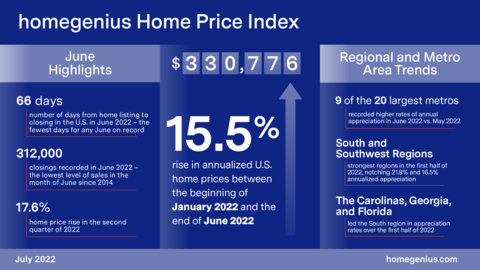

Home prices across the United States rose in the first six months of the year at an annualized rate of 15.5 percent, according to homegenius Home Price Index (HPI) data released today by homegenius Real Estate LLC, a Radian Group Inc. company (NYSE: RDN). The company believes the homegenius HPI is the most comprehensive and timely measure of U.S. housing market prices and conditions available in the market today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220729005474/en/

homegenius Home Price Index Infographic (Graphic: Business Wire)

The homegenius HPI also rose 16.9 percent year-over-year (July 2021 to June 2022), which was slightly higher than the year-over-year increase of 16.3 percent recorded last month. The annualized increase represents the continuation of record-breaking annualized yearly gains in recent months. The homegenius HPI is calculated based on the estimated values of more than 70 million unique addresses each month, covering all single-family property types and geographies.

“The U.S. remains in the throes of a severe housing shortage, which has offset the impact of quickly rising mortgage rates and lower equity markets. While affordability concerns have become even more important over the last six months, the pent-up demand for homes has meant that prices have just continued to go up. While inventory has been starting to rise, last month we saw the lowest level of homes for sale of any June over the last 15 years,” said Steve Gaenzler, SVP of Products, Data and Analytics. “However, some relief for prospective buyers may thankfully be on the horizon. There are signs that open house showings and bidding wars have slowed, returning many markets from frenzy to a more normal, and healthy pace.”

NATIONAL DATA AND TRENDS

- Median home price in the U.S. rose to $330,776 in June

- Home prices rose an annualized 17.6 percent during the second quarter

Nationally, the median estimated price for single-family and condominium homes rose to $330,776 in June from the $325,684 recorded in May. Across the U.S., home prices rose 17.6 percent in the second quarter, a solid increase over the first-quarter gain of 12.9 percent.

Across the U.S., demand for homes remains healthy considering supply challenges. June 2022 recorded 312,000 real estate closings. That is the lowest level of sales in the month of June since 2014. However, to put this in historical context, the absorption rate (measured as the count of sales as a percentage of the prior month’s active listings) was 34.8 percent in June, the second highest for any June and only lower than the 39.5 percent of June 2021. Homes continue to sell in record time. Nationally, the number of days from listing to closing dropped to 66 days, the fewest days for any June on record and the third consecutive month under 70 days.

REGIONAL DATA AND TRENDS

- First-half 2022 results are strongly positive for all regions

- Regional appreciation rates slowed from prior quarter

In the first half of 2022, all six regional indices recorded positive home price appreciation rates in excess of 10.0 percent (annualized). The South and Southwest turned in the strongest first half of the year, notching 21.8 and 16.5 percent annualized appreciation, respectively. The other four regions ranged from 10.9 percent (Midwest) to 12.7 percent (MidAtlantic). Compared to the final six months of 2021, all regions except for the South reported slower annualized appreciation. Based on recent appreciation data, the median-priced U.S. home has gained more than $20,000 in equity value thus far in 2022. Even as the most expensive region, with a median estimate of more than $580,000, the West recorded nearly a 12 percent annualized appreciation in the first half of 2022.

In the South, home prices in hot markets for remote work relocation, like the Carolinas, Georgia, and Florida, have led the region in appreciation rates over the first half of the year. Each of these states finished the first six months with annualized price growth of more than 20 percent.

The median estimated price of a home in Florida, the fastest growing state in the U.S. this year price-wise], was $330,975 as of the end of June, growing by nearly +$80,000 in just the last year. In contrast, Idaho, the once-darling of state house price appreciation, has struggled for the last quarter and finished Q2 with a lower estimated median home price than at the end of Q1, the first state-level negative quarter for home price appreciation since the start of the pandemic.

METROPOLITAN AREA DATA AND TRENDS

- Metro areas end quarter on strong note

- All largest Core-Based Statistical Areas (CBSAs) had better Q2 than Q1

During the first six months of 2022, all the largest metro areas in the U.S recorded price appreciation rates faster than the first quarter. However, in June, only 9 of the largest 20 metro areas recorded higher rates of annual appreciation than the prior month. The remaining 11 recorded slower rates of appreciation month-over-month. Of the 11 metros recording a weaker month in June as compared to May, six of them were MidAtlantic (3) or Southwest (3) metros. The strongest metro in the second quarter was Tampa, FL, although recent month-over-month data suggests that the market there may be softening.

ABOUT THE HOMEGENIUS HPI

homegenius Real Estate LLC, a subsidiary of Radian Group Inc., provides national and regional indices for download at homegenius.com/hpi, along with information on how to access the full library of indices.

Additional content on the housing market can also be found on the homegenius and Radian News and Insights pages.

homegenius offers the HPI data set along with a client access portal for content visualization and data extraction. The engine behind the homegenius HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The homegenius HPI Portal is a self-service data and visualization platform that contains a library of thousands of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the homegenius HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

homegenius Inc., a subsidiary of Radian Group Inc. (NYSE: RDN), and its family of companies combine an array of title, real estate and technology products and services into a full-service ecosystem. homegenius offers innovative experiences from search to close, enabling mortgage lenders, mortgage and real estate investors, consumers, GSEs, and real estate brokers and agents to benefit from integrated and personalized solutions leveraging advanced technology and the latest advancements in data science, machine learning and artificial intelligence. geniusprice is provided by homegenius Real Estate LLC, doing business as Red Bell Real Estate, LLC in some states where name change approvals are pending. For additional information on the homegenius family of companies, please visit homegenius.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220729005474/en/

Contacts

For Investors

John Damian – Phone: 215.231.1383

Email: john.damian@radian.com

For the Media

Rashi Iyer – Phone: 215.231.1167

Email: rashi.iyer@radian.com