“Software as a Service” Developer To Help Build Water Services Network

OriginClear Inc. (OTC Pink: OCLN), the Clean Water Innovation Hub™, announces that its subsidiary Water On Demand™ (WODI) recently entered into a Memorandum of Understanding (MOU) to acquire an established international SaaS (Software as a Service) Developer (Developer), founded nearly twenty years ago, which operates with a stable customer base of technology companies. The acquisition is anticipated to be accretive.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230522005695/en/

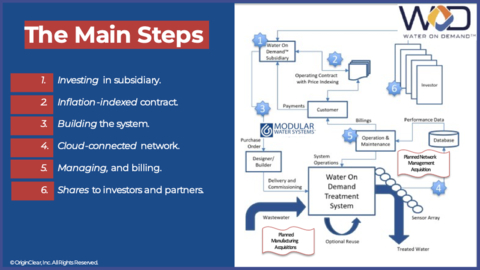

Figure 1: The main steps of the Water On Demand Process, with potential acquisitions. “Our plan is to acquire and maintain the Developer’s stable SaaS business, while also leveraging its expertise to help build our end-to-end water service network,” said Riggs Eckelberry, OriginClear and Water On Demand CEO. “With this network up and running, any business could fully outsource its wastewater treatment and water transportation needs to Water On Demand without requiring upfront capital.” (Graphic: OriginClear)

The MOU provides a framework for negotiating a definitive agreement for the acquisition of the Developer. The Parties caution that talks are in an early stage and may not succeed.

“Our plan is to acquire and maintain the Developer’s stable SaaS business, while also leveraging its expertise to help build our end-to-end water service network,” said Riggs Eckelberry, OriginClear and Water On Demand CEO. “With this network up and running, any business could fully outsource its wastewater treatment and water transportation needs to Water On Demand without requiring upfront capital.”

On 16 May, WODI released an updated presentation with a network schematic (see Figure 1) that identified the need for a network management acquisition, among others.

OCLN recently announced that it had transferred its Modular Water Systems division (MWS or Modular Water) (www.modularwater.com) and the related assets to WODI. The acquisition of Developer and its intellectual property as contemplated by the MOU is intended to complement the MWS asset transfer.

“As governments are tasked with improving water quality, businesses are doing their part by treating and recycling their own water right on the spot,” said Riggs Eckelberry, OriginClear CEO and Chairman of Water On Demand. “With its license to unique modular treatment technology and the managed network we plan to build with the help of the Developer acquisition, we believe Water On Demand will be well positioned to lead the new water managed services segment; and the only company in that segment to accept investments from everyday investors.”

Accredited Investors interested in WODI and the investment opportunity, which allows investors to receive a share of net profits from its water services, can review the offering at www.water.originclear.com/offer.

On January 5, 2023, Water On Demand, Inc. executed a Letter of Intent (“LOI”) with Fortune Rise Acquisition Corporation, a Delaware special purpose acquisition corporation (NASDAQ: FRLA) (“FRLA”) under which FRLA proposes to acquire all the outstanding securities of Water on Demand, Inc. (“WODI”), based on certain material financial and business terms and conditions being met. The LOI is not binding on the parties and is intended solely to guide good-faith negotiations toward definitive agreements.

The precise structure of the business combination, including the proportion of stock and/or cash consideration paid to the WODI equity holders, will be negotiated to meet the needs of all parties including management of WODI and key equity holders.

Previously, Water On Demand announced that it closed the acquisition of the equity interests of Fortune Rise Sponsor, LLC, a Delaware limited liability company (the “Sponsor”), which is the sponsor of FRLA.

FRLA is a blank check company incorporated in February 2021 as a Delaware corporation formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

FRLA is a "shell company" as defined under the Exchange Act of 1934, as amended, because it has no operations and nominal assets consisting almost entirely of cash. FRLA will not generate any operating revenues until after the completion of its initial business combination, at the earliest. To date, FRLA’s efforts have been limited to organizational activities and activities related to its initial public offering as well as the search for a prospective business combination target.

About OriginClear

Once a government monopoly, clean water is going private. Local industries and communities are now treating and recycling their own water, helping to reduce the burden on municipal systems and save on fast-rising water rates while also responding to the challenge of climate change. That’s good for business and good for sustainability, and now the innovative fintech, Water On Demand™, is fueling this movement. For the first time, Clean Water is becoming an investable asset, open to Main Street investors, with the potential for generational royalties. OriginClear® is the Clean Water Innovation Hub™ for both Water On Demand and Modular Water Systems™ – a leader in onsite, prefabricated systems made with sophisticated materials that can last decades. Get live weekly updates every Thursday by signing up at www.originclear.com/ceo.

For more information, visit the company’s website: https://www.originclear.com/

Follow us on Twitter

Follow us on LinkedIn

Like us on Facebook

Subscribe to us on YouTube

Signup for our Newsletter

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Safe Harbor Statement

Matters discussed in this release contain forward-looking statements. When used in this release, the words "anticipate," "believe," "estimate," "may," "intend," "expect," “plans” and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein.

These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include, but are not limited to, risks and uncertainties associated with our history of losses and our need to raise additional financing, the acceptance of our products and technology in the marketplace, our ability to demonstrate the commercial viability of our products and technology and our need to increase the size of our organization, and if or when the Company will receive and/or fulfill its obligations under any purchaser orders. Further information on the Company's risk factors is contained in the Company's quarterly and annual reports as filed with the Securities and Exchange Commission. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason except as may be required under applicable law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230522005695/en/

Contacts

Media Contact

The Pontes Group

Lais Pontes Greene (954) 960-6083

lais@thepontesgroup.com

www.thepontesgroup.com

Investor Relations and Press Contact:

Devin Angus

Toll-free: 877-999-OOIL (6645) Ext. 3

International: +1-323-939-6645 Ext. 3

Fax: 323-315-2301

ir@OriginClear.com

www.OriginClear.com