- Offer from Steel Partners Substantially Undervalues the Company and Its $2 Billion in Tax Assets (NOLs)

- Hillandale Plans to Vote All Shares Against Proposed Merger

- Proposes Alternative Structure to Unlock the Value of NOLs for Minority Shareholders

CHARLOTTE, NC / ACCESSWIRE / July 14, 2022 / Hillandale Advisors invests in undervalued companies and seeks to execute on opportunities to unlock value for the benefit of all shareholders. Hillandale delivered an open letter to the Board of Directors of Steel Connect, Inc. (STCN) raising concerns about the company's proposal to merge with Steel Partners Holdings L.P. (SPLP). SPLP's offer significantly undervalues the company and its $2 billion in tax assets (NOLs). The full text of Hillandale's open letter follows and can also be viewed at the following link:

https://www.hillandaleadvisors.com/news

July 14, 2022

Board of Directors

Steel Connect, Inc.

2000 Midway Lane

Smyrna, TN 37167

Dear Members of the Board:

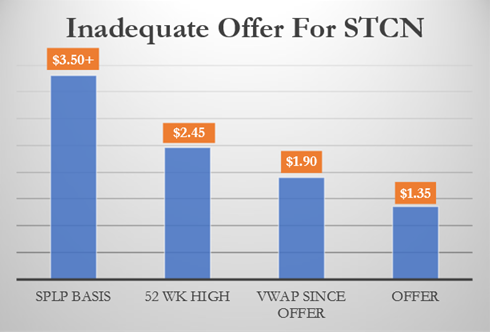

We are writing as long-term shareholders of Steel Connect (STCN), holding roughly 2.0% of minority shares outstanding. We are disappointed by the Special Committee's decision after 18 months of private negotiations, with only one party, to accept this opportunistic offer, which represents a significant 61%+ discount to the over $3.50 per share that Steel Partners (SPLP) acquired their existing stake in STCN, a 45% discount to the 52 week trading high of $2.45, and a 29% discount from the $1.90 volume weighted average share price since the original lowball offer was made in November 2020.

Most importantly, the latest offer delivers little to no value for STCN's $2 billion of tax assets, which could save SPLP and its limited partners several hundreds of millions in cash taxes over the next fifteen years (2038+). A vote for this transaction would represent a significant value transfer from STCN minority shareholders to SPLP and its limited partners. We intend to vote all of our shares against the proposed merger, in its current form.

We are open to an alternative structure where SPLP appropriately shares in the significant tax savings expected from STCN's $2 billion in tax assets. We have proposed a structure where minority shareholders could be granted "Tax CVRs" (contingent value rights) for 50% of cash tax savings at SPLP, which could deliver an additional $2.00+ per share to STCN's minority shareholders, who hold roughly 38 million shares. SPLP and STCN's Board's unwillingness to engage with 1.) minority shareholders and 2.) the Special Committee regarding a Tax CVR and 3.) a global investment firm on April 20th, 2022 regarding their proposal to unlock value in STCN's tax assets is quite concerning. Even the $0.15 per share Tax CVR proposed by SPLP on May 10, 2022 (for a total of $1.50 cash plus ModusLink CVR) would only result in SPLP sharing 1-4% in the potential cash tax savings from STCN's tax assets (or $5.7mm of the $141mm - $436mm savings).

* Tax shelter could range from 21-50%. ** 2023 utilization range of $300 - 500mm for SPLP.

Ultimately, it appears that SPLP, with its control and influence over the STCN Board, is proposing a deal that works best for SPLP, and not STCN minority shareholders. We are open to other structures, but will not support the current proposal, in its current form. We encourage shareholders to review our past letters to the STCN Board and decide for themselves.

Respectfully,

Matthew Hultquist

Hillandale Advisors

Matt@HillandaleAdvisors.com

www.HillandaleAdvisors.com

Board of Directors:

Mr. Warren G. Lichtenstein, Executive Chairman

Mr. Glen M. Kassan

Mr. Jack L. Howard

Mr. Jeffrey J. Fenton

Mr. Jeffrey S. Wald

Ms. Maria Molland

Ms. Renata Simril

CC: Houlihan Lokey, Financial Advisor to Special Committee

Dentons US, Legal Advisor to Special Committee

About Hillandale Advisors

Hillandale Advisors is a private investment and advisory firm founded in 2017 in Charlotte, North Carolina. We are long-term oriented value investors with a focus on special situations, spin-offs and tax assets (NOLs).

Investor Contact:

Matthew Hultquist, (704) 574-5659,

Matt@HillandaleAdvisors.com

https://www.hillandaleadvisors.com

SOURCE: Hillandale Advisors

View source version on accesswire.com:

https://www.accesswire.com/708439/Hillandale-Advisors-Delivers-Open-Letter-To-Steel-Connects-Board-of-Directors