- April 1, 2021 closed the acquisition of Mankind, a valued and long standing California retail cannabis brand located in San Diego ("Mankind Acquisition") helping GABY achieve:

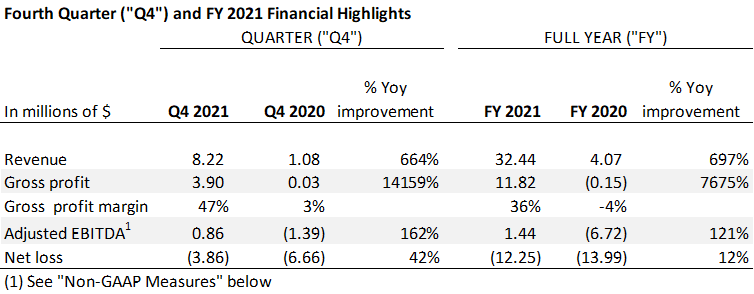

- Q4 and YTD revenue in 2021 of $9.2 million and $32.4 million, respectively, both up 7 times over comparative periods

- Q4 and YTD gross profit margin of 47% and 36%, respectively, improved from 3% and negative 4% of the respective periods last year

- Q4 and YTD Adjusted EBITDA1 of $0.9 million and $1.4 million, respectively, up from negative $1.4 million and negative $6.7 million of respective periods last year

- Pro forma Adjusted EBITDA, $3.2 million, assuming unprofitable divisions were closed January 1 instead of August 31.

- Cut costs by US $3.0 million which will be realized in 2022

- Continued rationalization and closing of unprofitable divisions also contributed to gross profit margin and Adjusted EBITDA1 improvements helping to reduce net loss by 42% and 12% to $3.8 million and $6.7 million for Q4 2021 and FY 2021, respectively.

- Margins were further enhanced by launching GABY branded products like Kind RepublicTM, which generate gross profit margin of 75%

- The rationalization and cost cutting program along with new branded products establishes a strong platform for positive EBITDA, Cash flow and profitability into 2022

SAN DIEGO, CA / ACCESSWIRE / May 2, 2022 / GABY Inc. ("GABY" or the "Company") (CSE:GABY)(OTCQB:GABLF), a California consolidator of cannabis dispensaries and the parent company of San Diego's Mankind Dispensary ("Mankind Dispensary"), today reported its financial and operating results for the fourth quarter and year ended December 31, 2021. All financial information is provided in Canadian dollars unless otherwise indicated. GABYs financial statements are prepared in accordance with International Financial Reporting Standards ("IFRS").

As part of GABY's rationalization strategy, Sonoma Pacific ("Sonoma") was shut down in Q3 of 2021. Sonoma generated the majority of its revenue through high volume, low margin bulk sales. Although revenue decreased after Sonoma was wound down, gross profit margin increased from 34% in Q2 to 35% and 47% in subsequent quarters. Adjusted EBITDA1 was impacted in Q4 by one-time costs associated with the Sonoma closure.

Management expects continued improvement in profitability in 2022 with:

- Annual cost savings of USD 3 million on payroll and operating costs implemented late Q4 2021 which should more fully materialize in Q1 2022 and beyond.

- Higher volume sales in the second half of the year through restructuring of its delivery business which is expected to increase revenue by 1 million over the next 12 months, commencing Q4 2021 along with marketing analytics and remerchandising efforts increasing both physical and virtual shopping basket sizes

- Continued growth in margin with merchandising prioritizing higher margin and proprietary products

- Continued streamlining of shared overhead costs

Margot Micallef, Founder and Chief Executive Officer of GABY commented, "2021 was a game changer for us with the acquisition of Mankind, which generated significant financial improvements at GABY, but 2022 is where our integration efforts should really start to shine with higher revenue, higher margins and lower costs - the triple crown of organic growth." Margot continued, "What's more, is that the Mankind Acquisition has readied us for acquisition growth with our completion of a finely tuned operations manual by which future acquired dispensaries will operate and prosper."

"I see the realization of the incremental benefits of the Mankind acquisition akin to nocking and aiming an arrow at a target. We readied the bowstring with the acquisition of Mankind. We drew it tight in Q2, as we observed, learned, and rationalized Q3. We released the arrow in Q4 as we started to realize our implementation efforts of driving profit from a combination of higher margin sales, higher volume and rationalization of costs. Our goal is to hit the bullseye and become cashflow positive in 2022" Margot added. "I am so proud of our team and what they have accomplished in delivery, merchandising, marketing and operational efficiencies and am looking forward to all of us being rewarded with continued improved results throughout 2022 and beyond."

Paul Stacey, CFO commented, "I am very impressed with the highly motivated and competitive attitude of the GABY team. The entire team from the sales floor to C-Suite is pulling on the necessary levers to deliver improvements in the customer experience and streamlining of operations. I am excited to be at the forefront of this opportunity where GABY is poised to realize impressive organic and acquisitive growth."

ABOUT GABY

GABY Inc. is a California-focused retail consolidator and the owner of Mankind Dispensary, one of the oldest licensed dispensaries in California. Mankind Dispensary is a well-known and highly respected dispensary with deep roots in the California cannabis community operating in San Diego. GABY curates and sells a diverse portfolio of products, including its own proprietary brands, Kind Republic™ Dank Space™ and Lulu's™ through Mankind, A pioneer in the industry with a strong management team with experience in retail, consolidation, and cannabis, GABY is poised to grow its retail operations both organically and through acquisition.

GABY's common shares trade on the Canadian Securities Exchange ("CSE") under the symbol "GABY" and on the OTCQB under the symbol "GABLF". For more information on GABY, visit www.GABYInc.com or the Company's SEDAR profile at www.sedar.com.

For further inquiries, please contact:

General

Margot Micallef, Founder & CEO or Investor Relations at IR@GABYinc.com

Media

Senior Communications Manager

Charlie Rohlfs

(631)579-0858

charlie@gabyinc.com

Currency Presentation

Unless otherwise indicated, all references to "$" or "C$" in this press release refer to Canadian dollars and all references to "US$" in this Listing Statement refer to United States dollars.

Disclaimer and Forward-Looking Information

The CSE does not accept responsibility for the adequacy or accuracy of this release. Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties, certain of which are beyond the control of the Company. Forward-looking statements are frequently characterized by words such as "plan", "continue", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. Forward-looking statements include, but are not limited to, management's expected continued improvement to GABY's profitability in 2022, the estimated current and future cost savings of the Company, the Company's future business strategy, including its plans to expand organically and through future acquisitions or greenfield expansions, and the anticipated benefits to be derived from GABY's New Standard Operating Procedures. Although GABY believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because GABY can give no assurance that they will prove to be correct. By its nature, such forward-looking information is subject to various risks and uncertainties, which could cause the actual results and expectations to differ materially from the anticipated results or expectations expressed. Without limitation, these risks and uncertainties include: the severity of the COVID-19 pandemic; risks associated with the cannabis industry in general; failure to benefit from partnerships or successfully integrate acquisitions; actions and initiatives of federal, state and provincial governments and changes to government policies and the execution and impact of these actions, initiatives and policies; the size of the medical-use and adult-use cannabis market; competition from other industry participants; adverse United States ("U.S."), Canadian and global economic conditions; failure to comply with certain regulations; and departure of key management personnel or inability to attract and retain talent. GABY undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

To the extent any information contained in forward-looking statements in this press release constitutes "future-oriented financial information" or "financial outlooks" within the meaning of applicable Canadian securities laws, such information is being provided to demonstrate the anticipated financial performance of the Company and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such future-oriented financial information or financial outlooks. Future-oriented financial information and financial outlooks, as with forward-looking statements generally, are, without limitation, based on the assumptions and subject to the risks set out above for forward-looking statements. The Company's actual financial position and results of operations may differ materially from its management's current expectations and, as a result, the Company's actual revenue may differ materially from the prospective revenue estimates or projections provided in this press release. Such information is presented for illustrative purposes only and may not be an indication of the Company's actual financial position or results of operations for the applicable financial periods.

Selected financial information outlined above for the Company's Q4 2021 and fiscal year ended December 31, 2021 should be read in conjunction with, GABY's audited annual financial statements and management's discussion and analysis for the three months and year ended December 31, 2021, which has been filed on the Company's SEDAR profile at www.sedar.com and the Company's website www.GABYinc.com.

Each of Mankind and GABY Manufacturing, are subsidiaries of GABY and hold a cannabis license in the State of California. Readers are cautioned that unlike in Canada which has Federal 032320-F legislation uniformly governing the cultivation, distribution, sale and possession of medical cannabis under the Cannabis Act (Federal), in the U.S., cannabis is largely regulated at the State level. Cannabis is legal in the State of California; however, cannabis remains illegal under U.S. federal laws. Notwithstanding the permissive regulatory environment of cannabis at the State level, cannabis continues to be categorized as a controlled substance under the Controlled Substances Act in the U.S. and as such, cannabis-related practices or activities, including without limitation, the manufacture, importation, possession, use or distribution of cannabis are illegal under U.S. federal law. To the knowledge of the Company, the businesses operated by each of GABY's subsidiaries are conducted in a manner consistent with the State law of California, as applicable, and are in compliance with regulatory and licensing requirements applicable in the State of California, respectively. However, readers should be aware that strict compliance with State laws with respect to cannabis will neither absolve GABY, or its subsidiary of liability under U.S. federal law, nor will it provide a defense to any federal proceeding in the U.S. which could be brought against any of GABY, or its subsidiary. Any such proceedings brought against GABY, or its subsidiary may materially adversely affect the Company's operations and financial performance generally in the U.S. market specifically.

Non-GAAP Measures

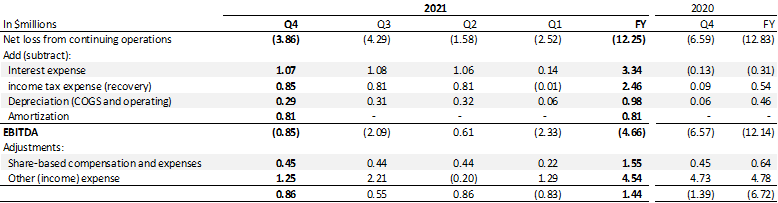

(1) Adjusted EBITDA (from continuing operations) does not have any standardized meaning as prescribed by IFRS , and, therefore, is considered a non-GAAP measure and may not be comparable to similar measures presented by other issuers. Management of GABY believe that the non-GAAP measure of Adjusted EBITDA combined with IFRS measures, such as revenue and net loss, is a useful measure to GABY's investors as management relies on it to provide a measure of operating cash flows before servicing debt, income taxes, capital expenditures and other gains and losses. As referenced and reconciled in GABY's December 31, 2021 financial statements as filed on www.sedar.com, Adjusted EBITDA (from continuing operations) is gross profit (loss) less selling, general and administrative expenses, and therefore excludes charges or income items of: share-based compensation and expenses, depreciation and amortization, interest income, interest expense and other items of income (expense). See Non-GAAP Disclosure in the Company's December 31, 2021 MD&A on www.sedar.com for a full explanation of the use of the non-GAAP measure Adjusted EBITDA from continuing operations for which there is a reconciliation to the nearest GAAP measure below:

SOURCE: GABY Inc.

View source version on accesswire.com:

https://www.accesswire.com/699629/GABY-Reports-Fourth-Quarter-and-Fiscal-Year-End-2021-Results