CSG Agrees to Purchase 7.5% of Standalone Revelyst for $150 Million, Valuing Revelyst at $2.0 Billion

Revelyst Plans to Establish Share Repurchase Program Following Closing of CSG Transaction

Continues to Engage with MNC and Urges MNC to Provide a Best and Final Proposal

Gates Capital Is a Conflicted Party – Vista Outdoor’s Second Largest Stockholder Revealed as an Investor in MNC’s Proposal

Vista Outdoor Inc.’s (“Vista Outdoor”, the “Company”) (NYSE: VSTO) Board of Directors today issued the following statement:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240912742992/en/

(Graphic: Vista Outdoor Inc.)

We take seriously our duty to maximize value for stockholders. In our continued efforts to maximize stockholder value and in response to stockholder feedback, we have been conducting a thorough process with financial and legal advisors to evaluate all strategic alternatives for our businesses. We are pleased to report that the Board’s process has yielded significant value for our stockholders.

After extensive diligence, CSG has agreed to make a significant investment in Revelyst which delivers increased cash consideration to stockholders. On September 12, the Company entered into an amendment to the merger agreement with Czechoslovak Group a.s. (“CSG”) in which CSG has agreed to purchase shares representing 7.5% of standalone Revelyst for $150 million (the “Revised CSG Transaction”) at a price of ~$31 per Revelyst share, valuing Revelyst at $2.0 billion.

Vista Outdoor notes that the Company’s GEAR Up transformation program is delivering value in line with prior guidance. Revelyst continues to gain market share in key categories and is on track to double Adjusted EBITDA sequentially for the quarter and for the full year.

The $150 million of cash payable by CSG for the purchase of Revelyst shares plus additional cash from Vista Outdoor’s balance sheet will be returned to Vista Outdoor stockholders, increasing the cash consideration payable in the Revised CSG Transaction by $4 per share to $28 per share. At the closing of the Revised CSG Transaction, Vista Outdoor stockholders will receive $28 in cash per share and one share of Revelyst common stock for each share of Vista Outdoor common stock.

Following the closing of the CSG Transaction, Revelyst plans to establish an initial $50 million share repurchase program.

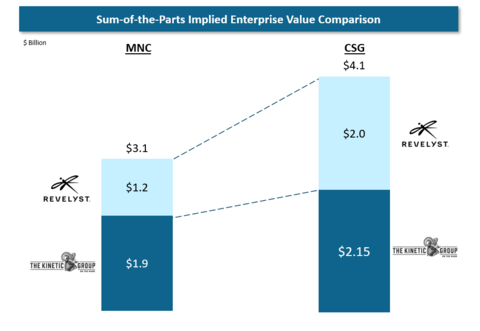

The MNC Revised Proposal significantly undervalues The Kinetic Group and Revelyst compared to the Revised CSG Transaction. On September 6, we received a revised proposal from MNC to acquire the Company for $43 in cash per share (the “MNC Revised Proposal”). Documentation delivered to the Board in connection with the MNC Revised Proposal implies a value of ~$1.9 billion for The Kinetic Group and ~$1.2 billion for Revelyst. In comparison, the Revised CSG Transaction represents a value of $2.15 billion for The Kinetic Group and an investment in Revelyst at a value of $2.0 billion.

We have engaged extensively with MNC, accommodated MNC’s diligence requests, and provided access to management. MNC has publicly confirmed that it completed its diligence. The Company notes that the MNC Revised Proposal does not represent an increase in enterprise value compared to MNC’s prior proposal when considering Vista Outdoor’s cash generated and lower net debt; however, we will continue to constructively engage with MNC and urge MNC to deliver its best and final proposal as soon as possible.

Gates Capital is a conflicted party. The Board recently learned that the Company’s second largest stockholder, Gates Capital Management Inc. (“Gates Capital”), is included in MNC’s equity consortium. Given its involvement with MNC, Gates Capital’s public expression in favor of MNC’s proposal reflects a bias and conflict of interest. Consequently, Gates Capital’s interests are not aligned with those of other Vista Outdoor stockholders. We urge stockholders to make their own informed decision based on the valuation differential between the Revised CSG Transaction and the MNC Revised Proposal.

The Board is, and has always been, committed to maximizing value for all Vista Outdoor stockholders and remains open to opportunities that achieve this goal. The Board continues to recommend Vista Outdoor stockholders vote in favor of the proposal to adopt the merger agreement with CSG at the special meeting of stockholders (the “Special Meeting”), which will be held at 9:00 am (Central Time) on September 27, 2024.

Morgan Stanley & Co. LLC is acting as sole financial adviser to Vista Outdoor and Cravath, Swaine & Moore LLP is acting as legal adviser to Vista Outdoor. Moelis & Company LLC is acting as sole financial adviser to the independent directors of Vista Outdoor and Gibson, Dunn & Crutcher LLP is acting as legal adviser to the independent directors of Vista Outdoor.

About Vista Outdoor Inc.

Vista Outdoor (NYSE: VSTO) is the parent company of more than three dozen renowned brands that design, manufacture and market sporting and outdoor products. Brands include Bushnell, CamelBak, Bushnell Golf, Foresight Sports, Fox Racing, Bell Helmets, Camp Chef, Giro, Simms Fishing, QuietKat, Stone Glacier, Federal Ammunition, Remington Ammunition and more. Our reporting segments, Outdoor Products and Sporting Products, provide consumers with a wide range of performance-driven, high-quality and innovative outdoor and sporting products. For news and information, visit our website at www.vistaoutdoor.com.

Forward-Looking Statements

Some of the statements made and information contained in this press release, excluding historical information, are “forward-looking statements,” including those that discuss, among other things: Vista Outdoor Inc.’s (“Vista Outdoor”, “we”, “us” or “our”) plans, objectives, expectations, intentions, strategies, goals, outlook or other non-historical matters; projections with respect to future revenues, income, earnings per share or other financial measures for Vista Outdoor; and the assumptions that underlie these matters. The words “believe,” “expect,” “anticipate,” “intend,” “aim,” “should” and similar expressions are intended to identify such forward-looking statements. To the extent that any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995.

Numerous risks, uncertainties and other factors could cause our actual results to differ materially from the expectations described in such forward-looking statements, including the following: risks related to the previously announced transaction among Vista Outdoor, Revelyst, Inc. (“Revelyst”), CSG Elevate II Inc., CSG Elevate III Inc. and CZECHOSLOVAK GROUP a.s. (the “Transaction”), including (i) the failure to receive, on a timely basis or otherwise, the required approval of the Transaction by our stockholders, (ii) the possibility that any or all of the various conditions to the consummation of the Transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals), (iii) the possibility that competing offers or acquisition proposals may be made, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement relating to the Transaction, including in circumstances which would require Vista Outdoor to pay a termination fee, (v) the effect of the announcement or pendency of the Transaction on our ability to attract, motivate or retain key executives and employees, our ability to maintain relationships with our customers, vendors, service providers and others with whom we do business, or our operating results and business generally, (vi) risks related to the Transaction diverting management’s attention from our ongoing business operations and (vii) that the Transaction may not achieve some or all of any anticipated benefits with respect to either business segment and that the Transaction may not be completed in accordance with our expected plans or anticipated timelines, or at all; risks related to the review of strategic alternatives announced on July 30, 2024 (“Review”), including (i) the terms, structure, benefits and costs of any transaction that may result from the Review, (ii) the timing of any such transaction that may result from the Review and whether any such transaction will be consummated at all, (iii) the effect of the announcement of the Review on our ability to attract, motivate or retain key executives and employees, our ability to maintain relationships with our customers, vendors, service providers and others with whom we do business, or our operating results and business generally, (iv) risks related to the Review diverting management’s attention from our ongoing business operations, (v) the costs or expenses resulting from the Review, (vi) any litigation relating to the Review and (vii) the Review may not achieve some or all of any anticipated benefits of the Review; impacts from the COVID-19 pandemic on our operations, the operations of our customers and suppliers and general economic conditions; supplier capacity constraints, production or shipping disruptions or quality or price issues affecting our operating costs; the supply, availability and costs of raw materials and components; increases in commodity, energy, and production costs; seasonality and weather conditions; our ability to complete acquisitions, realize expected benefits from acquisitions and integrate acquired businesses; reductions in or unexpected changes in or our inability to accurately forecast demand for ammunition, accessories, or other outdoor sports and recreation products; disruption in the service or significant increase in the cost of our primary delivery and shipping services for our products and components or a significant disruption at shipping ports; risks associated with diversification into new international and commercial markets, including regulatory compliance; our ability to take advantage of growth opportunities in international and commercial markets; our ability to obtain and maintain licenses to third-party technology; our ability to attract and retain key personnel; disruptions caused by catastrophic events; risks associated with our sales to significant retail customers, including unexpected cancellations, delays, and other changes to purchase orders; our competitive environment; our ability to adapt our products to changes in technology, the marketplace and customer preferences, including our ability to respond to shifting preferences of the end consumer from brick and mortar retail to online retail; our ability to maintain and enhance brand recognition and reputation; our association with the firearms industry; others’ use of social media to disseminate negative commentary about us, our products, and boycotts; the outcome of contingencies, including with respect to litigation and other proceedings relating to intellectual property, product liability, warranty liability, personal injury, and environmental remediation; our ability to comply with extensive federal, state and international laws, rules and regulations; changes in laws, rules and regulations relating to our business, such as federal and state ammunition regulations; risks associated with cybersecurity and other industrial and physical security threats; interest rate risk; changes in the current tariff structures; changes in tax rules or pronouncements; capital market volatility and the availability of financing; foreign currency exchange rates and fluctuations in those rates; general economic and business conditions in the United States and our markets outside the United States, including as a result of the war in Ukraine and the imposition of sanctions on Russia, the conflict in the Gaza strip, the COVID-19 pandemic or another pandemic, conditions affecting employment levels, consumer confidence and spending, conditions in the retail environment, and other economic conditions affecting demand for our products and the financial health of our customers.

You are cautioned not to place undue reliance on any forward-looking statements we make, which are based only on information currently available to us and speak only as of the date hereof. A more detailed description of risk factors that may affect our operating results can be found in Part 1, Item 1A, Risk Factors, of our Annual Report on Form 10-K for fiscal year 2024, and in the filings we make with the SEC from time to time. We undertake no obligation to update any forward-looking statements, except as otherwise required by law.

No Offer or Solicitation

This communication is neither an offer to sell, nor a solicitation of an offer to buy any securities, the solicitation of any vote, consent or approval in any jurisdiction pursuant to or in connection with the Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information and Where to Find It

These materials may be deemed to be solicitation material in respect of the Transaction. In connection with the Transaction, Revelyst, a subsidiary of Vista Outdoor, filed with the SEC a registration statement on Form S-4 in connection with the proposed issuance of shares of common stock of Revelyst to Vista Outdoor stockholders pursuant to the Transaction, which Form S-4 includes a proxy statement of Vista Outdoor that also constitutes a prospectus of Revelyst (the “proxy statement/prospectus”). INVESTORS AND STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING OUR PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The registration statement was declared effective by the SEC on March 22, 2024, and we have mailed the definitive proxy statement/prospectus to each of our stockholders entitled to vote at the meeting relating to the approval of the Transaction. Investors and stockholders may obtain the proxy statement/prospectus and any other documents free of charge through the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Vista Outdoor are available free of charge on our website at www.vistaoutdoor.com.

Participants in Solicitation

Vista Outdoor, Revelyst, CSG Elevate II Inc., CSG Elevate III Inc. and CZECHOSLOVAK GROUP a.s. and their respective directors, executive officers and certain other members of management and employees, under SEC rules, may be deemed to be “participants” in the solicitation of proxies from our stockholders in respect of the Transaction. Information about our directors and executive officers is set forth in our proxy statement on Schedule 14A for our 2024 Annual Meeting of Stockholders, which was filed with the SEC on July 24, 2024, and subsequent statements of changes in beneficial ownership on file with the SEC. These documents are available free of charge through the SEC’s website at www.sec.gov. Additional information regarding the interests of potential participants in the solicitation of proxies in connection with the Transaction, which may, in some cases, be different than those of our stockholders generally, is also included in the proxy statement/prospectus relating to the Transaction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240912742992/en/

Contacts

Investor Contact:

Tyler Lindwall

Phone: 612-704-0147

Email: investor.relations@vistaoutdoor.com

Media Contact:

Eric Smith

Phone: 720-772-0877

Email: media.relations@vistaoutdoor.com