NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. WIRE SERVICES

VANCOUVER, BC / ACCESSWIRE / December 20, 2023 / FireFox Gold Corp. (TSXV:FFOX)(OTCQB:FFOXF) ("FireFox" or the "Company") today announced that it closed a non-brokered private placement of 22,507,840 units of the Company ("Units") at a purchase price of $0.075 per Unit, for total gross proceeds of $1,688,088 (the "Private Placement"). Concurrent with the Private Placement, FireFox, together with its wholly-owned subsidiary FireFox Gold Oy, entered into an earn-in agreement (the "Earn-in Agreement"), pursuant to which FireFox Gold Oy granted a subsidiary of Agnico Eagle Mines Limited ("Agnico") the right to earn an interest in the Kolho properties located in northern Finland (the "Kolho Property").

Patrick Highsmith, Chairman of FireFox commented on the transactions, "We are excited to form this alliance with Agnico Eagle. Not only does the strategic investment recognize the potential of our more advanced projects, such as Mustajärvi, but the option agreement also demonstrates the geological potential of our Kolho Property. We are proud to add Agnico Eagle to our roster of strong shareholders as the strategic backbone for our future growth through discovery."

Carl Löfberg, CEO of FireFox added, "Our company was the first junior gold explorer built around a Finland-based CEO and Finland-based exploration management. Now we are part of a growing community of local and international mining professionals in Finland, and we find ourselves working closely with Europe's largest gold miner. We look forward to working with the Agnico Eagle team at the Kolho Property."

Private Placement

Pursuant to the Private Placement, the Company issued 19,010,000 Units to Agnico at a purchase price of $0.075 per Unit, for gross proceeds of $1,425,750. Each Unit is comprised of one common share of the Company ("Common Share") and one common share purchase warrant ("Warrant"), with each Warrant being exercisable to acquire one Common Share (a "WarrantShare") at an exercise price of $0.10 per Warrant Share for a term of five years following the closing of the Private Placement, subject to adjustment and an acceleration of the expiry date upon the occurrence of certain events. The proceeds of the Private Placement will be used for drilling and exploration expenditures on FireFox's Mustajärvi project, other exploration investment on the Company's projects in Lapland, and general working capital.

On closing of the Private Placement, Agnico will own 19,010,000 Common Shares and 19,010,000 Warrants, representing approximately 10.9% of the issued and outstanding Common Shares on a non-diluted basis and 19.6% of the Common Shares on a partially-diluted basis.

In connection with the Private Placement, FireFox entered into an investor rights agreement with Agnico (the "Investor Rights Agreement"). Pursuant to the Investor Rights Agreement, Agnico is entitled to certain rights, provided Agnico maintains certain ownership thresholds in FireFox, including: (i) the right to participate in equity financings and top-up its holdings in relation to dilutive issuances in order to maintain its pro rata ownership interest in FireFox at the time of such financing or acquire up to a 19.99% ownership interest, on a partially diluted basis, in FireFox; and (ii) the right to nominate one person to the board of directors of FireFox. Agnico has not elected to exercise this right as of the closing of the Private Placement.

Crescat Portfolio Management LLC ("Crescat") exercised its participation right and subscribed for 3,497,840 Units on the same terms as Agnico for additional gross proceeds of $262,388. Upon closing, Crescat will own 31,188,969 Common Shares and 8,050,678 Warrants, representing approximately 17.8% of the issued and outstanding Common Shares on a non-diluted basis and 21.5% of the Common Shares on a partially-diluted basis. Crescat has agreed to restrict the exercise of any Warrants if to do so would result in Crescat owning or controlling 20% or more of the then issued and outstanding Common Shares of the Company (calculated on a non-diluted basis), provided that Crescat may exercise all of its Warrants in certain circumstances (including for the purpose of participating in a take over bid, arrangement, amalgamation or similar transaction, or change in control of the Company), subject to compliance with applicable securities laws including obtaining prior requisite disinterested shareholder and TSX Venture Exchange ("TSXV") approvals.

The participation of Crescat in the Private Placement constitutes a "related party transaction" within the meaning of Multilateral Instrument 61- 101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101") and TSXV Policy 5.9 -- Protection of Minority Security Holders in Special Transactions. In connection with his related party transaction, the Company is relying on the formal valuation and minority approval exemptions of 5.5(a) and 5.7(1)(a) of MI 61-101, respectively, as the fair market value of the portion of the Private Placement subscribed for by Crescat does not exceed 25 percent of the Company's market capitalization.

The Common Shares and Warrants issued in connection with the Private Placement and the Warrant Shares underlying the Warrants are subject to a statutory hold period of four months plus one day from the date of completion of the Private Placement, in accordance with applicable securities legislation.

Option Agreement

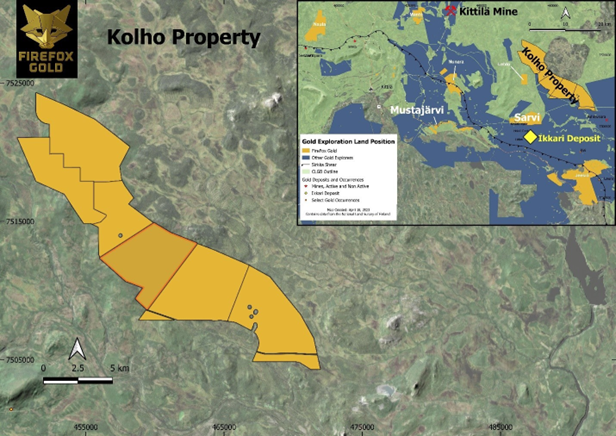

The Kolho Property is a group of exploration permit applications and one exploration permit (Nuttio) that occupies a prospective structural corridor northeast of Rupert Resources' Ikkari discovery and FireFox's Sarvi property (see Figure 1 below). The Kolho Property covers more than 120 km2, and FireFox has completed detailed airborne magnetic surveys and limited reconnaissance mapping and sampling in the area.

Pursuant to the terms of the Earn-in Agreement, FireFox granted Agnico an exclusive right to earn a 51% interest in the Kolho Property by incurring exploration expenditures totaling US$5,000,000 before the fifth anniversary of entering into the Earn-in Agreement (the "Earn-in Grant Date"), of which US$2,000,000 will be a committed amount required to be spent on or prior to the third anniversary of the date that certain permits are granted in respect of the Kolho Property.

Upon Agnico earning a 51% interest in the Kolho Property, Agnico and FireFox will enter into a joint venture agreement (the "JV Agreement"), pursuant to which, Agnico will become the operator of the venture and be entitled to a 5% management fee. Under the JV Agreement, Agnico will be granted the right to acquire an additional 24% interest in the Kolho Property by incurring additional exploration expenditures totaling US$7,500,000 before the eighth anniversary of the Earn-in Grant Date. A portion of the Kolho Property is subject to an existing 1.5% net smelter return royalty.

Neither the Earn-in Agreement nor the Private Placement affect any of FireFox's other mineral rights in Lapland. The Company maintains 100% control of its Mustajärvi Project, as well as the Jeesiö and Sarvi properties where earlier stage exploration targets are being advanced.

For more information concerning the Company, please refer to the Company's profile on the SEDAR+ website at www.sedarplus.ca and the Company's website at www.firefoxgold.com.

About FireFox Gold Corp.

FireFox Gold Corp. is listed on the TSX Venture Stock Exchange under the ticker symbol FFOX. FireFox also trades on the OTCQB Venture Market Exchange in the US under the ticker symbol FFOXF. The Company has been exploring for gold in Finland since 2017 where it holds a large portfolio of prospective ground.

Finland is one of the top mining investment jurisdictions in the world as indicated by its multiple top-10 rankings in recent Fraser Institute Surveys of Mining Companies. Having a strong mining law and long mining tradition, Finland remains underexplored for gold. Recent exploration results in the country have highlighted its prospectivity, and FireFox is proud to have a Finland based CEO and technical team.

Forward-Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to: the terms and conditions of the JV Agreement; anticipated payments under the Earn-in Agreement and JV Agreement, including any advancement on the Kolho Property; the terms and conditions of the Private Placement; anticipated use of net proceeds from the Private Placement, including any advancement on the Mustajärvi project; and Crescat's exercise of all of its Warrants and the Company obtaining requisite disinterest shareholder and TSXV approvals in connection therewith. Often, but not always, forward-looking statements or information can be identified by the use of words such as "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. With respect to forward-looking statements and information contained herein, FireFox has made numerous assumptions including among other things, assumptions about general business and economic conditions. The foregoing list of assumptions is not exhaustive.

Although management of FireFox believes that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These factors include, but are not limited to: risks relating to FireFox's financing efforts; risks associated with the business of FireFox; business and economic conditions in the industry generally; the supply and demand for labour and other project inputs; changes in commodity prices; changes in interest and currency exchange rates; risks relating to inaccurate geological and engineering assumptions (including with respect to the tonnage, grade and recoverability of reserves and resources); risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters); risks relating to adverse weather conditions; political risk and social unrest; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time. FireFox does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

For more information, please contact:

FireFox Gold Corp.

Carl Löfberg

Chief Executive Officer

FireFox Gold Corp.

Email: info@firefoxgold.com

Telephone: +1-778-938-1994

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of the content of this release.

Not for distribution to U.S. Newswire Services or for dissemination in the United States. Any failure to comply with this restriction may constitute a violation of U.S. Securities Laws.

THE SECURITIES OFFERED HAVE NOT BEEN REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION OR AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS. THIS PRESS RELEASE SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR SHALL THERE BE ANY SALE OF THE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL.

SOURCE: FireFox Gold Corp.

View the original press release on accesswire.com