BRIDGEVIEW, IL / ACCESSWIRE / November 8, 2021 / Manitex International, Inc. (Nasdaq:MNTX) ("Manitex" or the "Company"), a leading international provider of cranes and specialized industrial equipment, today announced results for the third quarter 2021, the three-month period ended September 30, 2021.

Financial Highlights

- Third quarter net sales increased 39.7% year-over-year, to $50.9 million, compared to $36.5 million in 2020

- Gross profit rose 20.7%, to $8.0 million, versus $6.7 million in the fiscal third quarter of 2020; as a percent of sales, gross margin was 15.8% in 2021 versus 18.3% last year, reflecting increased material costs

- The Company reported a net loss from continuing operations of $1.1 million, or $(0.06) per diluted share, compared to a loss of $1.4 million, or $(0.07) per diluted share, in the prior-year period

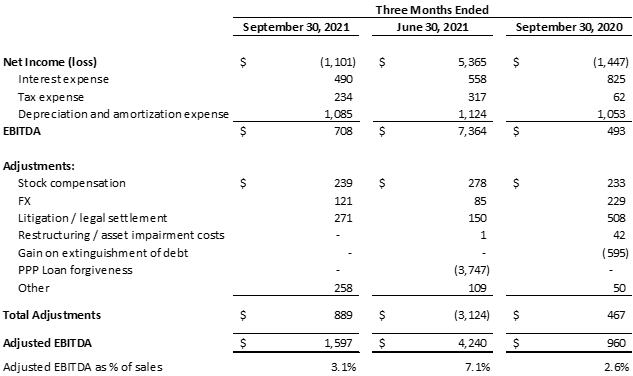

- Adjusted EBITDA* was $1.6 million in the third quarter of fiscal 2021 versus $1.0 million in 2020

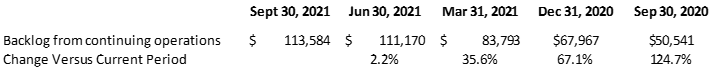

- Backlog increased to $113.6 million from $111.2 million as of June 30, 2021 and remains 67% higher than the start of fiscal 2021; the book to bill was 1.05:1

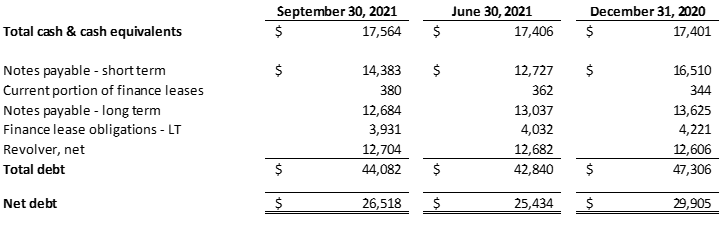

- Net debt was $26.5 million at the end of the quarter, representing a leverage ratio of less than 3.0 times trailing Adjusted EBITDA*

"The third quarter played out largely as expected, with solid top line growth even as the Company faced several challenges due to global supply chain constraints, seasonal shutdowns in Europe, and, to a lesser extent, the ongoing pandemic," said Steve Filipov, CEO of Manitex International. "Revenue rose nearly 40% year-over-year, to $50.9 million, while gross profit increased to $8.0 million and Adjusted EBITDA climbed to $1.6 million. Our backlog remains robust, at $113.6 million, providing a great deal of visibility through the end of fiscal 2021 and beyond.

"As previously indicated, supply chain disruptions and related logistical bottlenecks have impacted our ability to meet strong industrial demand and have, concurrently, increased material costs which have grown more pronounced since the last quarter. In order to address these additional input expenses, we have implemented several pricing adjustments and steel surcharges to protect margins and, in tandem, are building inventory to meet customer requirements. At the same time, we are actively managing costs and investigating all avenues to further streamline our operations to mitigate these unusual headwinds.

"Overall, we feel positive about the future given our record backlog and enduring demand for our products. Our teams are doing an excellent job working through the supply chain issues, and our facilities are delivering equipment to our customers as rapidly as possible. Our expanding position across the globe and general order trends underscore our optimism for the coming year, and we remain confident Manitex can continue posting solid results even while current supply chain inefficiencies play out."

Financial Results for the Third Quarter ended September 30, 2021

Net sales for the third quarter were $50.9 million compared to $36.5 million for the third quarter of fiscal 2020, and the Company reported a net loss from continuing operations of $1.1 million, or $(0.06) per diluted share, compared to a loss of $1.4 million, or $(0.07) per diluted share, in the prior-year period. Adjusted net loss* from continuing operations for the third quarter of 2021 was $0.2 million, or $(0.01) per share, compared to a loss of $1.0 million, or $(0.05) per share, for the third quarter of 2020.

Note: Results presented above are from Continuing Operations

* Adjusted Numbers are discussed in greater detail and reconciled under "Non-GAAP Financial Measures and Other Items" at the end of this release.

Conference Call:

Management will host a conference call with an accompanying slide presentation, after the close of the market, at 4:30PM ET today, November 8, 2021, to discuss the results with the investment community. Anyone interested in participating in the call should dial 855-327-6837 from within the United States or 631-891-4304 if calling internationally. A replay will be which can be accessed by dialing 844-512-2921 or 412-317-6671. Please use passcode 10017230 to access the replay. The call will be broadcast live and archived for 90 days over the internet with accompanying slides, accessible at the investor relations portion of the Company's corporate website, www.manitexinternational.com/eventspresentations.aspx.

Non-GAAP Financial Measures and Other Items

In this press release, we refer to various non-GAAP (U.S. generally accepted accounting principles) financial measures which management uses to evaluate operating performance, to establish internal budgets and targets, and to compare the Company's financial performance against such budgets and targets. These non-GAAP measures, as defined by the Company, may not be comparable to similarly titled measures being disclosed by other companies. While adjusted financial measures are not intended to replace any presentation included in our consolidated financial statements under generally accepted accounting principles (GAAP) and should not be considered an alternative to operating performance or an alternative to cash flow as a measure of liquidity, we believe these measures are useful to investors in assessing our operating results, capital expenditure and working capital requirements and the ongoing performance of its underlying businesses. A reconciliation of Adjusted GAAP financial measures for the three month periods ended September 30, 2021 and 2020, and June 30, 2021 is included with this press release below and with the Company's related Form 8-K. Results of operations reflect continuing operations. All per share amounts are on a fully diluted basis. The amounts described below are unaudited, are reported in thousands of U.S. dollars, and are as of, or for the three month periods ended September 30, 2021, June 30, 2021 and September 30, 2020, unless otherwise indicated.

About Manitex International, Inc.

Manitex International, Inc. is a leading worldwide provider of highly engineered mobile cranes (truck mounted straight-mast and knuckle boom cranes, industrial cranes, rough terrain cranes and railroad cranes), truck mounted aerial work platforms and specialized industrial equipment. Our products, which are manufactured in facilities located in the USA and Europe, are targeted to selected niche markets where their unique designs and engineering excellence fill the needs of our customers and provide a competitive advantage. We have consistently added to our portfolio of branded products and equipment both through internal development and focused acquisitions to diversify and expand our sales and profit base while remaining committed to our niche market strategy. Our brands include Manitex, PM, MAC, PM-Tadano, Oil & Steel, Badger, and Valla.

Forward-Looking Statements

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This release contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company's expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management's goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as "anticipate," "estimate," "plan," "project," "continuing," "ongoing," "expect," "we believe," "we intend," "may," "will," "should," "could," and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this release should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Company Contact

Manitex International, Inc.

Steve Filipov

Chief Executive Officer

512-942-3000

cwitty@darrowir.com

Darrow Associates

Chris Witty, Managing Director

Investor Relations

646-438-9385

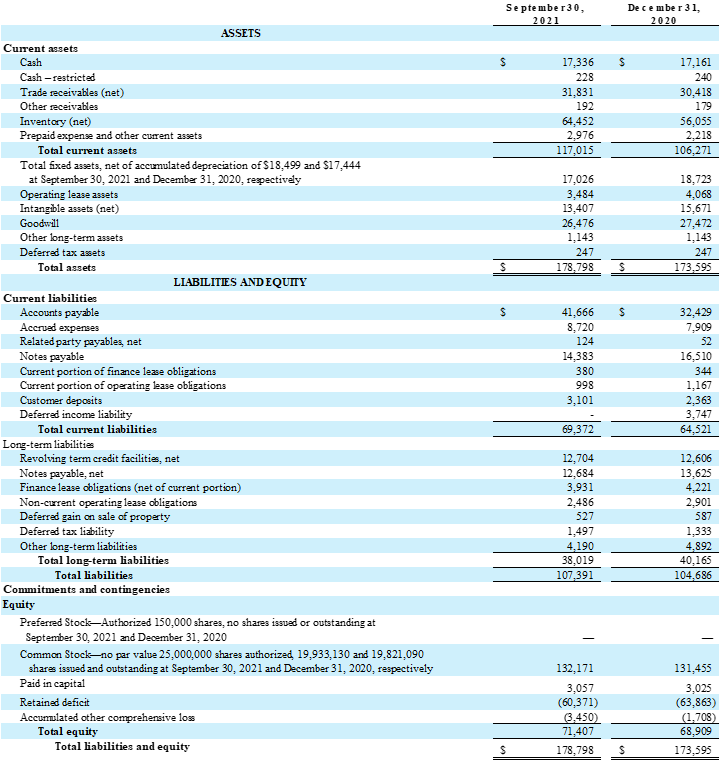

MANITEX INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(In thousands, except share and per share data)

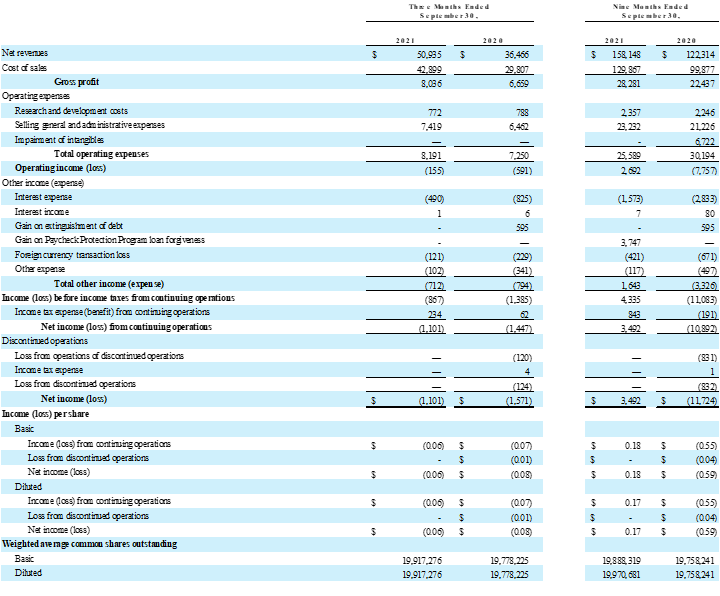

MANITEX INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for share and per share amounts)

Note: Results shown are from Continuing Operations

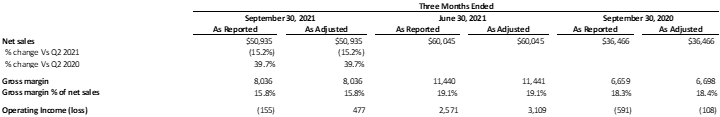

Net Sales, Gross Margin and Operating Income (Loss)

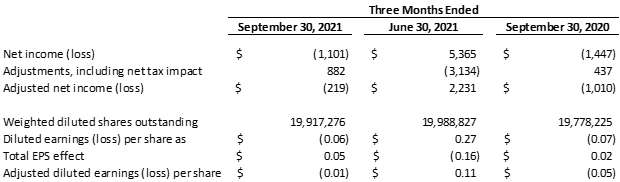

Reconciliation of Net Income (Loss) To Adjusted Net Income (Loss)

Reconciliation of Net Income (Loss) To Adjusted EBITDA

Backlog

Backlog is defined as purchase orders that have been received by the Company. The disclosure of backlog aids in the analysis the Company's customers' demand for product, as well as the ability of the Company to meet that demand. Backlog is not necessarily indicative of sales to be recognized in a specified future period.

Net Debt

Net debt is calculated using the Condensed Consolidated Balance Sheet amounts for current and long term portion of long term debt, capital lease obligations, notes payable, and revolving credit facilities minus cash and cash equivalents.

SOURCE: Manitex International, Inc.

View source version on accesswire.com:

https://www.accesswire.com/671618/Manitex-International-Reports-Third-Quarter-2021-Results