New feature uses the power of virtual cards to streamline accounts payable processes, optimize cash flow, and enhance security

Extend, a leading virtual card and spend management platform, today announced the launch of Bill Pay, a new feature that empowers businesses to streamline invoice payments using virtual cards. The Bill Pay feature simplifies the workflow for accounts payable processes, optimizes cash flow, maximizes credit card rewards, and enhances security for organizations of all sizes.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241028016541/en/

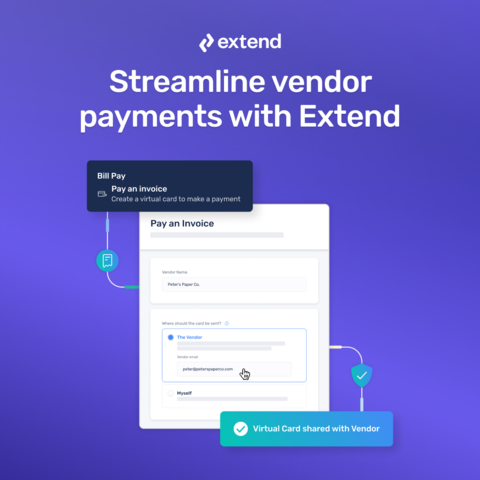

Streamline vendor payments with Extend. (Graphic: Business Wire)

Traditional payment methods pose significant challenges for finance teams. Paying invoices by check can lead to lost payments, delays, and difficulty tracking in real time. Keeping a business credit card on file with vendors is also problematic. If vendors overcharge or a card number is compromised, the finance team has to stop payments, dispute the fraud with the issuer, and replace the card on file with all vendors before it disrupts the supply chain. With Extend’s Bill Pay, teams can easily pay vendor invoices leveraging the control and security of virtual cards.

“Extend gives finance teams total control over their business credit cards with the power of virtual cards. Now with Bill Pay, they can get the same benefits when they settle invoices with virtual cards,” said Danny Morrow, Extend co-founder and chief innovation officer. “Bill Pay delivers a more efficient and secure way to control spending, simplify reconciliation, save time, and introduce more flexibility into the AP process.”

Leaving a single credit card on file across many vendors puts a business at greater risk for fraud, misuse, and wrongful billing. Extend’s Bill Pay feature solves this challenge and enables customers to:

- Send secure payments to vendors: Control charges and prevent fraud disruptions by providing vendors with a unique, secure, and easy-to-process payment.

- Easily manage invoice payments: Pay an invoice—one at a time or in bulk—all while maximizing card program rewards.

- Optimize the AP workflow: Cut down on paper checks and track payments in real time for improved cash flow and budgeting.

How Extend’s Bill Pay feature works:

For Extend customers:

- Easily create and send a virtual card specifically for invoice payments through the Extend app.

- View all invoice payments and vendors in the new Bill Pay section of the platform, offering greater visibility into transactions.

- Pay multiple vendor invoices in bulk with virtual cards.

For vendors:

- Receive a remittance email containing a secure link to the virtual card details.

- Charge the virtual card for the amount of the invoice, like any other card transaction.

Alongside recent enhancements from Extend – including its QuickBooks Online integration, Team Budgets feature, and other expense management capabilities – Bill Pay delivers increasing value for the thousands of businesses that use Extend to get more from the credit cards they already have.

To learn more about Extend’s new Bill Pay feature, see:

About Extend

Extend turns your business credit card into a spend management platform, so you can achieve more with what’s yours. Thousands of companies use Extend’s virtual cards, insights, and controls to empower their teams, streamline payment processes, and manage billions of dollars in transactions – all while keeping the financial partners they know and trust. Extend was founded in 2017 by industry veterans of American Express, Capital One, and other Fortune 500 companies. For more information visit paywithextend.com or follow Extend on LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241028016541/en/