CNWE's drills new intervals grading up to 70.1 g/t gold and 6.2 % copper

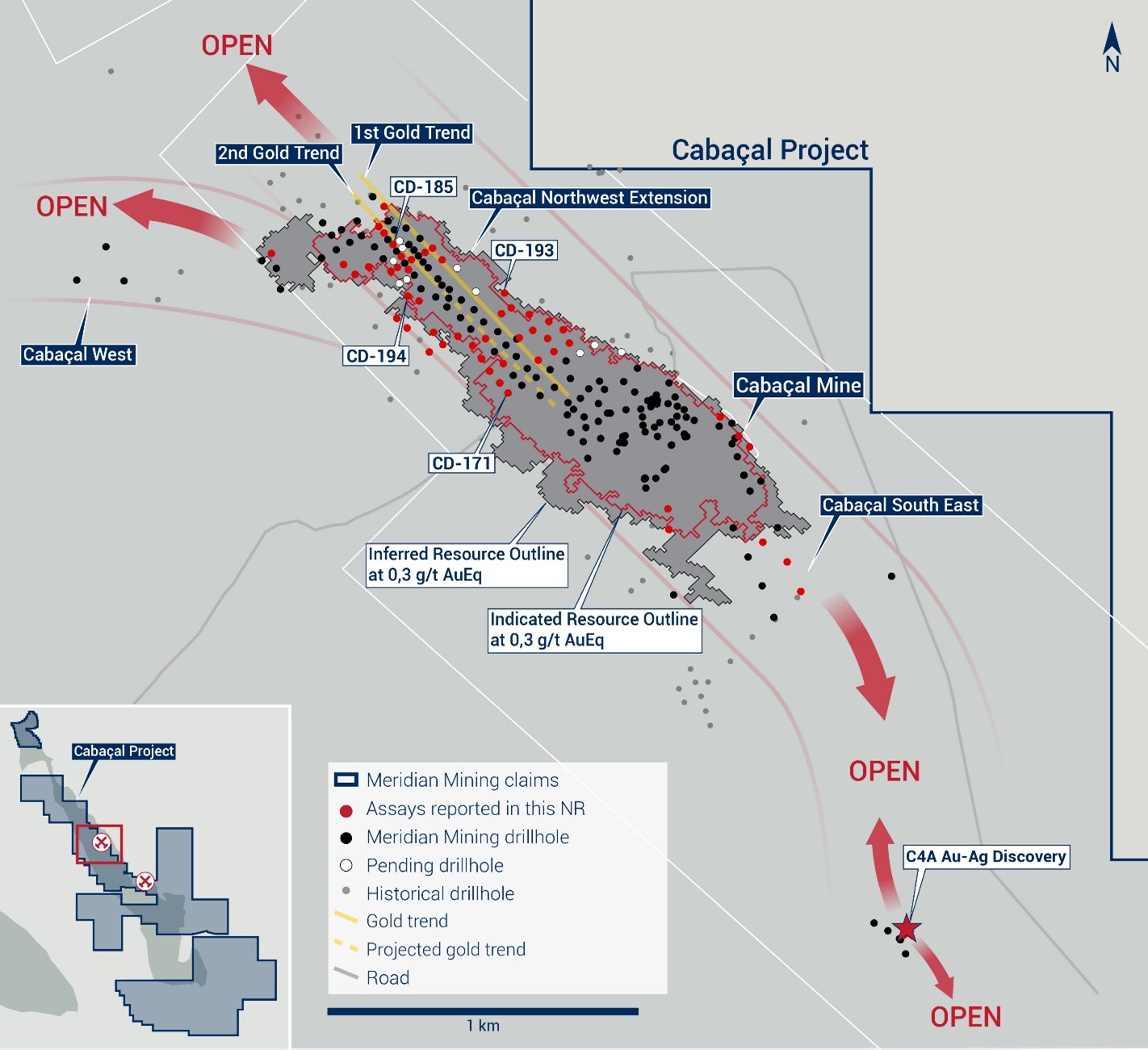

LONDON, UK / ACCESSWIRE / October 19, 2022 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQB:MRRDF), ("Meridian" or the "Company") is pleased to report further assays from the Cabaçal gold-copper VMS deposit ("Table 1"). Down-dip resource drilling has intercepted new strong gold-copper trends within the CNWE area, while infill drilling has continued to confirm the high-grade near-surface gold trend within the Indicated Resource envelope, designed to enhance its level of confidence in the evaluation of high-grade starter pits. Today's results include a new copper enriched trend within Cabaçal's Northwest Extension ("CNWE") located outside of the current Cabaçal Resource[1] model ("Figure 1") with one of the new gold-copper zones also overprinted by a new high-grade open gold structure. Further assay results are pending.

Highlights Reported Today[2]

- Meridian drills multiple new high-grade gold veins and copper-gold layers at Cabaçal;

- Extension drilling defines new gold-copper rich trend with localized gold overprint;

- New trend graded 13m @ 3.4 g/t Au, 0.9% Cu, & 5.1 g/t Ag from 50.4m (CD-171);

- Intervals of 6.2% Cu over 0.7m and 27.7 g/t Au over 0.3m;

- New trend graded 13m @ 3.4 g/t Au, 0.9% Cu, & 5.1 g/t Ag from 50.4m (CD-171);

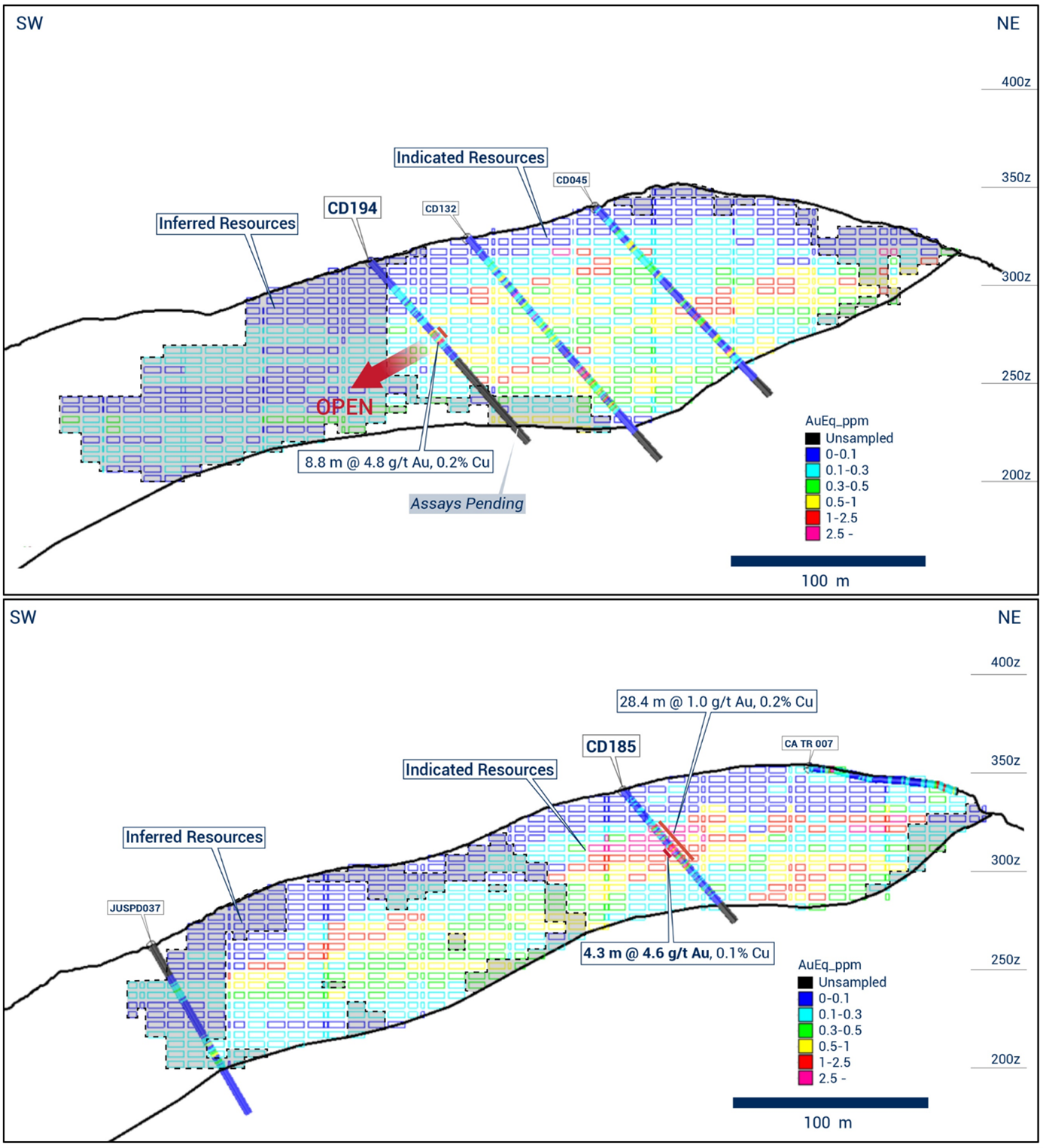

- CNWE extensional drilling hits new high-grade gold trend while infill drilling confirms the near-surface high-grade gold trend ("Figure 2");

- New down-dip high-grade gold trend drilled at the limit of the Indicated Resource;

-

8.8m @ 4.8 g/t Au, 0.2% Cu and 0.8 g/t Ag from 46.7m (CD-194);

- Peak gold interval graded 70.1 g/t Au over 0.35m from 52.87m;

-

8.8m @ 4.8 g/t Au, 0.2% Cu and 0.8 g/t Ag from 46.7m (CD-194);

- Infill drilling confirms CNWE's shallow high-grade gold trend within the Indicated Resource envelope;

- 28.4m @ 1.0 g/t Au, 0.2% Cu & 0.4 g/t Ag, from 23.5m (CD-185), including;

- 4.3m @ 4.6 g/t Au, 0.1% Cu and 0.3 g/t Ag from 37.0m;

- 28.4m @ 1.0 g/t Au, 0.2% Cu & 0.4 g/t Ag, from 23.5m (CD-185), including;

- New down-dip high-grade gold trend drilled at the limit of the Indicated Resource;

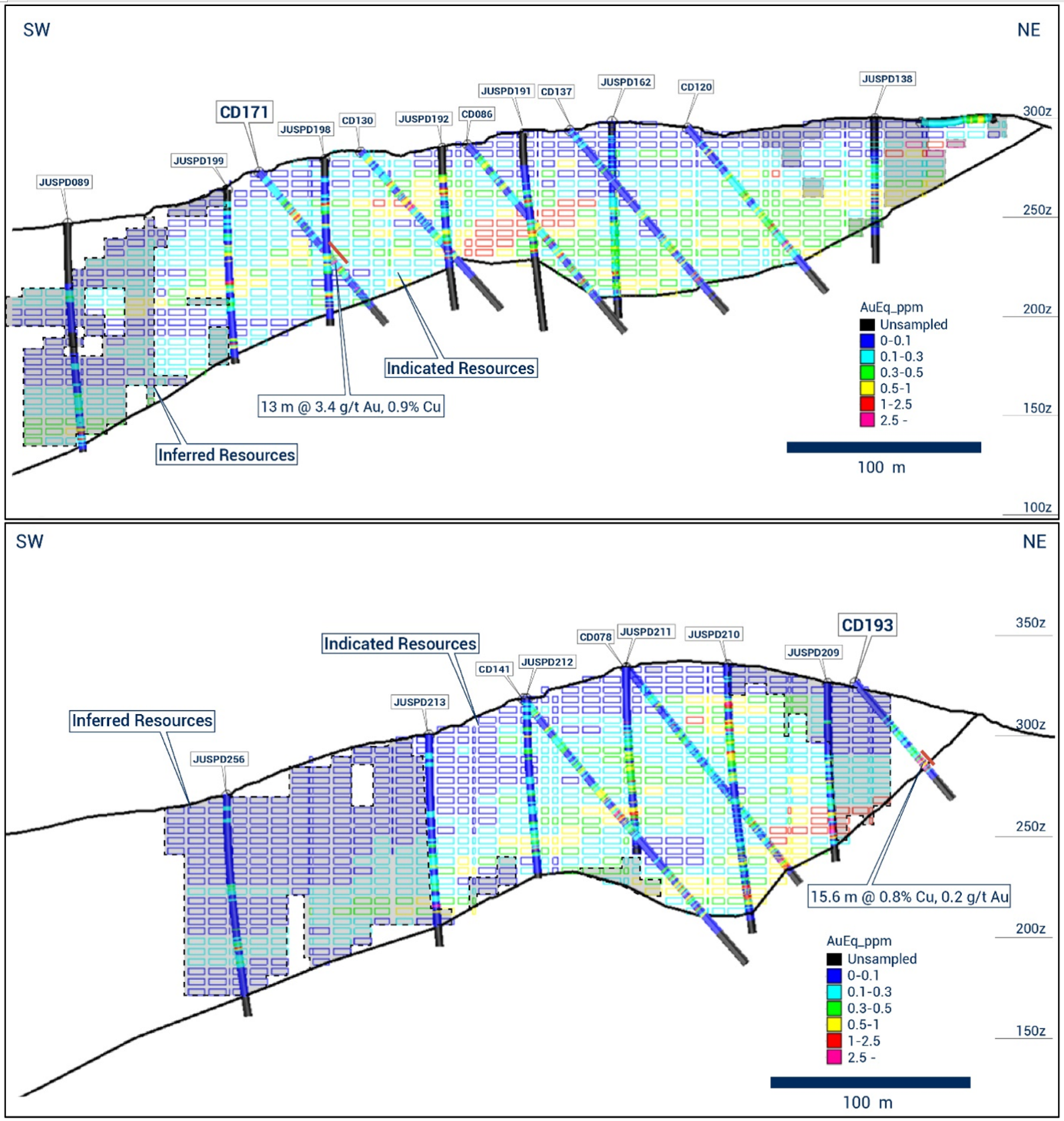

- Extension drilling intercepts further strong zones of copper enriched VMS mineralization within the CNWE ("Figure 3");

- Up-dip trend graded: 15.6m @ 0.8% Cu, 0.2 g/t Au & 1.1 g/t Ag from 42m (CD-193);

- Intervals of 6.0% Cu over 0.4m, 4.4% Cu over 0.35m and 3.8% Cu over 0.8m; and

- Up-dip trend graded: 15.6m @ 0.8% Cu, 0.2 g/t Au & 1.1 g/t Ag from 42m (CD-193);

- Extension drilling defines new gold-copper rich trend with localized gold overprint;

- Assays results to be included in the 2023 Resource update. True widths are approximately 80-90% of downhole lengths

The separate gold-dominant and copper-enriched trends confirm the zonal aspect of the 1.9km Cabaçal VMS deposit. Consistent strong copper zones are generally concentrated in the south-east sector of the deposit, however new copper enriched lenses are emerging within the CNWE. The entire deposit is overprinted by a later stage high grade gold event.

Dr Adrian McArthur, CEO and President comments: "Today's results have identified new VMS high-grade gold rich zones and copper-gold layers and are very encouraging as these and future results will contribute to the 2023 resource update. These results have also opened the CNWE for another two corridors where the high-grade gold overprint is present. Having continual strong results at shallow depths support our views that the Cabaçal gold-copper deposit offers strong optionality in its early years for high-grade feed for rapid capital payback, backed by a larger resource. The Company plans to update the resource early in the second quarter of 2023, and in parallel continues with data compilation and evaluation of targets to prepare for expanded exploration programs targeting and unlocking the potential of the broader belt."

Cabaçal's Infill and Extensional Drill Program

The infill program of angled holes has been critical in defining high-grade gold trends plunging gently to the south that were previously not detected in the historical program. Whilst much of the CNWE is gold-dominant, the recent detection of higher-grade copper-dominant copper-gold mineralization in CD-193 and CD-171 suggests potential to yet define further higher-grade shoots of stringer copper sulphide mineralization plunging through this part of the VMS system.

The Company is focusing its future studies on the resource's higher-grade zone that is hosted within a coherent trend along the deposit's 1.9km strike length. Ongoing drilling has focussed on continuing the closure of the broad-spaced 100m historical drill sections and preparing the project for a full feasibility study. The Company intends to update the mineral resource estimate early in the second quarter of 2023.

The Company froze assay results for the Cabaçal database in mid-August, to commission a mineral resource estimate which was reported on September 26, 2022. The Company's inaugural mineral resource estimate for Cabaçal delivered Indicated Resources hosting 1.1M ounces gold, 168.0 Kt of copper and 2.4M ounces of silver, and Inferred Resources hosting 0.2M ounces gold, 24.5 Kt of copper and 0.4M ounces of silver. The inaugural resource reflected the discovery of significant additional gold-dominant mineralization in the north-west extension during the infill and extensional drilling program, which resulted in a significant increase in known mineralization from historic estimates.

The objectives of the ongoing program are:

- To complete an angled drilling pattern on a 50 x 50m grid to define the ultimate limits of economic mineralization and convert inferred resources to indicated resources;

- To conduct further closure to a 25 x 25m pattern in select areas to increase confidence in shallow mineralization representing potential targets for higher-grade starter pits in development studies; and

- To target select drilling into shallow resource areas where prior sampling was limited or absent and verify copper recovery in the oxide zone (currently set to zero).

Work continues on compilation and validation of the data for the shallow and high-grade Zn-Cu-Au-Ag Santa Helena deposit which will be targeted as the next resource development project following statutory approvals by the environmental agencies, along with evaluation of a range of high priority gold and copper exploration targets within the Cabaçal belt's C2 Trend[3].

Figure 1: Collar map of drill results reported today in relation to resource outline.

Figure 2: Gold-rich intersections from the CNWE. Top: CD-194 intersection: 8.8m @ 4.8 g/t Au, 0.2% Cu and 0.8 g/t Ag from 46.7m - results will add a new higher-grade zone to the block model; assays pending from the lower part of the hole. Bottom: CD-185 - resource infill hole returning high-grade mineralization in predicted position on 25m infill section (28.4m @ 1.0 g/t Au, 0.2% Cu & 0.4 g/t Ag, from 23.5m, including: 4.3m @ 4.6 g/t Au, 0.1% Cu and 0.3g/t Ag from 37.0m).

Figure 3: Copper-rich intersections from the CNWE. Top: CD-171, returning 13.0m @ 0.9% Cu, 3.4 g/t Au and 5.1 g/t Ag from 50.4m: Bottom: CD-193, returning 15.6m @ 0.8% Cu, 0.2 g/t Au & 1.1 g/t Ag from 42.0m.

About Cabaçal

In November 2020, Meridian signed a Purchase Agreement to acquire 100% ownership certain tenements covering the historical Cabaçal and Santa Helena mines and the along strike tenements from two, private, Brazilian companies ("Vendors"). Subsequently, Meridian expanded its land tenure to today's 55km of strike length. Cabaçal had two historical, shallow, high-grade selectively mined underground mines that cumulatively produced ~34 million pounds of copper, ~170,108 ounces of gold, ~1,033,532 ounces of silver and ~103 million pounds of zinc via conventional flotation and gravity metallurgical processes.

Meridian has defined an open trend of shallow copper-gold mineralization centred on the Cabaçal Mine. This mineralization trends Northwest-Southeast, sub-crops along its Northeast limits and dips to the southwest at 26° and is up 90m thick; presenting excellent open-pit geometry and mineral endowment. Meridian is currently focused on infilling drilling along a 2,000m corridor along this trend.

Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within units of deformed metavolcanic-sedimentary rocks ("VMS"). A later stage sub-vertical gold overprint event has emplaced high-grade gold mineralization truncating the dipping VMS layers. It was explored and developed by BP Minerals/Rio-Tinto from 1983 to 1991 and then by the Vendors in the mid 2000's. This historical exploration database includes over 83,000 metres of drilling, extensive regional mapping, soil surveys, metallurgy from production reports and both surface and airborne geophysics. The majority of Cabaçal's prospects remain to be tested.

Cabaçal has excellent infrastructure with access by all-weather road, industrial electricity provided by the adjacent hydroelectric power station supplying this clean energy grid, and local communities provide a large population to draw employees from. Cabaçal consists of 1 mining license, 1 mining lease application and 7 exploration claims which total 44,265 hectares. The September 2022 Cabaçal mineral resource estimate consists of Indicated resources of 52.9Mt @ 0.6g/t Au, 0.3% Cu and 1.4g/t Ag and Inferred resources of 9.0Mt @ 0.7g/t Au, 0.2% Cu & 1.1g/t Ag (0.3 g/t AuEq cut-off grade), with strong optionality for targeting higher grade mineralization using a 0.5 AuEq cut-off for the future development studies.

About Meridian

Meridian Mining UK S is focused on the acquisition, exploration, and development activities in Brazil. The Company is currently focused on resource development of the Cabaçal VMS copper-gold project, exploration in the Jaurú & Araputanga Greenstone belts located in the state of Mato Grosso; exploring the Espigão polymetallic project and the Mirante da Serra manganese project in the State of Rondônia Brazil.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO, President, and Director

Executive Chairman

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Notes

Sample CBDS23253: 6.2% Cu, 8.4g/t Au & 35.1g/t Ag over 0.7m from 58.85m

Sample CBDS23244: 3.8% Cu, 27.7g/t Au & 23.4g/t Ag over 0.3m from 55.35m

One sample pending in interval currently awaiting results from 55.6 - 55.95

Sample CBDS26174: 6.0% Cu, 1.2g/t Au & 5.8g/t Ag over 0.4m from 50.95m

Sample CBDS26171: 4.4% Cu, 1.1g/t Au & 4.3g/t Ag over 0.35m from 48.85m

Sample CBDS26173: 3.8% Cu, 0.7g/t Au & 3.6g/t Ag over 0.8m from 50.15m

Sample CBDS26275: 2.5% Cu, 70.1g/t Au & 12.5g/t Ag over 0.35m from 52.87m

Drill holes have been drilled HQ through the saprolite and upper bedrock and then reduced to NQ - mineralized intervals represent half HQ or NQ drill core. Samples have been analysed at the accredited SGS laboratory in Belo Horizonte. Gold analyses have been conducted by FAA505 (fire assay of a 50g charge), and base metal analysis by methods ICP40B and ICP40B_S (four acid digest with ICP-OES finish). Visible gold intervals are sampled by metallic screen fire assay method MET150-FAASCR. Samples are held in the Company's secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps are retained for umpire testwork, and ultimately returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by ITAK and OREAS, supplementing laboratory quality control procedures. True widths are approximately 80-90% of downhole lengths and assay figures and intervals rounded to 1 decimal place.

Qualified Person

Dr Adrian McArthur, B.Sc. Hons, PhD. FAusIMM., CEO and President of Meridian as well as a Qualified Person as defined by National Instrument 43-101, has supervised the preparation of the technical information in this news release.

Stay up to date by subscribing for news alerts here: https://meridianmining.co/subscribe/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at www.meridianmining.co

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Please click here for PDF with Tables.

[1] Meridian news release September 26, 2022 https://meridianmining.wp2.adnetcms.com/press-releases/

[2] See this news release's Note section for individual sample numbers and intervals

[3] Meridian news release September 6, 2022 https://meridianmining.wp2.adnetcms.com/press-releases/

SOURCE: Meridian Mining UK S

View source version on accesswire.com:

https://www.accesswire.com/720979/Meridian-Reports-New-Trends-of-Gold-and-Copper-Mineralization-at-Cabaal