"Bolt-ons" to expand footprint by >10%, increase working interest and lateral lengths in existing development program

Acquisitions funded through first quarter free cash flow

HOUSTON, TX / ACCESSWIRE / May 3, 2022 / Ranger Oil Corporation ("Ranger" or the "Company") (NASDAQ: ROCC) today announced the signing of separate agreements to acquire three "bolt-on" oil producing properties in the Eagle Ford shale contiguous to Ranger's existing assets for a total purchase price of approximately $64 million in cash, subject to customary adjustments. The acquisitions are expected to be accretive to key financial metrics, add to the Company's deep, high-quality inventory of well locations and generate significant near-term operational synergies. As a result of higher cash flow, Ranger's leverage ratio should continue to strengthen.

The transactions are expected to close early in the third quarter, subject to customary closing conditions. The Company plans to discuss these transactions on its upcoming first quarter conference call, scheduled for 11 am ET on Thursday, May 5, 2022.

Transaction Highlights:

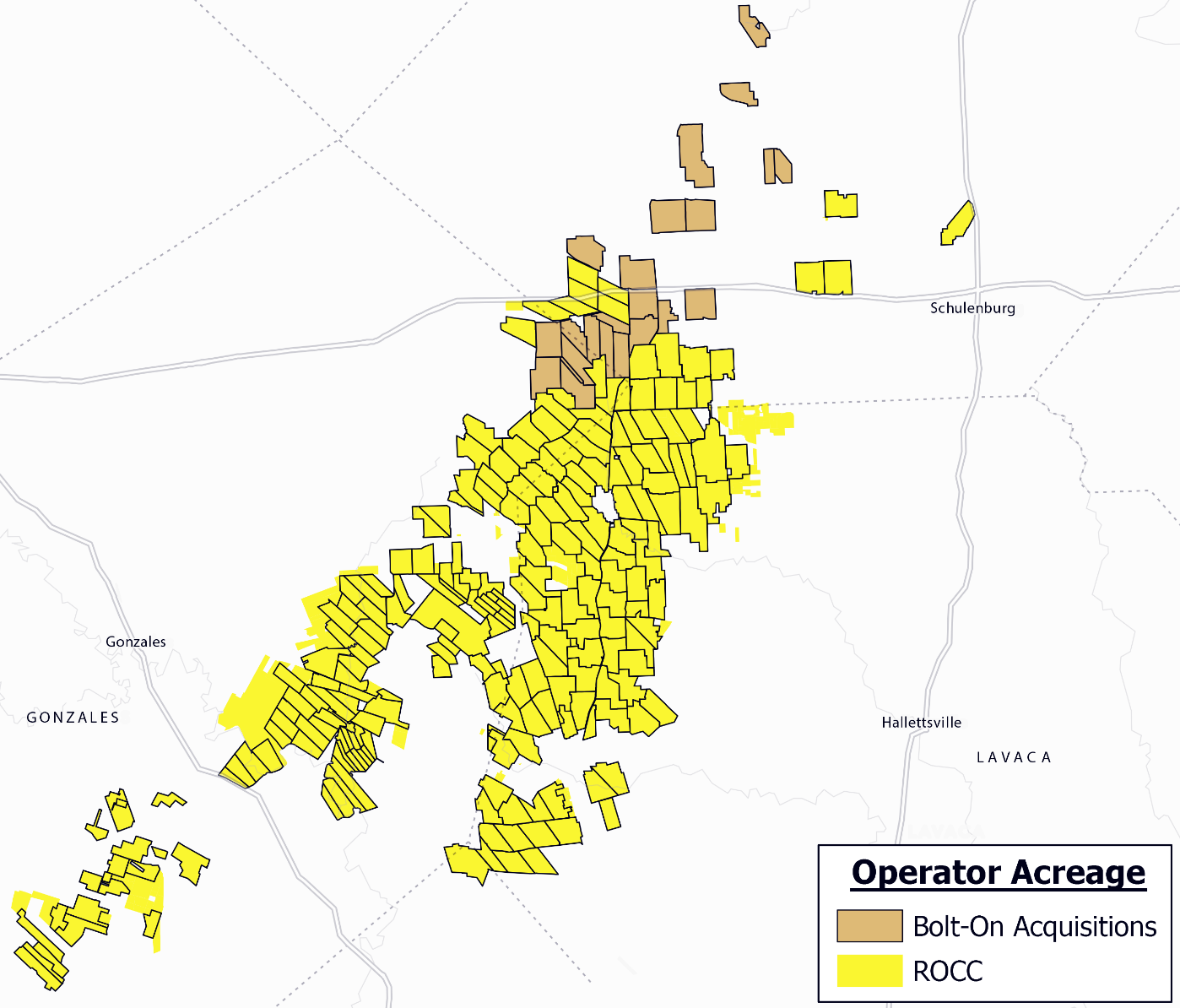

Strategic fit - The properties are largely contiguous with Ranger's current portfolio and working interests overlap with the Company's existing wells. The assets can be expeditiously integrated with minimal cost or disruption. A map is included within this release.

Growing inventory and enhanced near-term development program - With the addition of approximately 17,000 net acres at closing, Ranger will have more than 155,000 net acres, a greater than 10% increase from year-end 2021. Significant and highly economic near-term development opportunities in the bolt-on acquisitions are coupled with approximately 19 miles of shared leaselines with Ranger's current acreage, enhancing existing development plans through longer-lateral wells and increased working interest. Substantial operational synergies mitigate the need for additional rigs and services, further strengthening capital returns.

Attractive valuation consistent with disciplined strategy to maximize free cash flow and maintain balance sheet strength - Assets acquired are at a discount to management's estimated Proved Developed PV-10 value(1). All cash consideration maximizes accretion to shareholders, while funding from free cash flow will maintain our strong balance sheet with under 1.0x leverage(2).

Legacy oil-weighted, low decline production profile enhances margins and free cash flow outlook - Low decline, stable production of approximately 1,000 BOE/d (65% oil / 87% liquids) creates a solid free cash flow profile, maintains our strong capital structure, and enhances Ranger's framework to return cash to shareholders.

Darrin Henke, Ranger's President and CEO, said, "These strategic and accretive acquisitions of adjacent oil-weighted assets further demonstrate the strength of our business and our strategy of delivering shareholder value through a variety of avenues. We recently announced our achievement of leverage(2) below 1.0x and our plans to begin a fixed dividend and a share repurchase program. As consolidation in the Eagle Ford continues, we see additional attractive opportunities that, at the right valuation, could add both immediate and long-term value to shareholders. We are firmly committed to disciplined capital allocation, the preservation of our strong balance sheet and using internally-generated cash flow to bolster our portfolio and grow shareholder value."

Pro Forma Acreage Map

The map below represents the Company's current assets in proximity to acreage associated with the bolt-ons.

Note: Additional ORRI and WI are being acquired within the ROCC-operated acreage as part of the transactions.

(1) Management estimates of Proved Developed values include acquired working interest in 2 wells in process operated by ROCC, estimated to turn in line in May. Commodity strip prices as of 5/2/2022.

(2) Leverage defined as Net debt/LTM EBITDAX.

First Quarter Conference Call and Webcast Details

A conference call and webcast are planned for 11 am ET on Thursday, May 5, 2022 to review these transactions and first quarter results.

To participate in the conference call, please dial (844) 707-6931 (international: (412) 317-9248) approximately 10 minutes prior. For the webcast, please log in to Ranger's website at least 15 minutes prior to the scheduled start time to download supporting materials and install necessary audio software.

A replay of the webcast (available shortly after the call) will be available through May 12, 2022 on the Company's website. The replay will also be available by phone by dialing (877) 344-7529 (international (412) 317-0088) and entering the passcode 1425946.

About Ranger Oil Corporation

Ranger Oil is a pure-play independent oil and gas company engaged in the development and production of oil, NGLs and natural gas, with operations in the Eagle Ford shale in South Texas. For more information, please visit our website at www.Rangeroil.com.

Cautionary Statements

This communication contains certain "forward-looking" statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not historical facts are forward-looking statements, and such statements generally include, words such as "anticipate," "target," "guidance," "assumptions," "projects," "forward," "estimates," "outlook," "expects," "continues,", "project", "intends," "plans," "believes," "future," "potential," "may," "foresee," "possible," "should," "would," "could," "focus" and variations of such words or similar expressions, including the negative thereof, to identify that they are forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this news release include (i) expectations with respect to the pending transactions, including with respect to timing, descriptions of the post-acquisition company and associated operations, integration, acreage development plans, synergies, decline rates, opportunities and anticipated future performance, (ii) anticipated utilization of the Company's free cash flow and (iii) the Company's strategic plans, including with respect to the proposed share repurchase program and dividend. Because such statements include assumptions, risks, uncertainties, and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to, the following: the risk that a condition to closing of the acquisitions may not be satisfied, that either party may terminate the purchase and sale agreements or that the closing of the acquisitions might be delayed or not occur at all; the risk the transactions could distract management from ongoing business operations or cause Ranger to incur substantial costs; the risk that Ranger is unable to achieve projected synergies; the ability of Ranger to integrate the acquisitions into its current development plan; the impact of the COVID-19 pandemic, including reduced demand for oil and natural gas, economic slowdown, governmental actions, stay-at-home orders, interruptions to our operations or our customer's operations; risks related to and the impact of actual or anticipated other world health events; our ability to satisfy our short-term and long-term liquidity needs, including our ability to generate sufficient cash flows from operations or to obtain adequate financing; our ability to execute our business plan in volatile commodity price environments; our ability to develop, explore for, acquire and replace oil and gas reserves and sustain production; changes to our drilling and development program; our ability to generate profits or achieve targeted reserves in our development and exploratory drilling and well operations; the projected demand for and supply of oil, NGLs and natural gas; our ability to contract for drilling rigs, frac crews, materials, supplies and services at reasonable costs; our ability to renew or replace expiring contracts on acceptable terms; drilling, completion and operating risks, including adverse impacts associated with well spacing and a high concentration of activity; our ability to convert drilling locations into reserves and production, if at all; the longevity of our currently estimated inventory; approval by our board of directors of any dividends; and other risks set forth in our filings with the Securities and Exchange Commission ("SEC"), including our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. Additional Information concerning these and other factors can be found in our press releases and public filings with the SEC. Many of the factors that will determine our future results are beyond the ability of management to control or predict. In addition, readers should not place undue reliance on forward-looking statements, which reflect management's views only as of the date hereof. The statements in this communication speak only as of the date of the communication. We undertake no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable law.

CONTACT:

Investor Relations

Phone: (713) 722-6540

E-Mail: invest@RangerOil.com

SOURCE: Ranger Oil Corporation

View source version on accesswire.com:

https://www.accesswire.com/700008/Ranger-Oil-to-Acquire-Strategic-Eagle-Ford-Assets-in-Accretive-Transactions