Dividend.watch emphasizes how reduced interest rates can boost the appeal of dividend-paying stocks, which allows investors to look for income-generating investments. These changes also allow investors to seize the opportunity to use tools that provide dividend tracking and portfolio tracking to ensure investments in quality dividends.

TALLINN, ESTONIA / ACCESSWIRE / July 23, 2024 / Dividend.watch has stressed the impact of expected interest rate cuts on investment strategies, which underscored the need for investors to shift from traditional savings accounts to dividend and value stocks.

According to Dividend.watch, as financial markets brace for possible cuts as early as September, with over a 90 percent probability, there is a need for conservative investors to rethink their strategies.

"The decrease in interest rates will likely drive growth in value and dividend stocks. Markets are forward-looking; they will not wait for the rate cut and should begin pricing it in now," Dividend.watch stated.

With interest rates on savings accounts dwindling, investors face a pressing need to identify assets that can offer reliable returns. Dividend stocks present a viable solution, as they provide income streams that can be especially appealing to retirees and those needing immediate cash flow.

Dividend-paying investments can play vital roles here. It provides income for urgent needs and offers downside protection during market volatility. Businesses with a history of consistent dividend increases have proved to be more stable and of higher quality, making them more likely to sustain dividend payments during downturns.

Dividend-paying firms are also seen to do well relative to the market in the wake of interest rate cuts, says. For investors who want to rebalance and are looking to capture yield ahead of interest-rate cuts, dividend-paying stocks are proven to be excellent investments.

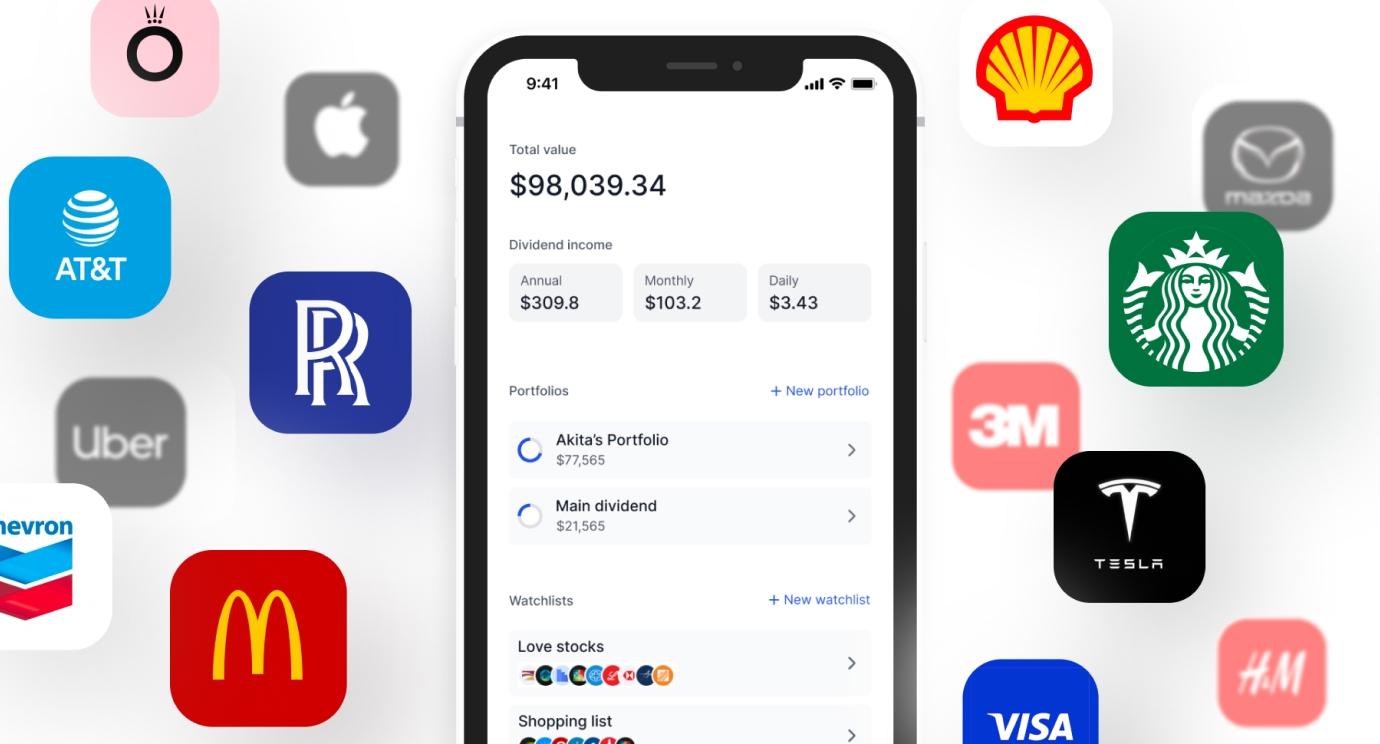

Given this, Dividend.watch has unveiled the ultimate tool to navigate these changes effectively. The platform assists investors in managing their dividend portfolios with ease, providing essential insights into dividend tracking and performance. The app simplifies portfolio tracking, allowing users to focus on growth opportunities without the clutter often found in financial applications.

Dividend.watch serves as a personal investing assistant. It makes dividend tracking and portfolio management seamless. The app is an excellent choice for investors who value clarity and precision, offering a straightforward overview of holdings and performance without unnecessary distractions. The platform features a comprehensive portfolio calendar and a reliable dividend safety score, ensuring that users can invest with confidence.

"As conservative investors contemplate their next moves, the importance of quality dividends becomes increasingly clear. These investments not only offer potential income but also serve as a hedge against market downturns." With the right tools, like Dividend.watch, investors can make informed decisions and take advantage of the upcoming shift in market dynamics.

In addition to simplifying the tracking of dividends and reinvestments, Dividend.watch provides users with real-time updates on dividend payouts and allows them to create watchlists for potential investment opportunities. This engagement level is vital for investors who want to stay ahead in a rapidly changing environment.

"Investors must be proactive and prepared for the rotation of capital away from conservative strategies," according to the team behind Dividend.watch, which expects the biggest bets on value companies as the market adjusts to lower interest rates. "Now is the time to focus on dividend stocks that not only meet immediate cash needs but also possess strong fundamentals for future growth."

As interest rates continue to decrease, Dividend.watch reiterated the need for a strategic shift toward dividend and value investing, which have never been more critical.

Dividend.watch urges investors to consider the benefits of dividend stocks and leverage tools to enhance their investment journeys. By adapting to these changes, investors can better position themselves for long-term success in a fluctuating market.

For more information about Dividend.watch, please visit https://dividend.watch/.

Contact Details:

Business: Dividend.watch

Contact Name: Ales Chromec

Contact Email: ales@dividend.watch

Website: https://dividend.watch/

Address: Tallinn, Harju maakond

Country: Estonia

SOURCE: Dividend.watch

View the original press release on accesswire.com