid-core and hard-core game business to unleash growth potential in this booming market.

Unique localization

Considering that overseas markets are highly fragmented, overseas enterprises need to embrace many challenges as language barriers, cultures differences, policies, and user habits. Yalla Group has achieved success through its uniquely localized operations despite all the above.

User's loyalties are constantly improving thanks to Yalla's deep dive into the local market in the MENA region. For example, in the past quarter, Yalla has rolled out a series of operational activities, including an Islamic New Year event and National Day events across several countries in MENA. Yalla Ludo has also launched a number of operational events, including Islamic New Year event, Mystery Store Opening event and such activities to enhance user engagement.

As a localized enterprise, Yalla Group itself has grown with the local market and accumulated rich experience. With this background, Yalla Group can empower other startups going overseas and jointly promote the development of this market as a pioneer of localized operations in the MENA market.

Middle East potential

In the early stages of digital transformation, following North America and Southeast Asia, the MENA region has gradually become the next popular destination for entrepreneurs.

Cloud computing, artificial intelligence, new energy, financial technology and other sections all contain huge opportunities. The government has also provided policy support, such as the "2030 Vision" announced by the Saudi government. Thus, more and more companies around the world are pursuing the MENA market, leading to the emergence of a group of MENA concept stocks represented by Yalla, attracting widespread attention.

Yalla's stock price has risen by over 60% since the beginning of this year, it has been newly selected for the S&P Global BMI Index, which shows that the company has already gain authorized recognition.

Meanwhile, the promotion of China's "the Belt and Road" policy has provided new opportunities for the MENA market and strong support for the rise of relevant concept stocks. This model can serve as a reference for other countries and enterprises cooperating with the MENA region. Investors can also closely monitor the performance of related companies to catch better market opportunities.

Media Contact

Company Name: Yalla Group Limited

Contact Person: Kerry Gao - IR Director

Email: Send Email

Phone: +86-571-8980-7962

City: DUBAI

Country: United Arab Emirates

Website: www.yalla.com