Growth is predicted to be driven primarily by Gen Z and Millennial social media users

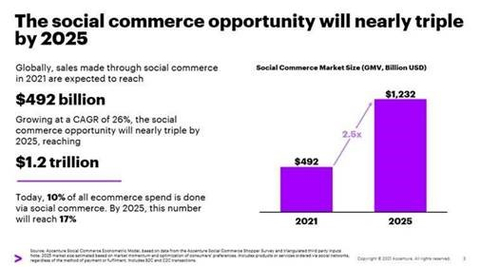

A new study by Accenture (NYSE: ACN) found that the $492 billion global social commerce industry is expected to grow three times as fast as traditional ecommerce to $1.2 trillion by 2025. Growth is predicted to be driven primarily by Gen Z and Millennial social media users, accounting for 62% of global social commerce spend by 2025.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220103005434/en/

Accenture’s report “Why Shopping’s Set for a Social Revolution” estimates social commerce will account for 17% of all ecommerce spend by 2025. (Graphic: Business Wire)

According to Accenture’s report, “Why Shopping’s Set for a Social Revolution,” social commerce means a person’s entire shopping experience — from product discovery to the check-out process — takes place on a social media platform. Just under two thirds (64%) of social media users surveyed said they made a social commerce purchase in the last year, which Accenture estimates to reflect nearly 2 billion social buyers globally.

“The pandemic showed how much people use social platforms as the entry point for everything they do online — news, entertainment and communication,” said Robin Murdoch, global Software & Platforms industry lead at Accenture. “The steady rise in time spent on social media reflects how essential these platforms are in our daily life. They’re reshaping how people buy and sell, which provides platforms and brands with new opportunities for user experiences and revenue streams.”

While the opportunity is significant for large businesses, individuals and smaller brands also stand to benefit. More than half (59%) of social buyers surveyed said they are more likely to support small and medium-sized businesses through social commerce than when shopping through ecommerce websites. Furthermore, 63% said they are more likely to buy from the same seller again, showing the benefits of social commerce in building loyalty and driving repeat purchases.

“Social commerce is a leveling force that is driven by the creativity, ingenuity and power of people. It empowers smaller brands and individuals and makes big brands reevaluate their relevance for a marketplace of millions of individuals,” said Oliver Wright, global Consumer Goods and Services lead at Accenture. “Getting social commerce right will require creators, resellers and brands to bring their products and services where the consumer is, and will be, rather than the other way around. It means working together within a dynamic ecosystem of platforms, marketplaces, social media and influencers to share data, insights and capabilities to deliver the right incentives and best consumer experience across an integrated digital marketplace.”

Half of social media users surveyed, however, indicate they are concerned that social commerce purchases will not be protected or refunded properly, making trust the biggest barrier to adoption, as it was for eCommerce at its beginning.

“Those who have yet to use social commerce say one reason they are held back is their lack of trust in the authenticity of social sellers, while active social commerce users point to poor policies on returns, refunds and exchanges as an area for improvement,” said Wright. “Trust is an issue that will take time to overcome, but the sellers who focus on these areas will be better positioned to grow market share.”

Who is Buying What

Accenture’s report found that by 2025 the highest number of social commerce purchases globally are expected in clothing (18% of all social commerce by 2025), consumer electronics (13%) and home décor (7%). Fresh food and snack items also represent a large product category (13%) although sales are nearly exclusive to China. Beauty and personal care, although smaller in terms of total social commerce sales, is predicted to quickly gain ground on eCommerce and capture over 40% of digital spend on average for this category in key markets by 2025.

Among the study’s other findings:

- Consumers in developing countries are more likely to use social commerce and do so often. Eight out of ten social media users in China use social commerce to make purchases for a given category, while the majority of social media users in the U.K. and U.S. have yet to make a purchase via social commerce.

- Shoppers in China, India, and Brazil care more about features that help them discover and evaluate potential purchases while those in the U.K. and U.S. place more importance on pricing and discounts.

- Trust is more important to older generations than younger generations. Older shoppers emphasize security features and value brand familiarity while younger generations are attracted to livestreams and put more faith in buyer reviews.

For additional insights and findings on social commerce, click here.

Research methodology

Accenture Research conducted a series of studies on social commerce to better understand the nature of this opportunity. We designed and fielded an online survey of 10,053 social media users in China, India, Brazil, the U.S. and the U.K. The online study was conducted August 12th – September 3rd, 2021. We also conducted in-depth interviews with shoppers and sellers from those same five markets between May 26th and June 2nd, 2021.

Accenture’s social commerce market forecasts were produced using econometric modeling, considering the optimization of consumers’ preferences to accelerating existing market momentum. The social commerce market includes products or services ordered via social networks, regardless of the method of payment or fulfillment, covering business to consumer (B2C) and consumer to consumer (C2C) transactions.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 674,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at accenture.com.

Accenture’s Software and Platforms industry helps software and platform companies innovate to stay ahead of disruption. To learn more, visit https://www.accenture.com/us-en/industries/software-and-platforms-index.

Accenture’s Consumer Goods & Services industry group helps businesses innovate and grow — from enabling front-office transformation to building intelligent enterprises underpinned by technology and analytics — to help them achieve consumer relevance. To learn more, visit https://www.accenture.com/us-en/industries/consumer-goods-and-services-index.

Copyright © 2022 Accenture. All rights reserved. Accenture and its logo are trademarks of Accenture.

This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors. This document refers to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220103005434/en/

Contacts

Quentin Nolibois

Accenture

+1 415 741 8356

quentin.nolibois@accenture.com

Tara Burns

Accenture

+44 7850 435158

tara.burns@accenture.com