All top 10 metro areas posted gains during the year

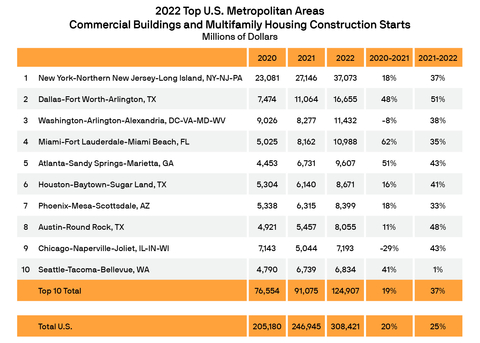

In 2022, the value of commercial and multifamily construction starts in the top 10 metropolitan areas of the U.S. increased 37% from 2021, according to Dodge Construction Network. Nationally, commercial and multifamily construction starts increased 25%.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230131005405/en/

(Graphic: Business Wire)

Commercial and multifamily construction has made impressive gains in 2022 largely driven by rising demand for apartments and condos. Not to be outdone, commercial starts also posted strong gains fueled by increased demand for hotel, data center, and retail projects.

The New York metropolitan area was the top market for commercial and multifamily starts in 2022 at $37.1 billion, an increase of 37% from 2021. The Dallas, TX, metropolitan area was in second place, totaling $16.7 billion in 2022, a 51% gain. The Washington, D.C., metro area ranked third during 2022 with $11.4 billion in starts — a 38% gain over 2021.

The remaining top 10 metropolitan areas through the first half of 2022 were:

- Miami, FL, up 35% ($11.0 billion)

- Atlanta, GA, up 43% ($9.6 billion)

- Houston, TX, up 41% ($8.7 billion)

- Phoenix, AZ, up 33% ($8.4 billion)

- Austin, TX, up 48% ($8.1 billion)

- Chicago, IL, up 42% ($7.2 billion)

- Seattle, WA, up 1% ($6.8 billion)

In 2022, the top 10 metropolitan areas accounted for 40% of all commercial and multifamily starts in the United States, up from 37% in 2021.

Commercial and multifamily starts are comprised of office buildings, stores, hotels, warehouses, commercial garages, and multifamily housing. Not included in this ranking are institutional projects (e.g., educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single family housing, public works, and electric utilities/gas plants.

In total, U.S. commercial and multifamily building starts rose 25% from 2021 to $308.4 billion. Commercial starts climbed 25% to $159 billion, and multifamily starts gained 25% to $149.4 billion. In 2022, across the top 10 metro areas, commercial building starts rose 34% to $60.4 billion, and multifamily starts gained 40% to $64.6 billion.

“The year 2022 will go down as a banner year for construction starts,” stated Richard Branch, chief economist for Dodge Construction Network. “Even when adjusted for inflation, commercial and multifamily starts were impressive as construction activity began to move back towards downturn urban cores. This pace of activity, however, is unlikely to be sustained in 2023 as the economy is slated to slow and approach stall speed. Commercial and multifamily construction starts are likely to take this on the chin and post declines for the year.”

In the New York, NY, metropolitan area, commercial and multifamily construction starts rose 37% in 2022 to $37.1 billion. Multifamily starts were up a stellar 76%. The largest multifamily projects to break ground during 2022 were the $800 million Two Bridges mixed-use building and the $680 million first phase of the One Journal Square building. In 2022, commercial starts were down 15% as office and warehouse starts posted sizable declines offsetting gains in retail and hotel starts. The largest commercial projects to get started in 2022 were the $540 million 520 Fifth Avenue mixed-use building and a $400 million hotel on Eighth Avenue.

Commercial and multifamily starts in the Dallas, TX, metro area rose 51% in 2022 to $16.7 billion. Commercial starts increased 52% with only the hotel sector to fall during the year. The largest commercial projects to get underway during the year were the $314 million Hall Park D1 mixed-use building and a $206 million Walmart distribution center. Multifamily starts rose 48% over the year. The largest multifamily projects to start were the $119 million Hanover Preston Hollow residential building and the $177 million third phase of the Trinty Green apartments.

In the Washington, D.C., metropolitan area, commercial and multifamily construction starts rose 38% to $11.4 billion. Multifamily starts moved 3% higher in 2022. The largest multifamily projects to break ground were the $329 million Reston Next Block D tower and the $163 million 113 Potomac Ave SW building. In 2022, commercial starts rose 78% thanks to a large increase in office and hotel starts, while retail construction fell. The largest commercial projects to get underway during the year were the $940 million Digital Dulles Data Center Buildings 7 and 9 and the $675 million Dulles Berry Data Center LC8.

Miami, FL, commercial and multifamily starts were 35% higher in 2022 than the year prior at $11 billion. Commercial starts in Miami gained 38% as office starts more than doubled during the year. The largest commercial projects to get started during 2022 were the $300 million Royal Caribbean headquarters and the $91 million One Flagler office building. In 2022, multifamily construction rose 33% from 2021. The largest multifamily buildings to get started were the $700 million Aria Reserve building and the $450 million Waldorf Astoria hotel and residences.

The Atlanta, GA, commercial and multifamily building starts rose 43% in 2022 to $9.6 billion. Commercial starts in Atlanta gained 55% with hotel starts the only sector to decline. The largest commercial projects to start during the year were the $224 million 1020 Spring Street office building and the $160 million “The Bailey” mixed-use building. Multifamily starts meanwhile rose 29%. The largest multifamily buildings to break ground in 2022 were the $143 million Society mixed-use building and the $135 million Rhapsody apartments.

Commercial and multifamily starts in the Houston, TX, metropolitan area climbed 41% in 2022 to $8.7 billion. For the year, multifamily construction rose 29%. The largest multifamily structures to break ground during the year were the $101 million X Houston apartments and the $90 million Resia Ten Oaks apartments. In 2022, commercial starts in Houston moved 48% higher, fueled by more gains in warehouse and retail starts. The largest commercial projects to get started during the year were the $168 million Project Channel fulfillment center and the $150 million Great Wolf Lodge hotel.

In Phoenix, AZ, commercial and multifamily starts were up 33% in 2022 to $8.4 billion. Multifamily starts were up 16% for the year. The largest multifamily projects to break ground during the year were the $345 million 601 N Central mixed-use building and the $184 million Saiya/McKinley Green residential tower. In 2022, total commercial starts rose 44% compared to 2021. This growth was mostly led by the warehouse sector, although retail and parking structures also posted solid growth while office and hotel starts fell. The largest commercial projects to get underway were the $460 million Park 303 warehouse building and the $224 million The Hub @ 202 industrial complex.

Austin, TX, commercial and multifamily starts were 48% higher at $8.1 billion in 2022. Commercial starts in Austin more than doubled over the year, mainly due to office construction, supplemented by all other commercial sectors. The largest commercial projects to get started during 2022 were the $520 million Waller Creek mixed-use building and the $375 million The Republic office building. In 2022, multifamily construction rose 17% from 2021. The largest multifamily buildings to get started were the $300 million Modern Austin residences and the $262 million Union on 24th building.

Chicago, IL, commercial and multifamily construction starts were up 43% to $7.2 billion during in 2022. Commercial starts moved 86% higher during the year led by sharp gains in office and hotel construction. The largest commercial projects to break ground were the $840 million CloudHQ Data Center and $230 million Microsoft data center. Multifamily starts fell 3% in 2022. The largest multifamily structures to break ground during the year were the $140 million Fulton River District apartment tower and a $140 million apartment building at 210 N Aberdeen St.

In Seattle, WA, commercial and multifamily starts were up 1% to $6.8 billion in 2022. Multifamily starts were up 8% from 2021. The largest multifamily projects to get underway during the year were the $400 million Civic Square condominium building and the $371 million Seattle House mixed-use building. Commercial starts were down 4% for the year due to pullbacks in office and warehouse construction, while retail and hotel starts improved. The largest commercial projects to break ground during the year were the $350 million Omni South Lake Union office building and the $265 million Washington 1000 office tower.

About Dodge Construction Network

Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry.

The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem.

Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230131005405/en/

Contacts

Cailey Henderson | 104 West Partners | dodge@104west.com